San Jose California Checklist — Health and Disability Insurance: A Comprehensive Guide Introduction: San Jose, California, also known as the "Capital of Silicon Valley," is a vibrant city known for its diverse population, economic growth, and excellent healthcare facilities. When residing in San Jose, it is vital to have comprehensive health and disability insurance to ensure access to quality medical care and financial protection during unexpected events. This checklist aims to provide a detailed description of various health and disability insurance options available in San Jose, California, as well as the necessary steps to acquire appropriate coverage. 1. Individual Health Insurance Plans: Individual health insurance plans are designed to cover an individual's medical expenses, offering a range of options based on needs, preferences, and budget. In San Jose, California, various insurance providers offer individual health insurance plans. Some prominent providers include Kaiser Permanent, Blue Shield of California, and Anthem Blue Cross. Key keywords: Individual health insurance plans San Jose, California; Kaiser Permanent San Jose; Blue Shield of California San Jose; Anthem Blue Cross San Jose. 2. Group Health Insurance Plans: Group health insurance plans cater to businesses or organizations that provide health coverage to their employees or members. These plans offer several advantages, such as lower premiums, broader coverage, and potential employer contributions. San Jose, California, has numerous insurance providers offering group health insurance plans, including Aetna, United Healthcare, and Cagney. Key keywords: Group health insurance plans San Jose, California; Aetna San Jose; United Healthcare San Jose; Cagney San Jose. 3. Medicare: Medicare is a federal health insurance program primarily serving individuals aged 65 and older, as well as certain younger individuals with disabilities. It operates in four parts — Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage). San Jose, California, residents can explore various Medicare Advantage and Part D plans offered by providers like Human, Health Net, and SCAN Health Plan. Key keywords: Medicare San Jose, California; Medicare Advantage plans San Jose; Medicare Part D plans San Jose; Human San Jose; Health Net San Jose; SCAN Health Plan. 4. Supplemental Insurance: Supplemental insurance, often known as Median, is designed to supplement Medicare coverage by filling the gaps in costs, such as deductibles, co-payments, and coinsurance. Numerous insurance companies in San Jose, California, offer a range of Median plans, including Blue Shield of California, Anthem Blue Cross, and United Healthcare. Key keywords: Supplemental insurance San Jose, California; Median plans San Jose; Blue Shield of California Median plans San Jose; Anthem Blue Cross Median plans San Jose; United Healthcare Median plans San Jose. 5. Disability Insurance: Disability insurance provides income replacement in the event of a disability that prevents an individual from working. It helps protect against financial uncertainties and provides a safety net during such circumstances. Insurance providers like Guardian, Northwestern Mutual, and Mutual of Omaha offer disability insurance plans in San Jose, California. Key keywords: Disability insurance San Jose, California; Guardian disability insurance San Jose; Northwestern Mutual disability insurance San Jose; Mutual of Omaha disability insurance San Jose. Conclusion: Securing comprehensive health and disability insurance in San Jose, California, is crucial for ensuring access to quality medical care while protecting oneself and loved ones from financial burdens. By utilizing this checklist, individuals can explore various options, understand the available providers, and make informed decisions when choosing appropriate health and disability insurance coverage based on their unique needs and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Lista de Verificación - Seguro de Salud y Discapacidad - Checklist - Health and Disability Insurance

Description

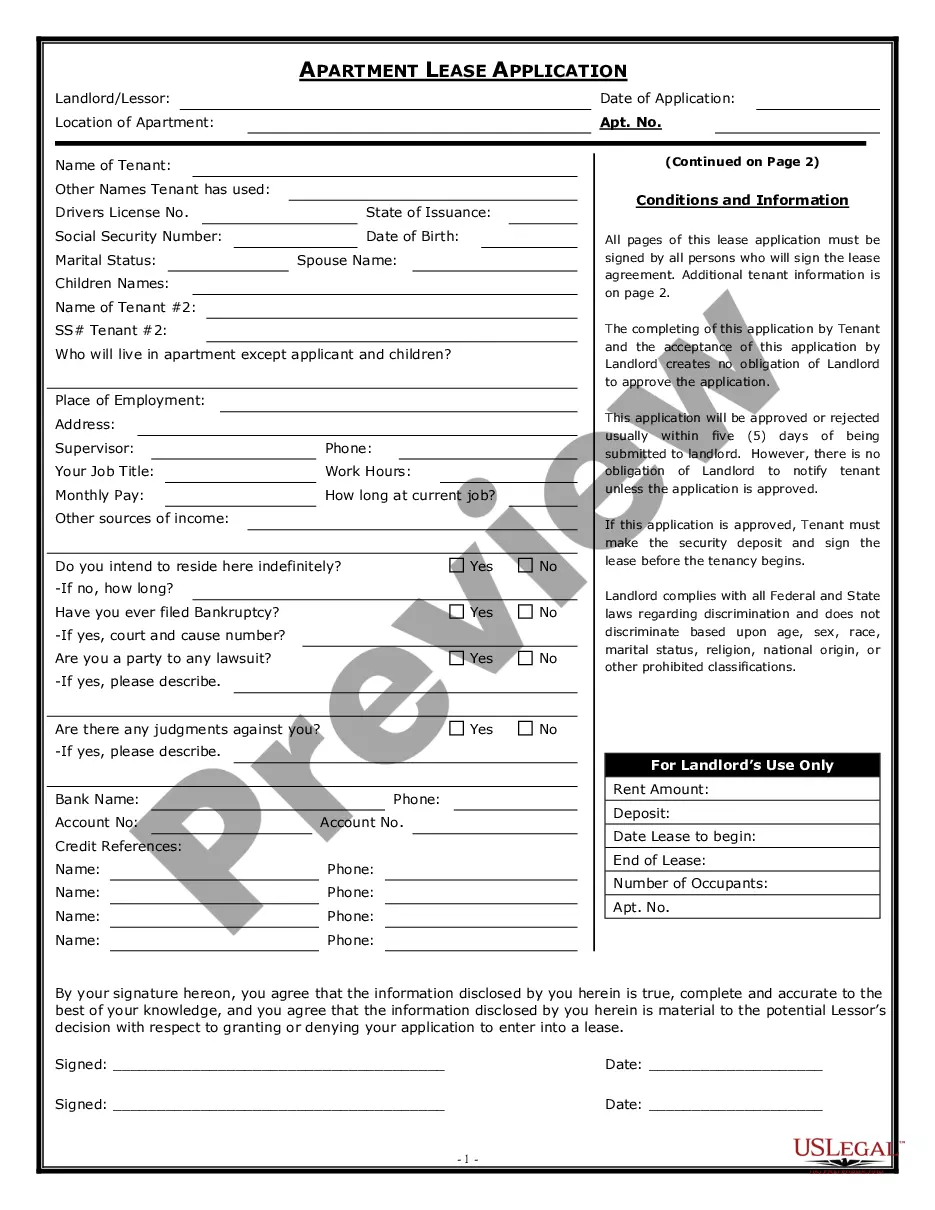

How to fill out San Jose California Lista De Verificación - Seguro De Salud Y Discapacidad?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including San Jose Checklist - Health and Disability Insurance, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any tasks associated with document completion simple.

Here's how you can locate and download San Jose Checklist - Health and Disability Insurance.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase San Jose Checklist - Health and Disability Insurance.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Jose Checklist - Health and Disability Insurance, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to deal with an extremely challenging situation, we recommend getting a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!