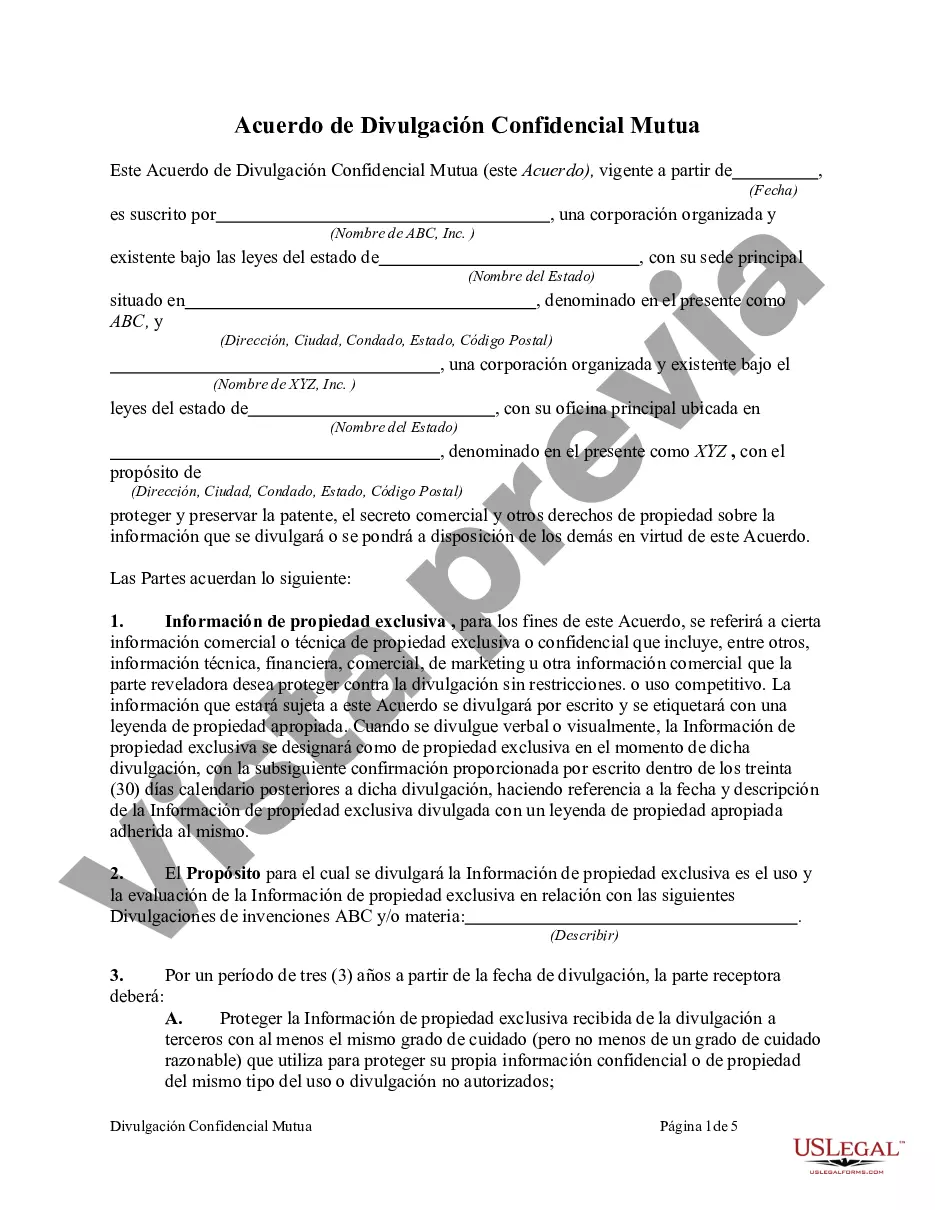

Collin Texas Mutual is an insurance company based in Collin County, Texas, specializing in providing workers' compensation coverage to businesses in Texas. A Mutual Confidential Disclosure Agreement (CDA) is a legally binding contract between Collin Texas Mutual and another party, typically an individual or organization, that outlines the terms and conditions of sharing proprietary or confidential information between the two parties. The CDA is designed to protect the intellectual property, trade secrets, or any other confidential information shared between Collin Texas Mutual and the other party. It ensures that both parties are aware of their responsibilities and obligations regarding the handling, use, and protection of disclosed information. The agreement is essential in establishing a trusted relationship and preventing any unauthorized use or disclosure of sensitive information. In the context of Collin Texas Mutual, there might be different types of CDA tailored to specific situations or relationships. These can include: 1. Employment CDA: This agreement is signed between Collin Texas Mutual and its employees or contractors, outlining confidentiality obligations related to company trade secrets, customer information, or other proprietary data. 2. Business Partnership CDA: When Collin Texas Mutual enters into partnerships with other businesses or organizations, this agreement ensures that both parties understand their obligations to protect each other's confidential information during the collaboration. 3. Vendor or Supplier CDA: Collin Texas Mutual may also have CDA agreements with vendors, suppliers, or service providers, ensuring the confidentiality of information shared during the course of their business relationship. 4. Client or Customer CDA: In some cases, Collin Texas Mutual may require clients or customers to sign an CDA to protect sensitive information they may have access to during the provision of services or processing of claims. Each type of CDA includes specific clauses on the definition of confidential information, limitations on use and disclosure, duration of the agreement, and procedures for resolving disputes or breaches. It is crucial for all parties involved to carefully review and understand the terms and conditions of the CDA before signing, as any violation of its terms can lead to legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Acuerdo de Divulgación Confidencial Mutua - Mutual Confidential Disclosure Agreement

Description

How to fill out Collin Texas Acuerdo De Divulgación Confidencial Mutua?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Collin Mutual Confidential Disclosure Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the latest version of the Collin Mutual Confidential Disclosure Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Collin Mutual Confidential Disclosure Agreement:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Collin Mutual Confidential Disclosure Agreement and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!