Fairfax Virginia Profit-Sharing Plan and Trust Agreement is a comprehensive legal document that outlines the terms and conditions of a profit-sharing plan and trust agreement in the state of Virginia. This agreement is specifically designed to facilitate profit-sharing programs for businesses and their employees in Fairfax, Virginia. The Fairfax Virginia Profit-Sharing Plan and Trust Agreement is a strategic financial tool that allows employers to share a portion of their company's profits with eligible employees. It aims to incentivize and reward employees for their valuable contributions towards the success and profitability of the company. Under this agreement, employers contribute a predetermined percentage of the company's annual profits into a trust fund, which is then allocated among the eligible employees based on specific criteria outlined in the agreement. These criteria often consider factors such as employee tenure, job performance, and salary level. The Fairfax Virginia Profit-Sharing Plan and Trust Agreement offers flexibility by allowing employers to choose from different types of profit-sharing arrangements that best suit their business needs. Some common types of profit-sharing plans and trust agreements available under the Fairfax Virginia jurisdiction include: 1. Traditional Profit-Sharing Plan: This type of plan distributes a portion of the company's profits to eligible employees in the form of cash or employer contributions to retirement accounts, such as 401(k) plans. 2. Deferred Profit-Sharing Plan: With this plan, the profit-sharing contributions made by the employer are held in a trust account and distributed to employees at a specified future date, often upon retirement or separation from the company. 3. Integrated Profit-Sharing Plan: In an integrated profit-sharing plan, the employer combines the profit-sharing contributions with other qualified retirement plans, such as a pension or retirement savings plan, allowing employees to benefit from greater overall retirement benefits. 4. Employee Stock Ownership Plan (ESOP): An ESOP is a specialized profit-sharing plan that allows eligible employees to acquire ownership interest in the company through the allocation of company stock. It serves as a long-term retirement savings vehicle and provides employees with a sense of ownership and motivation. The Fairfax Virginia Profit-Sharing Plan and Trust Agreement is subject to compliance with federal and state regulations, including the Employee Retirement Income Security Act (ERICA), to ensure fair treatment of employees and protect their retirement assets. Businesses considering the implementation of a profit-sharing plan in Fairfax, Virginia should consult with legal and financial professionals to understand the specific requirements and legal implications associated with such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

Description

How to fill out Fairfax Virginia Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Fairfax Profit-Sharing Plan and Trust Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the current version of the Fairfax Profit-Sharing Plan and Trust Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Profit-Sharing Plan and Trust Agreement:

- Look through the page and verify there is a sample for your region.

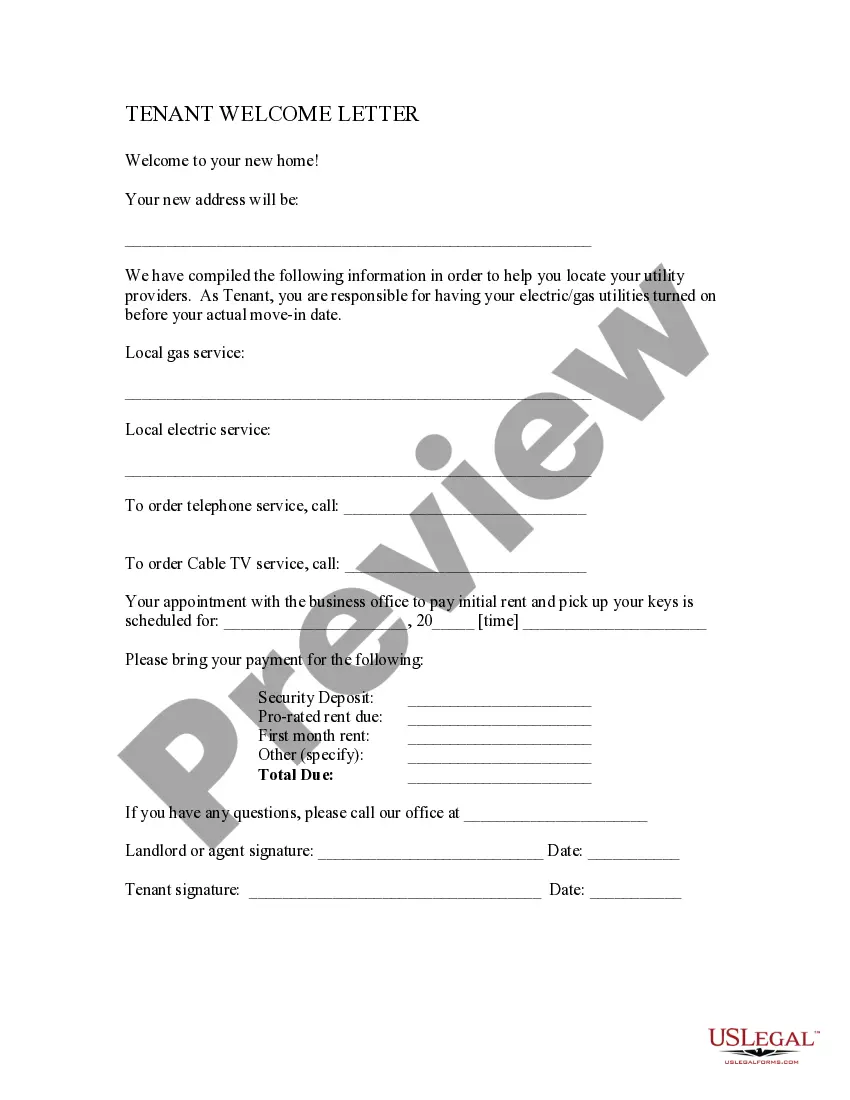

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Fairfax Profit-Sharing Plan and Trust Agreement and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!