Franklin Ohio Profit-Sharing Plan and Trust Agreement is a legal document that outlines the terms and conditions of a profit-sharing plan established by an organization in Franklin, Ohio. This agreement serves as a binding contract between the employer and the employees participating in the profit-sharing program. The Franklin Ohio Profit-Sharing Plan and Trust Agreement aim to provide employees with a share in the company's profits, incentivizing their performance and fostering a sense of ownership within the organization. By sharing a portion of the company's earnings with the workforce, the plan aims to motivate employees to work diligently towards achieving the organization's goals, which ultimately benefits both parties involved. The agreement typically defines the eligibility requirements for employees to participate in the profit-sharing plan. These requirements may include factors such as length of service, employment status, or contribution to the company's profitability. It also outlines the vesting schedule, which determines when employees gain ownership over the employer-contributed funds in their profit-sharing accounts. Furthermore, the agreement specifies the formula or method used to calculate the distribution of profits among eligible employees. This calculation methodology may be based on various factors, such as salary, position, or a combination of both. Additionally, the agreement may outline any limitations or restrictions on the distribution of profits, such as caps or minimums. It is important to note that there can be different types of Franklin Ohio Profit-Sharing Plan and Trust Agreements, customized to meet the specific requirements and preferences of the employer and employees. Some common variations include: 1. Traditional Profit-Sharing Plan: This type of plan distributes a portion of the company's profits to employees based on a predetermined formula. The formula usually considers factors like salary or position, ensuring that higher-performing employees receive a larger share of the profits. 2. Performance-Based Profit-Sharing Plan: This variation ties the distribution of profits to the achievement of specific performance goals or targets. Employees receive a share of the profits only if the company meets or exceeds these pre-determined objectives. It acts as an additional motivator for employees to work towards shared goals and encourages a culture of performance-based compensation. 3. Discretionary Profit-Sharing Plan: In this type of plan, the distribution of profits is solely at the discretion of the employer. The employer has the flexibility to determine the allocation based on individual or company-wide performance, economic conditions, or other factors that they deem relevant. This type of plan provides the employer with the flexibility to adjust the distribution according to the prevailing business circumstances. Overall, the Franklin Ohio Profit-Sharing Plan and Trust Agreement serve as a crucial tool for fostering employee engagement, rewarding performance, and aligning the interests of the employer and employees. It establishes a fair and transparent framework that benefits both parties by promoting a sense of shared success and financial security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

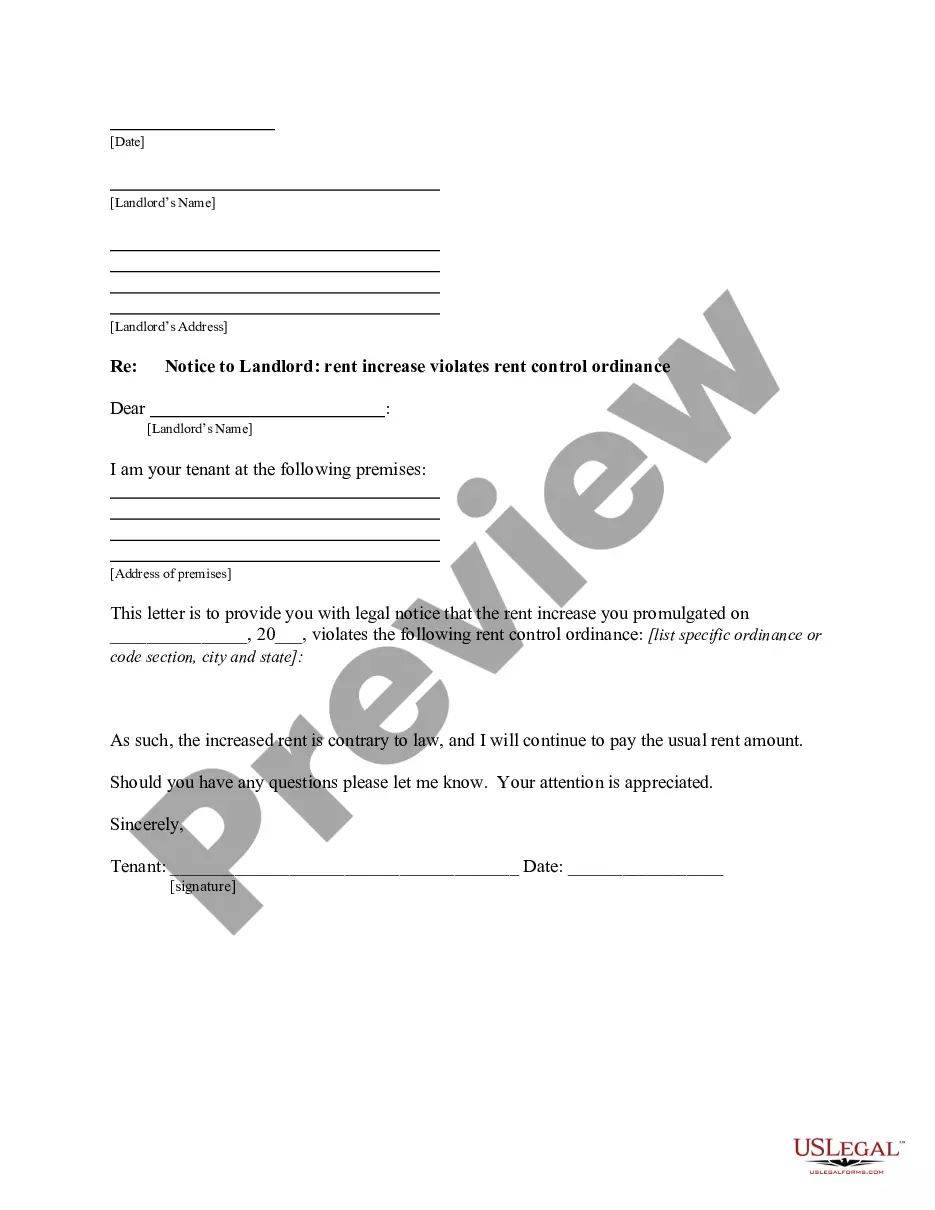

Description

How to fill out Franklin Ohio Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Franklin Profit-Sharing Plan and Trust Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Franklin Profit-Sharing Plan and Trust Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Franklin Profit-Sharing Plan and Trust Agreement:

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!