Orange California Profit-Sharing Plan and Trust Agreement is a legal document that outlines the terms and conditions of a profit-sharing plan and trust arrangement in Orange, California. This agreement is designed to benefit employees by allowing them to share in the profits of their employer. The Orange California Profit-Sharing Plan and Trust Agreement typically establishes a trust fund that holds contributions made by the employer. The employer may choose to contribute a percentage of its profits each year or make regular fixed contributions. This plan is an effective way for employers to incentivize employees, promote loyalty, and align their interests with the success of the business. There are various types of Orange California Profit-Sharing Plan and Trust Agreements, including: 1. Traditional Profit-Sharing Plan: This type allows employers to make discretionary contributions to the plan based on the profitability of the business. The contributions are typically divided among the eligible employees, based on a predetermined formula or allocation method. 2. Age-Weighted Profit-Sharing Plan: This plan considers an employee's age and compensation to determine the contribution amount. Generally, employees closer to retirement age with higher levels of compensation receive larger allocations. 3. New Comparability Profit-Sharing Plan: This type of plan allows employers to divide employees into specific groups or classes, each with its own contribution rate. This classification is typically based on factors such as job title, length of service, or any other reasonable grouping criteria. 4. Integrated Profit-Sharing Plan: Integrated plans combine profit-sharing contributions with Social Security benefits. The employer calculates the total retirement income required, including Social Security, and then offsets the contribution amount accordingly. The Orange California Profit-Sharing Plan and Trust Agreement typically includes details such as eligibility requirements for employees, contribution limits, vesting schedules, investment options, and distribution rules. It also ensures compliance with relevant state and federal laws, such as the Employee Retirement Income Security Act (ERICA) and the Internal Revenue Code. In conclusion, the Orange California Profit-Sharing Plan and Trust Agreement provides a flexible and beneficial arrangement for employers and employees in Orange, California. It allows employees to participate in the financial success of their employer and helps promote long-term loyalty and dedication.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

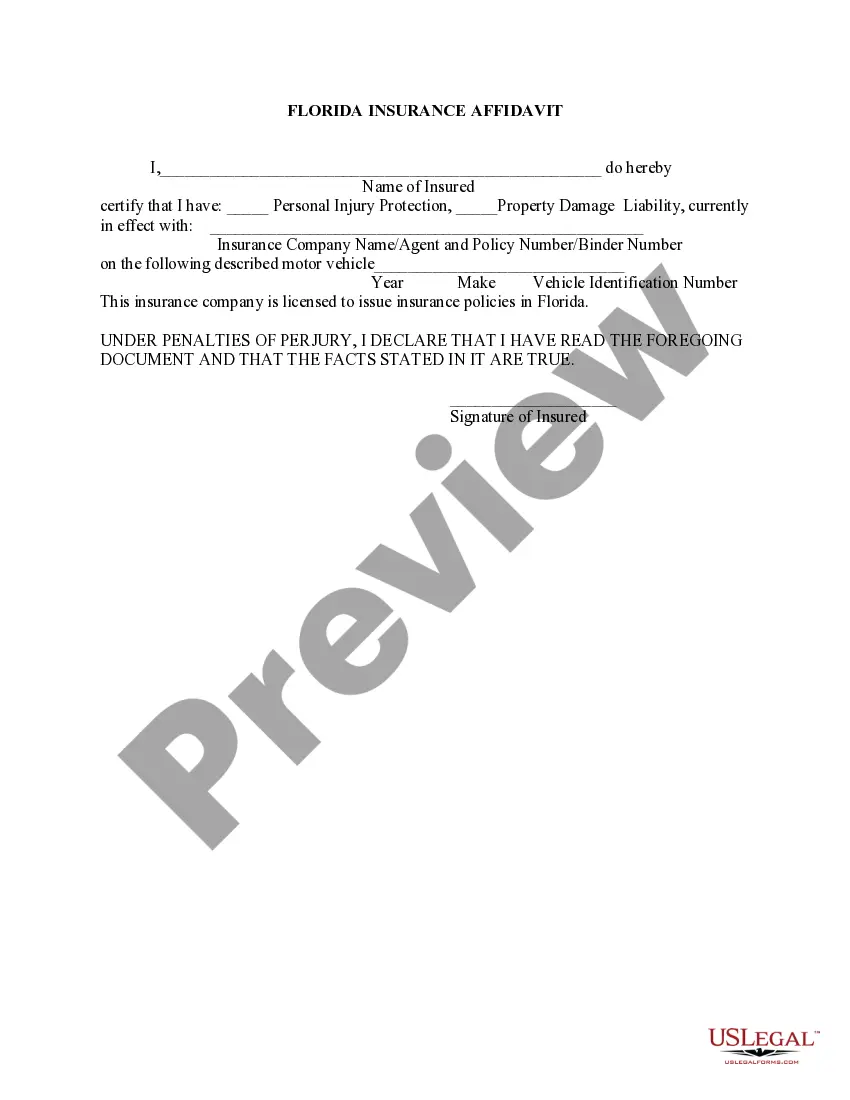

Description

How to fill out Orange California Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Orange Profit-Sharing Plan and Trust Agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Orange Profit-Sharing Plan and Trust Agreement. Follow the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Orange Profit-Sharing Plan and Trust Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!