The Phoenix, Arizona Profit-Sharing Plan and Trust Agreement is a legal document that outlines the terms and conditions of a profit-sharing program in Phoenix, Arizona. This agreement establishes a framework for employers to distribute a portion of their profits to eligible employees, fostering a sense of financial ownership and incentivizing productivity and dedication. The Phoenix, Arizona Profit-Sharing Plan and Trust Agreement typically includes provisions regarding eligibility criteria, contribution limits, vesting schedules, and the distribution of profits. It also outlines the rights and responsibilities of both the employer and employees participating in the profit-sharing plan. Some key components included in the Phoenix, Arizona Profit-Sharing Plan and Trust Agreement are: 1. Eligibility Criteria: This section outlines the requirements for employees to become eligible participants in the profit-sharing plan. It commonly specifies factors like length of service, position, and hours worked per week. 2. Contribution Limits: The agreement sets limits on the maximum amount that an employer can contribute to the profit-sharing plan. This may be a fixed dollar amount or a percentage of the company's profits. 3. Vesting Schedule: The vesting schedule specifies the timeline for employees to gain ownership rights over their share of the profit-sharing plan. It typically includes gradual vesting over a specific number of years, encouraging employee retention. 4. Distribution of Profits: The agreement states the method and frequency for distributing profits to eligible participants. This could involve annual contributions, lump-sum payments, or regular installments. 5. Investment Options: In some cases, the Phoenix, Arizona Profit-Sharing Plan and Trust Agreement may include information about investment options available to participants. This allows employees to choose how their contributions are invested, potentially growing their share over time. It is worth noting that there may be different types of profit-sharing plans and trust agreements within Phoenix, Arizona. For example, some companies may offer "401(k) profit-sharing plans," which combine elements of both retirement savings and profit-sharing. The specifics of these plans can vary depending on the preferences of the employer, industry norms, and legal requirements. In conclusion, the Phoenix, Arizona Profit-Sharing Plan and Trust Agreement is a legally binding document that outlines the terms and conditions of a profit-sharing program. It provides structure and clarity for both employers and employees, ensuring a fair and transparent distribution of profits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

Description

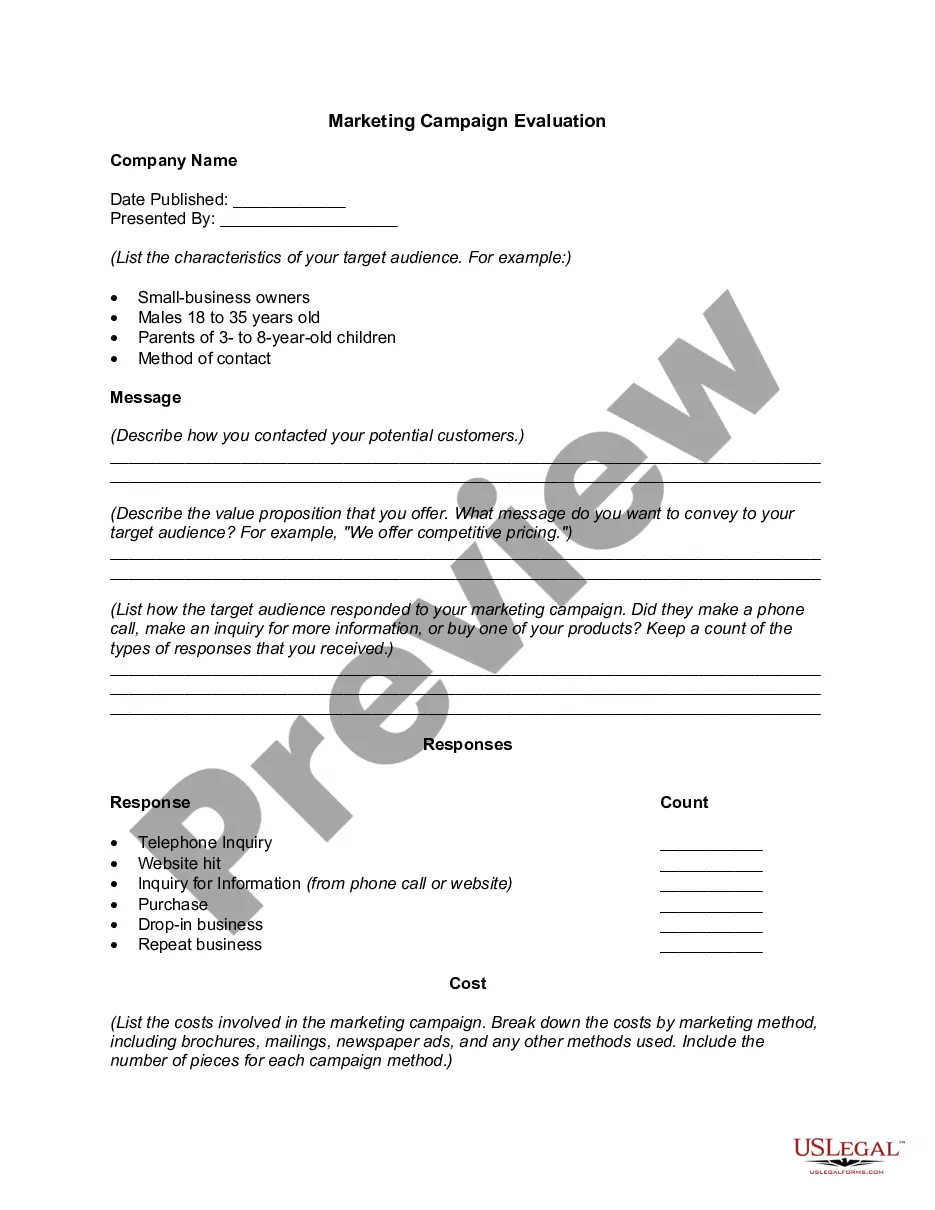

How to fill out Phoenix Arizona Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so opting for a copy like Phoenix Profit-Sharing Plan and Trust Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Phoenix Profit-Sharing Plan and Trust Agreement. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Profit-Sharing Plan and Trust Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!