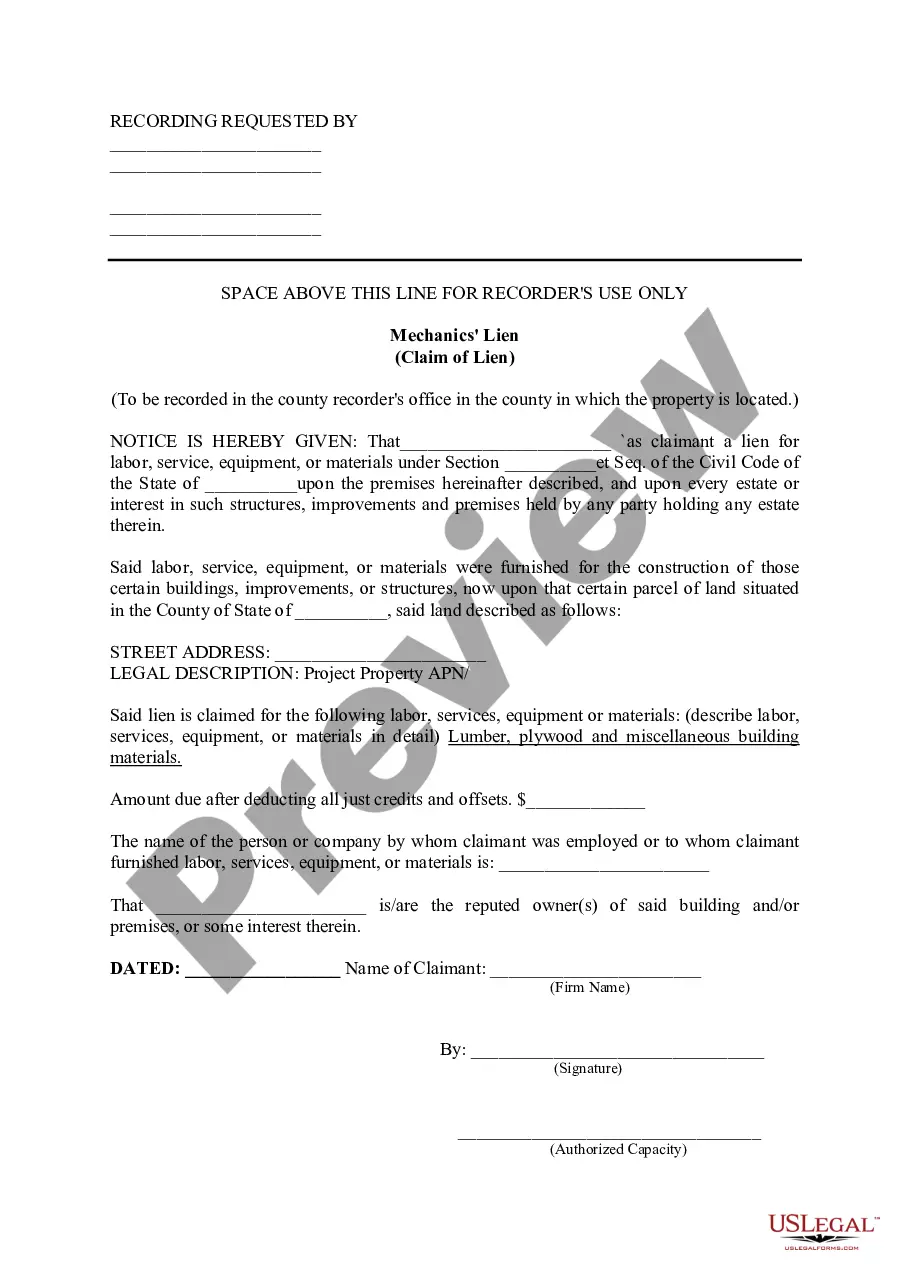

The Santa Clara California Profit-Sharing Plan and Trust Agreement is a legally binding document that outlines the terms and conditions for a profit-sharing plan offered by employers in Santa Clara, California. This agreement establishes guidelines for the allocation of a portion of the company's profits to eligible employees, providing a means for them to share in the financial success of the organization. The Santa Clara California Profit-Sharing Plan and Trust Agreement ensures transparency, fairness, and compliance with legal requirements, guaranteeing that both employers and employees understand their rights and obligations. It generally includes provisions related to eligibility criteria, contribution amounts, vesting schedules, distribution methods, and administrative procedures. There may be various types of Santa Clara California Profit-Sharing Plan and Trust Agreements, each tailored to the specific needs of different organizations. Some examples include: 1. Traditional Profit-Sharing Plan: This type of agreement typically allows employers to distribute a portion of their annual profits to eligible employees based on predetermined criteria, such as years of service or compensation level. 2. Performance-Based Profit-Sharing Plan: In this arrangement, the profit-sharing contributions are tied to the company's overall performance or specific performance goals. Eligible employees receive a share of the profits if certain objectives are met, motivating them to contribute to the organization's success. 3. Age-Weighted Profit-Sharing Plan: This type of agreement takes into account the age of employees, putting more emphasis on older employees who may have less time until retirement. Contributions to their individual profit-sharing accounts are allocated proportionally based on their age and compensation. 4. New Comparability Profit-Sharing Plan: This plan allows employers to allocate different percentages of profit-sharing contributions to specific employee groups, such as executives or employees in different departments, based on their compensation levels or other designated factors. The Santa Clara California Profit-Sharing Plan and Trust Agreement provides a framework for employers to encourage employee motivation, loyalty, and engagement by sharing the financial success of the company. It can serve as a valuable tool to attract, retain, and reward talented individuals while fostering a collaborative and positive work environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Plan de participación en las ganancias y contrato de fideicomiso - Profit-Sharing Plan and Trust Agreement

Description

How to fill out Santa Clara California Plan De Participación En Las Ganancias Y Contrato De Fideicomiso?

Creating documents, like Santa Clara Profit-Sharing Plan and Trust Agreement, to manage your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for different cases and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Santa Clara Profit-Sharing Plan and Trust Agreement form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before getting Santa Clara Profit-Sharing Plan and Trust Agreement:

- Ensure that your document is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Santa Clara Profit-Sharing Plan and Trust Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!