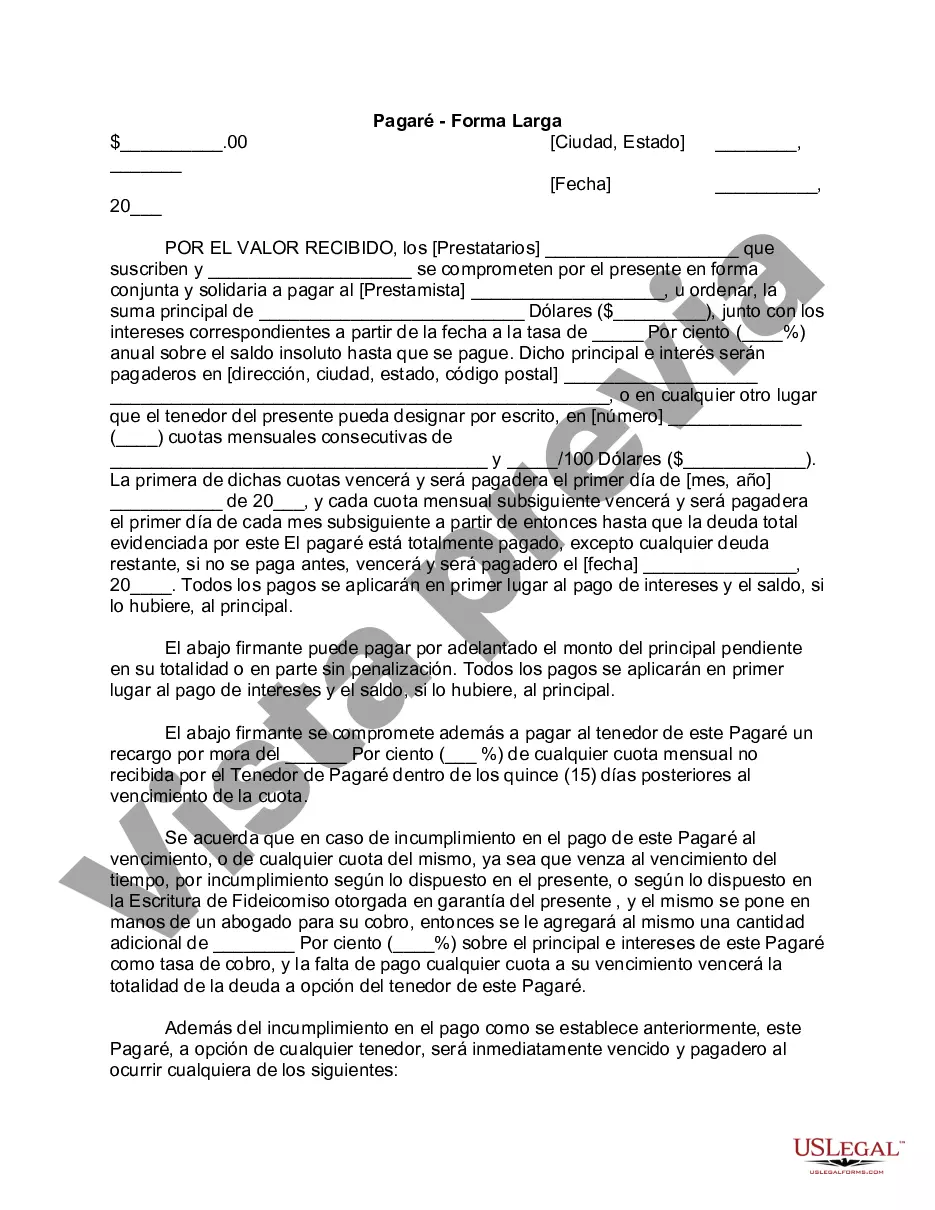

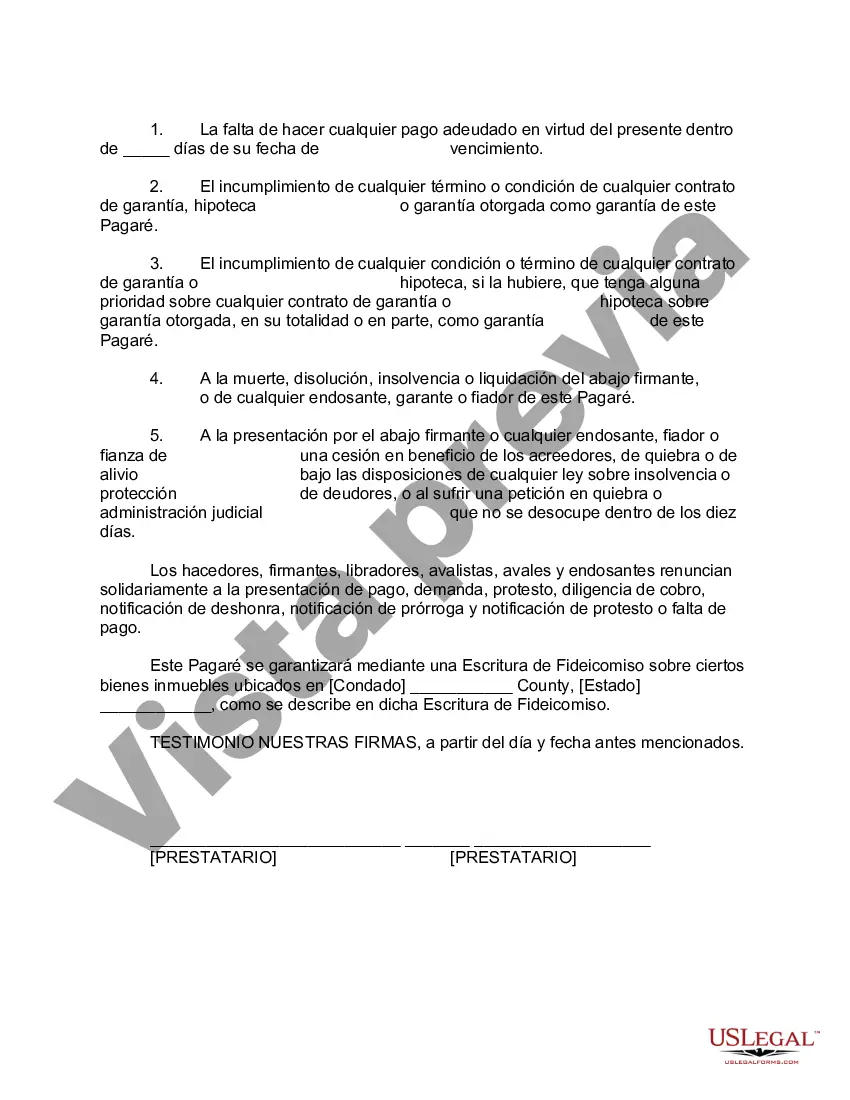

A Chicago Illinois Promissory Note — Long Form is a legal document commonly used in financial transactions between parties in Chicago, Illinois. It outlines the terms and conditions under which the borrower promises to repay a specific amount of money borrowed from the lender. This long form of a Promissory Note provides a more comprehensive and detailed agreement, compared to a short form note. It includes essential information such as the names and addresses of both parties involved, the principal amount borrowed, the interest rate charged, repayment schedule, late payment fees, and any collateral provided. The Chicago Illinois Promissory Note — Long Form also includes clauses to ensure legality, such as a governing law clause specifying that any disputes arising will be determined by the laws of Illinois. There are different types of Chicago Illinois Promissory Note — Long Form that can be used based on varying situations. Some relevant variations may include: 1. Secured Promissory Note: This type of note includes provisions for collateral provided by the borrower, such as personal property, real estate, or valuable assets. In case of default on the loan, the lender has the right to seize and sell the collateral to recover the outstanding amount. 2. Unsecured Promissory Note: Unlike the secured note, this type of note does not require collateral. The borrower's promise to repay the loan is based solely on their creditworthiness and trustworthiness. This type of note carries higher risk for the lender and often results in higher interest rates. 3. Demand Promissory Note: This type of note allows the lender to demand repayment of the entire loan amount at any time, without adhering to a specific repayment schedule. It provides flexibility for the lender but may not be favorable for the borrower who may need predictable installment payments. 4. Installment Promissory Note: This note divides the loan amount into regular and equal installment payments, usually monthly or quarterly. It includes specific dates for repayment, interest calculation, and penalty provisions for late payments. The Chicago Illinois Promissory Note — Long Form serves as a legally binding contract between the borrower and lender, ensuring transparency and clarity in financial arrangements. Seeking legal counsel or using professionally-drafted templates is advisable to ensure compliance with relevant laws and to protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré - Forma larga - Promissory Note - Long Form

Description

How to fill out Chicago Illinois Pagaré - Forma Larga?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Chicago Promissory Note - Long Form, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any tasks related to document execution simple.

Here's how you can purchase and download Chicago Promissory Note - Long Form.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Chicago Promissory Note - Long Form.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Promissory Note - Long Form, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer entirely. If you need to cope with an exceptionally difficult case, we advise getting a lawyer to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!