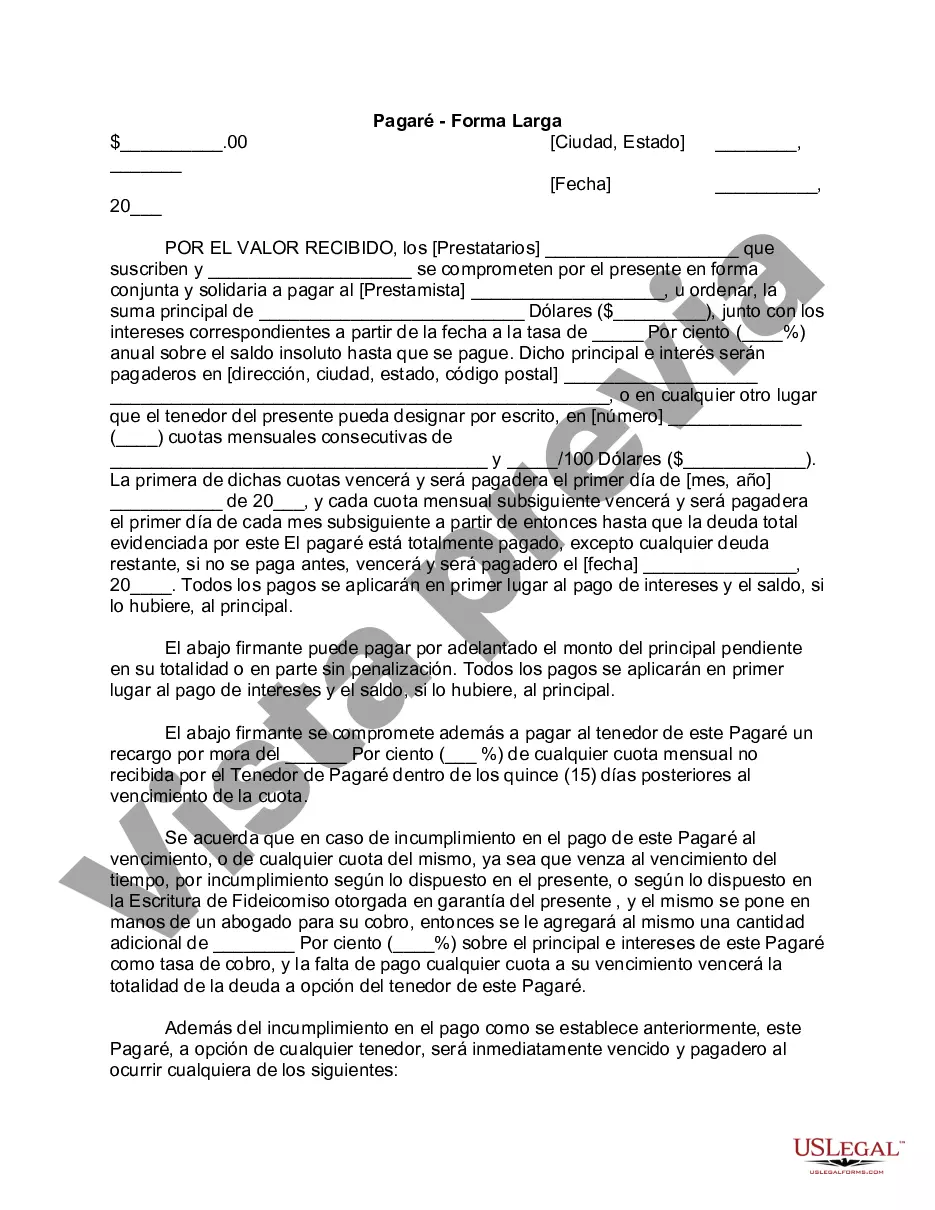

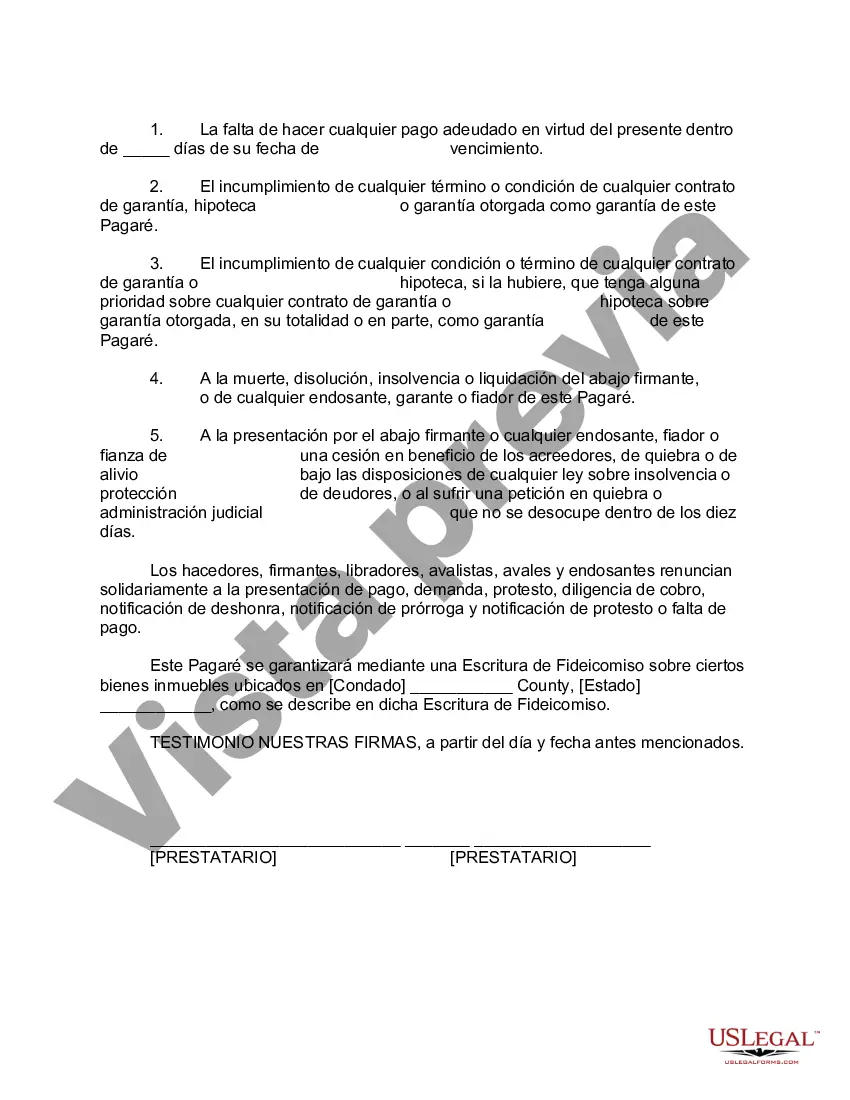

A Maricopa Arizona Promissory Note — Long Form is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower. This note serves as evidence of the borrower's promise to repay the lender a certain amount of money on a specified date or according to a predetermined repayment schedule. The Maricopa Arizona Promissory Note — Long Form includes various crucial elements such as the names and addresses of both the lender and the borrower, the principal loan amount, the interest rate (if applicable), the repayment terms, and any penalties or late fees for missed payments or default. The note also includes provisions regarding the collateral, if any, that secures the loan. Collateral can be any valuable asset of the borrower, such as real estate, vehicles, or other personal property, which can be claimed by the lender in case of default. Different types of Maricopa Arizona Promissory Note — Long Form may arise based on the specific purpose of the loan or the parties involved. Some common variations include: 1. Maricopa Arizona Promissory Note for Student Loans: This type of promissory note is specific to educational loan agreements between individuals or organizations providing funds for academic purposes. 2. Maricopa Arizona Promissory Note for Real Estate: This note is used when the loan is obtained for real estate transactions, such as purchasing, refinancing, or construction of properties. It may include additional provisions related to mortgages and liens. 3. Maricopa Arizona Promissory Note for Business Loans: This type of note is utilized for loans taken by businesses to finance operations, expansions, or acquisitions. It often includes clauses regarding business assets, repayment based on revenue, or other business-specific considerations. 4. Maricopa Arizona Promissory Note for Personal Loans: This note is used for borrowing money between individuals for personal reasons, such as debt consolidation, medical expenses, or home renovations. It is essential to carefully review and understand the terms outlined in the Maricopa Arizona Promissory Note — Long Form before signing, as it will have legal consequences in case of default or disputes. Consulting with a legal professional is advisable to ensure compliance with Arizona state laws and to protect the rights and interests of both the lender and the borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Pagaré - Forma larga - Promissory Note - Long Form

Description

How to fill out Maricopa Arizona Pagaré - Forma Larga?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Maricopa Promissory Note - Long Form.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Maricopa Promissory Note - Long Form will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Maricopa Promissory Note - Long Form:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Maricopa Promissory Note - Long Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!