A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

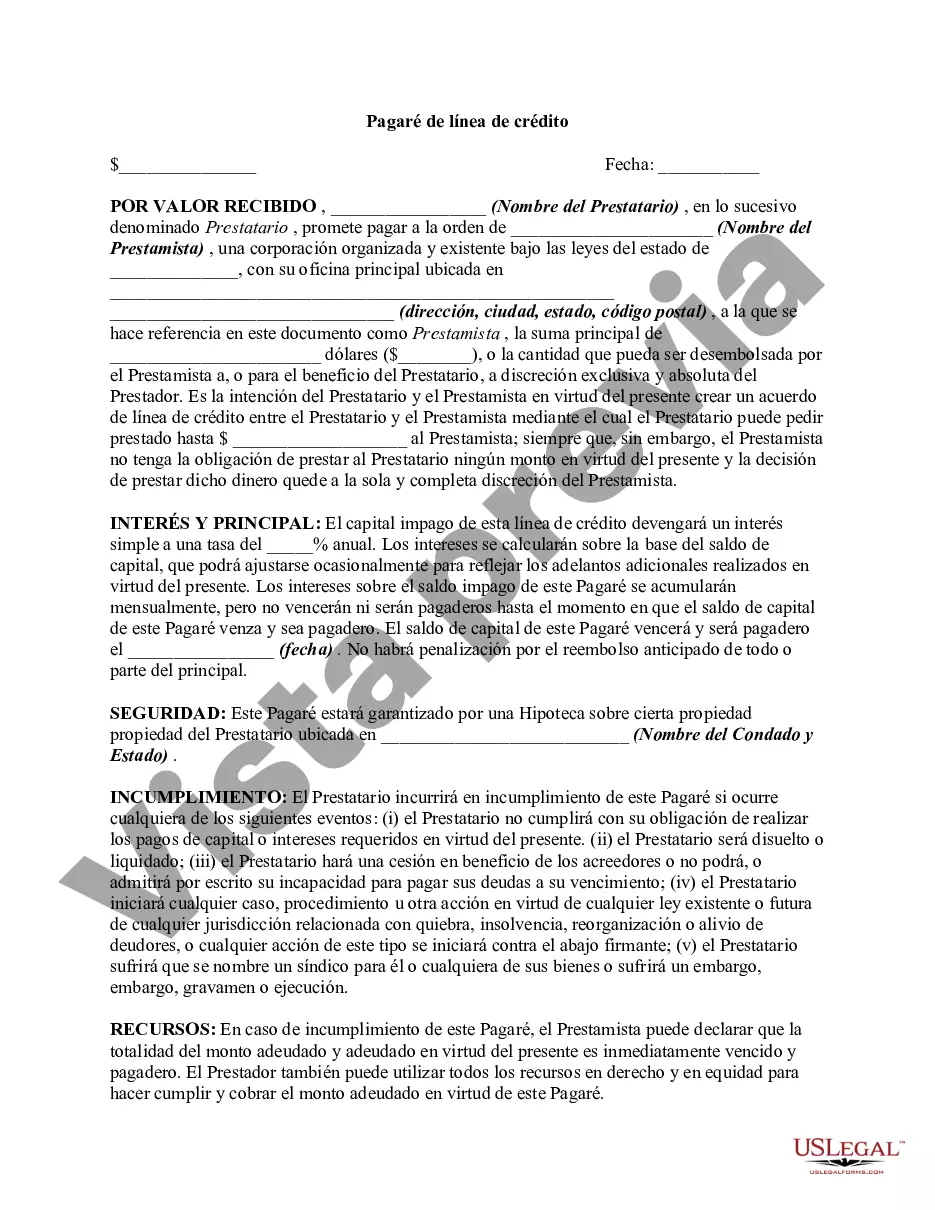

Keywords: Alameda California, Line of Credit Promissory Note, types, detailed description A Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Alameda, California. This note serves as a promissory note for a line of credit, which is a flexible financing option that allows the borrower to access funds up to a predetermined limit. In Alameda, California, there are various types of Line of Credit promissory notes available. Some common types include: 1. Unsecured Line of Credit Promissory Note: This type of note does not require any collateral from the borrower. The lender extends credit based solely on the borrower's creditworthiness and financial standing. 2. Secured Line of Credit Promissory Note: In contrast to an unsecured note, this type of note is backed by collateral. The borrower pledges certain assets, such as real estate or equipment, as collateral to secure the line of credit. 3. Revolving Line of Credit Promissory Note: This type of note allows the borrower to borrow, repay, and borrow again up to the maximum credit limit. It provides the borrower with ongoing access to funds as long as the note is active and in good standing. 4. Non-revolving Line of Credit Promissory Note: Unlike a revolving note, this type of note does not allow the borrower to borrow again once the repaid amount is withdrawn. The credit limit is fixed, and once fully utilized, the borrower cannot borrow additional funds. In Alameda, California, the Line of Credit Promissory Note typically includes essential information such as the borrower's and lender's names and contact details, the loan amount, the interest rate, repayment terms, and any collateral or security provided. It also outlines late payment penalties, default conditions, and any other terms specific to the loan agreement. It is important for both parties to understand and agree upon the terms stated in the Line of Credit Promissory Note before signing it. Seeking legal advice is recommended to ensure compliance with California laws and to protect the rights and interests of both the borrower and the lender.Keywords: Alameda California, Line of Credit Promissory Note, types, detailed description A Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Alameda, California. This note serves as a promissory note for a line of credit, which is a flexible financing option that allows the borrower to access funds up to a predetermined limit. In Alameda, California, there are various types of Line of Credit promissory notes available. Some common types include: 1. Unsecured Line of Credit Promissory Note: This type of note does not require any collateral from the borrower. The lender extends credit based solely on the borrower's creditworthiness and financial standing. 2. Secured Line of Credit Promissory Note: In contrast to an unsecured note, this type of note is backed by collateral. The borrower pledges certain assets, such as real estate or equipment, as collateral to secure the line of credit. 3. Revolving Line of Credit Promissory Note: This type of note allows the borrower to borrow, repay, and borrow again up to the maximum credit limit. It provides the borrower with ongoing access to funds as long as the note is active and in good standing. 4. Non-revolving Line of Credit Promissory Note: Unlike a revolving note, this type of note does not allow the borrower to borrow again once the repaid amount is withdrawn. The credit limit is fixed, and once fully utilized, the borrower cannot borrow additional funds. In Alameda, California, the Line of Credit Promissory Note typically includes essential information such as the borrower's and lender's names and contact details, the loan amount, the interest rate, repayment terms, and any collateral or security provided. It also outlines late payment penalties, default conditions, and any other terms specific to the loan agreement. It is important for both parties to understand and agree upon the terms stated in the Line of Credit Promissory Note before signing it. Seeking legal advice is recommended to ensure compliance with California laws and to protect the rights and interests of both the borrower and the lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.