A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

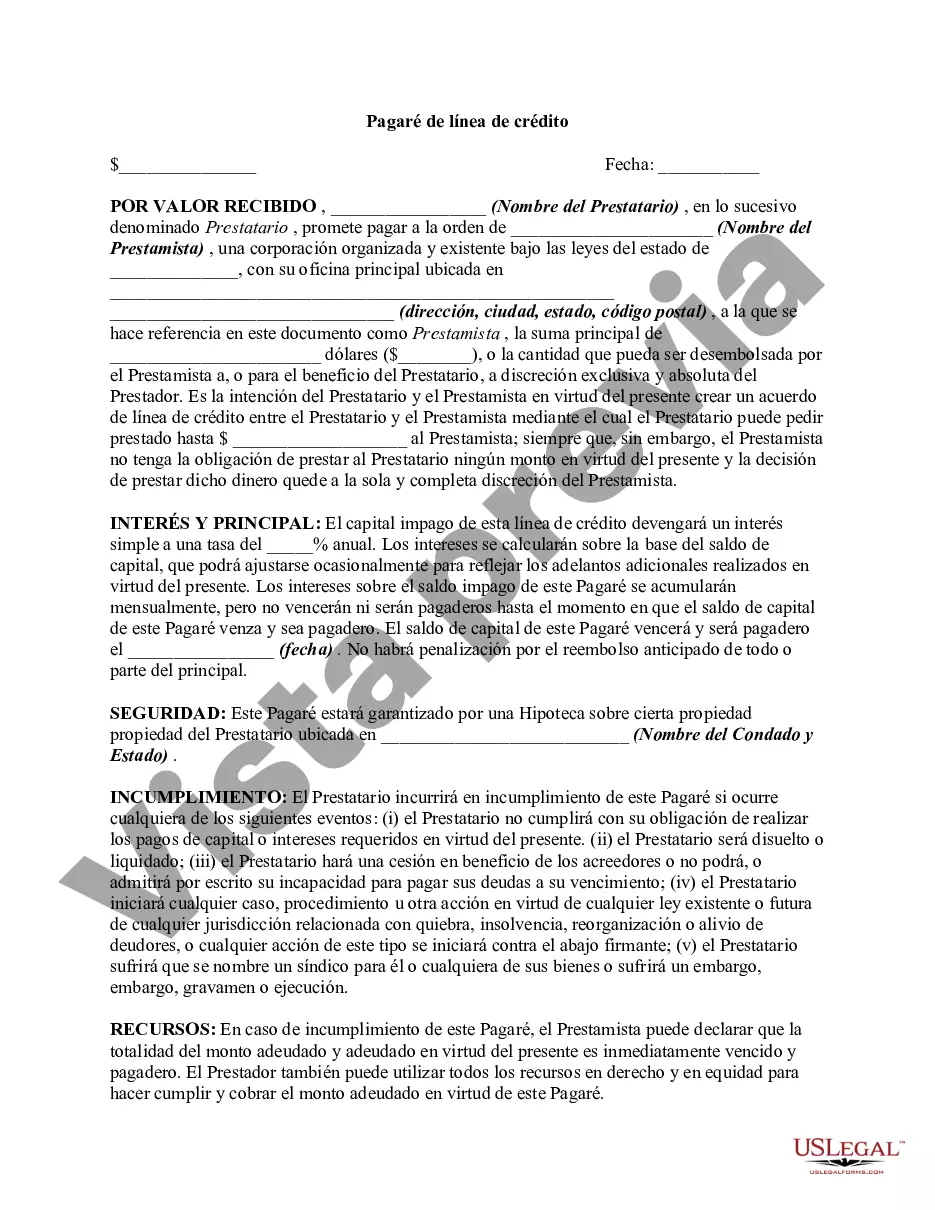

A Bronx New York Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan obtained from a financial institution or lender in the Bronx, New York area. This type of promissory note is specifically used for a line of credit, which is a flexible form of borrowing that allows the borrower to access funds up to a certain limit as needed, rather than receiving a lump sum upfront. The Bronx New York Line of Credit Promissory Note typically includes details such as the names and contact information of both the borrower and lender, the principal amount of the line of credit, the interest rate, repayment terms, and any late payment penalties or fees. This document acts as evidence of the borrower's commitment to repay the borrowed amount in a timely manner. In the Bronx, New York area, there may be different types of Line of Credit Promissory Notes available to borrowers. Some common variations include: 1. Unsecured Line of Credit Promissory Note: This type of promissory note does not require any collateral from the borrower. The lender may rely solely on the borrower's creditworthiness and signature to grant the line of credit. 2. Secured Line of Credit Promissory Note: In contrast to an unsecured note, a secured promissory note involves the borrower providing collateral as a guarantee for repayment. Collateral could be in the form of real estate, vehicles, or other valuable assets that the lender can claim in case of borrower default. 3. Revolving Line of Credit Promissory Note: A revolving line of credit promissory note allows the borrower to borrow, repay, and borrow again within the set credit limit. As the borrower repays the borrowed amount, the available credit is replenished. This type of note offers flexibility and is typically used for ongoing financing needs. 4. Demand Line of Credit Promissory Note: A demand line of credit promissory note allows the lender to request repayment of the outstanding balance at any time, without prior notice. This type of note provides the lender with more control over the repayment timeline. Bronx New York Line of Credit Promissory Notes serve as a crucial legal document that protects the rights and obligations of both parties involved. It is recommended that borrowers carefully review and understand the terms of the promissory note before signing, and consider seeking legal advice if necessary.A Bronx New York Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan obtained from a financial institution or lender in the Bronx, New York area. This type of promissory note is specifically used for a line of credit, which is a flexible form of borrowing that allows the borrower to access funds up to a certain limit as needed, rather than receiving a lump sum upfront. The Bronx New York Line of Credit Promissory Note typically includes details such as the names and contact information of both the borrower and lender, the principal amount of the line of credit, the interest rate, repayment terms, and any late payment penalties or fees. This document acts as evidence of the borrower's commitment to repay the borrowed amount in a timely manner. In the Bronx, New York area, there may be different types of Line of Credit Promissory Notes available to borrowers. Some common variations include: 1. Unsecured Line of Credit Promissory Note: This type of promissory note does not require any collateral from the borrower. The lender may rely solely on the borrower's creditworthiness and signature to grant the line of credit. 2. Secured Line of Credit Promissory Note: In contrast to an unsecured note, a secured promissory note involves the borrower providing collateral as a guarantee for repayment. Collateral could be in the form of real estate, vehicles, or other valuable assets that the lender can claim in case of borrower default. 3. Revolving Line of Credit Promissory Note: A revolving line of credit promissory note allows the borrower to borrow, repay, and borrow again within the set credit limit. As the borrower repays the borrowed amount, the available credit is replenished. This type of note offers flexibility and is typically used for ongoing financing needs. 4. Demand Line of Credit Promissory Note: A demand line of credit promissory note allows the lender to request repayment of the outstanding balance at any time, without prior notice. This type of note provides the lender with more control over the repayment timeline. Bronx New York Line of Credit Promissory Notes serve as a crucial legal document that protects the rights and obligations of both parties involved. It is recommended that borrowers carefully review and understand the terms of the promissory note before signing, and consider seeking legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.