A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

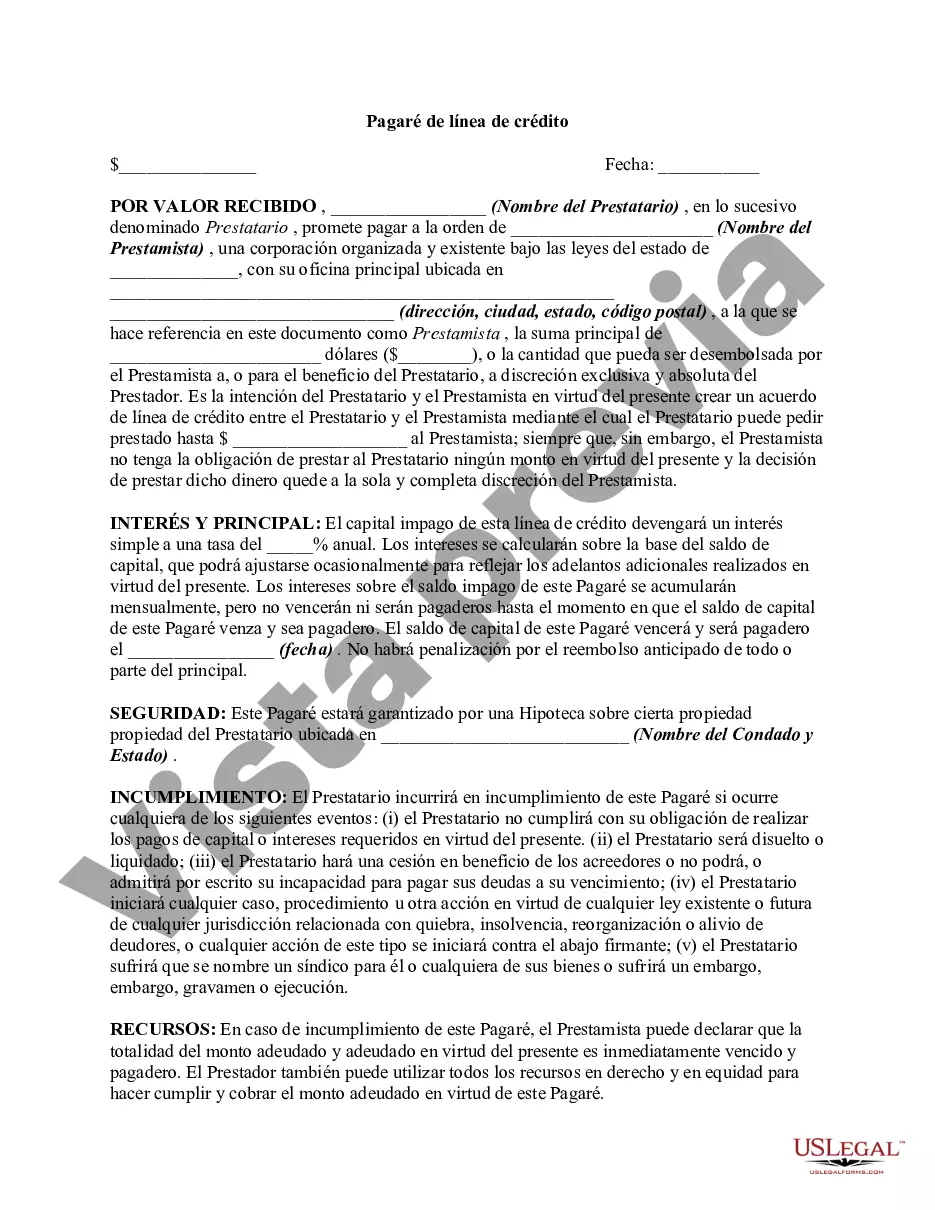

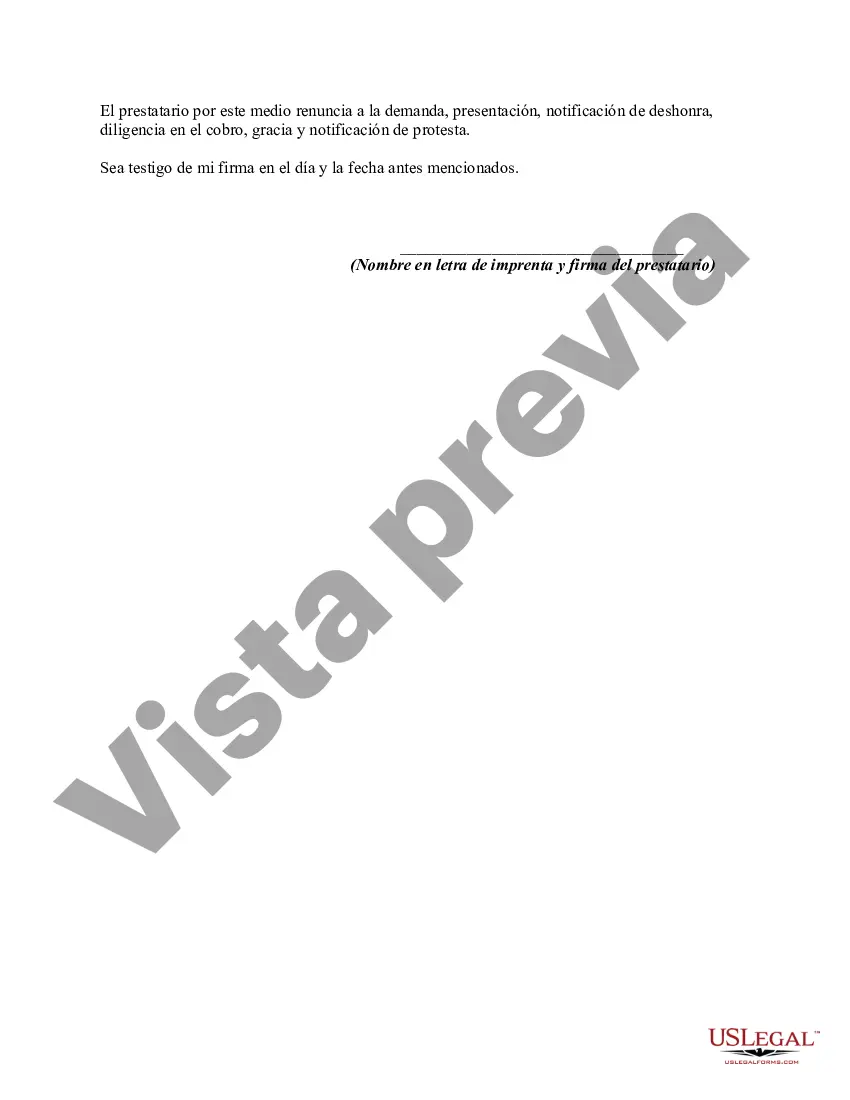

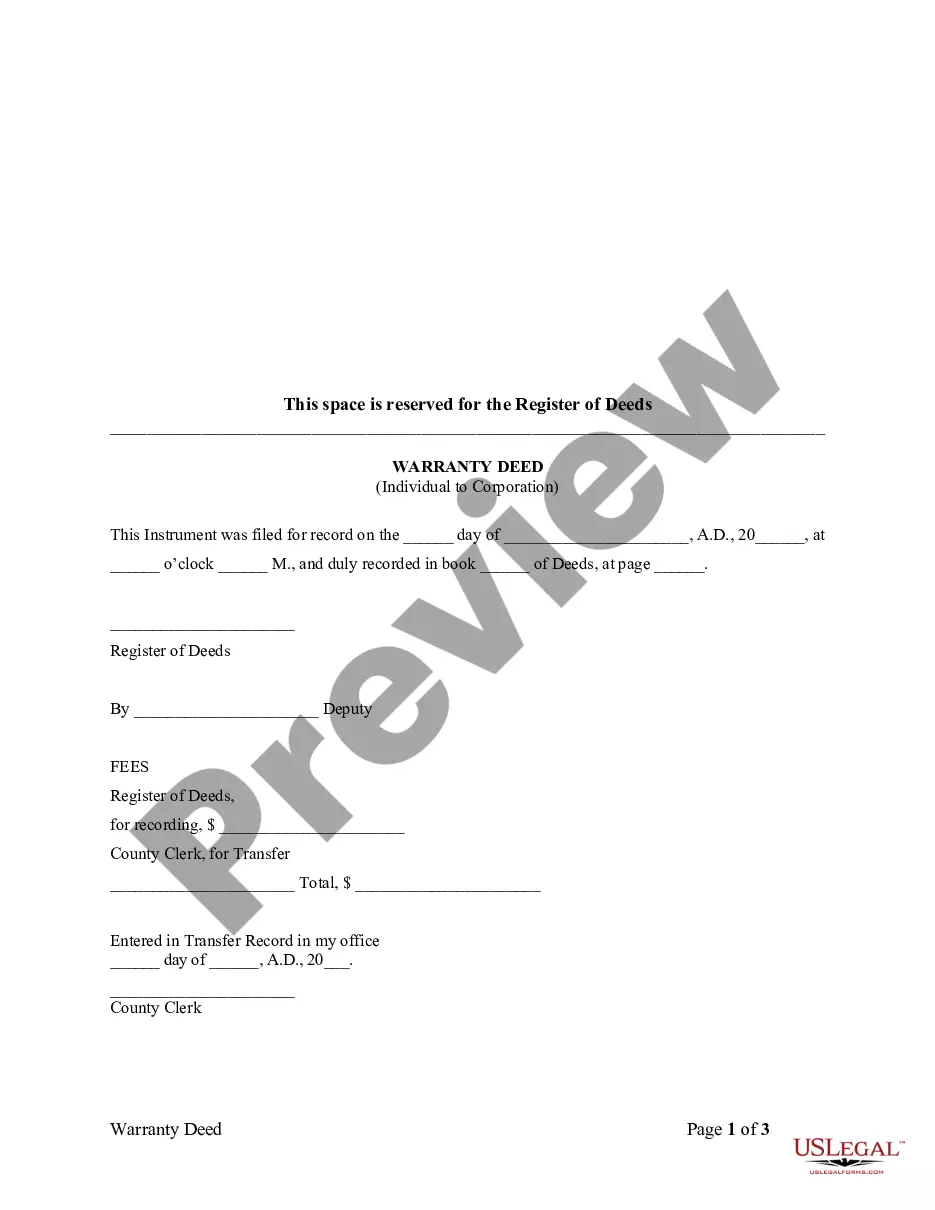

Collin Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a financial agreement between a lender and a borrower in Collin, Texas. This promissory note serves as evidence of the borrower's promise to repay a line of credit based on their creditworthiness and the lender's discretion. It is an important document in establishing and enforcing the lending relationship. The Collin Texas Line of Credit Promissory Note typically includes key details such as the names of the lender and borrower, the principal amount of the line of credit, the applicable interest rate, the repayment terms, and any additional fees or charges. It also specifies the timeline for repayment, outlining whether the line of credit is open-ended or has a specific repayment period. Different types of Collin Texas Line of Credit Promissory Notes may exist based on the specific terms and conditions agreed upon by the lender and borrower. Some possible variations include: 1. Revolving Line of Credit Promissory Note: This type of promissory note establishes an open-ended line of credit, enabling the borrower to access funds as needed over a certain period. Repayments can be made at any time, and interest is typically charged only on the outstanding balance. 2. Secured Line of Credit Promissory Note: In this case, the borrower provides collateral to secure the line of credit. This collateral, such as real estate or a vehicle, acts as an assurance for the lender in case of default. 3. Unsecured Line of Credit Promissory Note: Unlike a secured line of credit, an unsecured promissory note does not require collateral. Instead, the borrower's creditworthiness and financial stability are the main factors considered by the lender. 4. Personal Line of Credit Promissory Note: This type of promissory note is designed for individuals to borrow funds for personal expenses, such as home renovations or education. The borrowing limit and repayment terms are determined based on the borrower's financial situation. 5. Business Line of Credit Promissory Note: This promissory note is tailored for small business owners in Collin, Texas, allowing them to access funds for operational expenses or expansion plans. The terms and conditions may consider the borrower's business financials and potential collateral. In summary, the Collin Texas Line of Credit Promissory Note is a legally binding document that defines the terms and expectations of a line of credit between a lender and a borrower. It acts as a commitment to repay the borrowed funds according to the agreed-upon terms and conditions. Lenders and borrowers can explore different variations of this note, such as revolving, secured, unsecured, personal or business lines of credit, to suit their specific financial needs and circumstances.Collin Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a financial agreement between a lender and a borrower in Collin, Texas. This promissory note serves as evidence of the borrower's promise to repay a line of credit based on their creditworthiness and the lender's discretion. It is an important document in establishing and enforcing the lending relationship. The Collin Texas Line of Credit Promissory Note typically includes key details such as the names of the lender and borrower, the principal amount of the line of credit, the applicable interest rate, the repayment terms, and any additional fees or charges. It also specifies the timeline for repayment, outlining whether the line of credit is open-ended or has a specific repayment period. Different types of Collin Texas Line of Credit Promissory Notes may exist based on the specific terms and conditions agreed upon by the lender and borrower. Some possible variations include: 1. Revolving Line of Credit Promissory Note: This type of promissory note establishes an open-ended line of credit, enabling the borrower to access funds as needed over a certain period. Repayments can be made at any time, and interest is typically charged only on the outstanding balance. 2. Secured Line of Credit Promissory Note: In this case, the borrower provides collateral to secure the line of credit. This collateral, such as real estate or a vehicle, acts as an assurance for the lender in case of default. 3. Unsecured Line of Credit Promissory Note: Unlike a secured line of credit, an unsecured promissory note does not require collateral. Instead, the borrower's creditworthiness and financial stability are the main factors considered by the lender. 4. Personal Line of Credit Promissory Note: This type of promissory note is designed for individuals to borrow funds for personal expenses, such as home renovations or education. The borrowing limit and repayment terms are determined based on the borrower's financial situation. 5. Business Line of Credit Promissory Note: This promissory note is tailored for small business owners in Collin, Texas, allowing them to access funds for operational expenses or expansion plans. The terms and conditions may consider the borrower's business financials and potential collateral. In summary, the Collin Texas Line of Credit Promissory Note is a legally binding document that defines the terms and expectations of a line of credit between a lender and a borrower. It acts as a commitment to repay the borrowed funds according to the agreed-upon terms and conditions. Lenders and borrowers can explore different variations of this note, such as revolving, secured, unsecured, personal or business lines of credit, to suit their specific financial needs and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.