A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

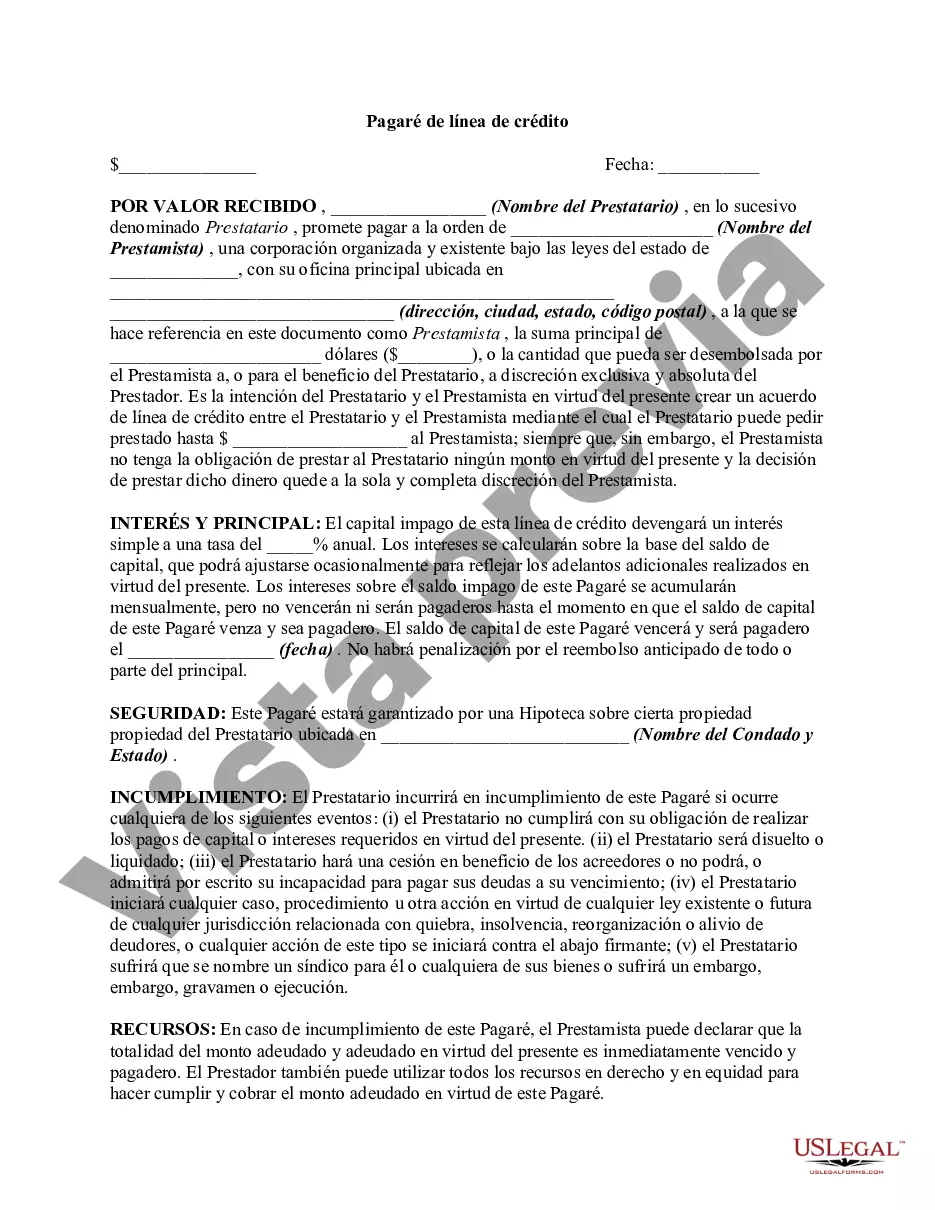

The Contra Costa California Line of Credit Promissory Note is a legal and binding document that outlines the terms and conditions under which a line of credit is extended to a borrower in Contra Costa County, California. This note serves as an agreement between the borrower and the lender, establishing the obligations and terms associated with the line of credit. Keywords: Contra Costa California, Line of Credit, Promissory Note, borrower, lender, terms and conditions, agreement, obligations. Different types of Contra Costa California Line of Credit Promissory Notes may include: 1. Personal Line of Credit Promissory Note: This type of promissory note is used when an individual borrower seeks a line of credit from a lender for personal financial needs in Contra Costa County, California. It defines the terms of repayment, interest rates, and any collateral or guarantees required. 2. Business Line of Credit Promissory Note: This promissory note is specifically designed for businesses in Contra Costa County, California seeking a line of credit. It specifies the terms of borrowing, repayment structure, interest rates, and any other conditions agreed upon between the lender and the borrower. 3. Real Estate Line of Credit Promissory Note: When a borrower wishes to obtain a line of credit for real estate purposes in Contra Costa County, California, this specific promissory note is utilized. It includes provisions related to the use of the line of credit for real estate transactions, repayment terms, and any additional requirements related to the property. 4. Educational Line of Credit Promissory Note: This type of promissory note is used when a borrower in Contra Costa County, California seeks a line of credit specifically for educational purposes. It outlines terms of repayment, interest rates, and any conditions related to the educational institution the borrower plans to attend. 5. Medical Line of Credit Promissory Note: When a borrower requires a line of credit to cover medical expenses in Contra Costa County, California, this promissory note is used. It encompasses the terms of borrowing, repayment schedules, interest rates, and any specific provisions related to medical costs. By utilizing the appropriate Contra Costa California Line of Credit Promissory Note, both the borrower and lender can establish clear expectations and protections as they engage in a line of credit arrangement in Contra Costa County, California.The Contra Costa California Line of Credit Promissory Note is a legal and binding document that outlines the terms and conditions under which a line of credit is extended to a borrower in Contra Costa County, California. This note serves as an agreement between the borrower and the lender, establishing the obligations and terms associated with the line of credit. Keywords: Contra Costa California, Line of Credit, Promissory Note, borrower, lender, terms and conditions, agreement, obligations. Different types of Contra Costa California Line of Credit Promissory Notes may include: 1. Personal Line of Credit Promissory Note: This type of promissory note is used when an individual borrower seeks a line of credit from a lender for personal financial needs in Contra Costa County, California. It defines the terms of repayment, interest rates, and any collateral or guarantees required. 2. Business Line of Credit Promissory Note: This promissory note is specifically designed for businesses in Contra Costa County, California seeking a line of credit. It specifies the terms of borrowing, repayment structure, interest rates, and any other conditions agreed upon between the lender and the borrower. 3. Real Estate Line of Credit Promissory Note: When a borrower wishes to obtain a line of credit for real estate purposes in Contra Costa County, California, this specific promissory note is utilized. It includes provisions related to the use of the line of credit for real estate transactions, repayment terms, and any additional requirements related to the property. 4. Educational Line of Credit Promissory Note: This type of promissory note is used when a borrower in Contra Costa County, California seeks a line of credit specifically for educational purposes. It outlines terms of repayment, interest rates, and any conditions related to the educational institution the borrower plans to attend. 5. Medical Line of Credit Promissory Note: When a borrower requires a line of credit to cover medical expenses in Contra Costa County, California, this promissory note is used. It encompasses the terms of borrowing, repayment schedules, interest rates, and any specific provisions related to medical costs. By utilizing the appropriate Contra Costa California Line of Credit Promissory Note, both the borrower and lender can establish clear expectations and protections as they engage in a line of credit arrangement in Contra Costa County, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.