A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

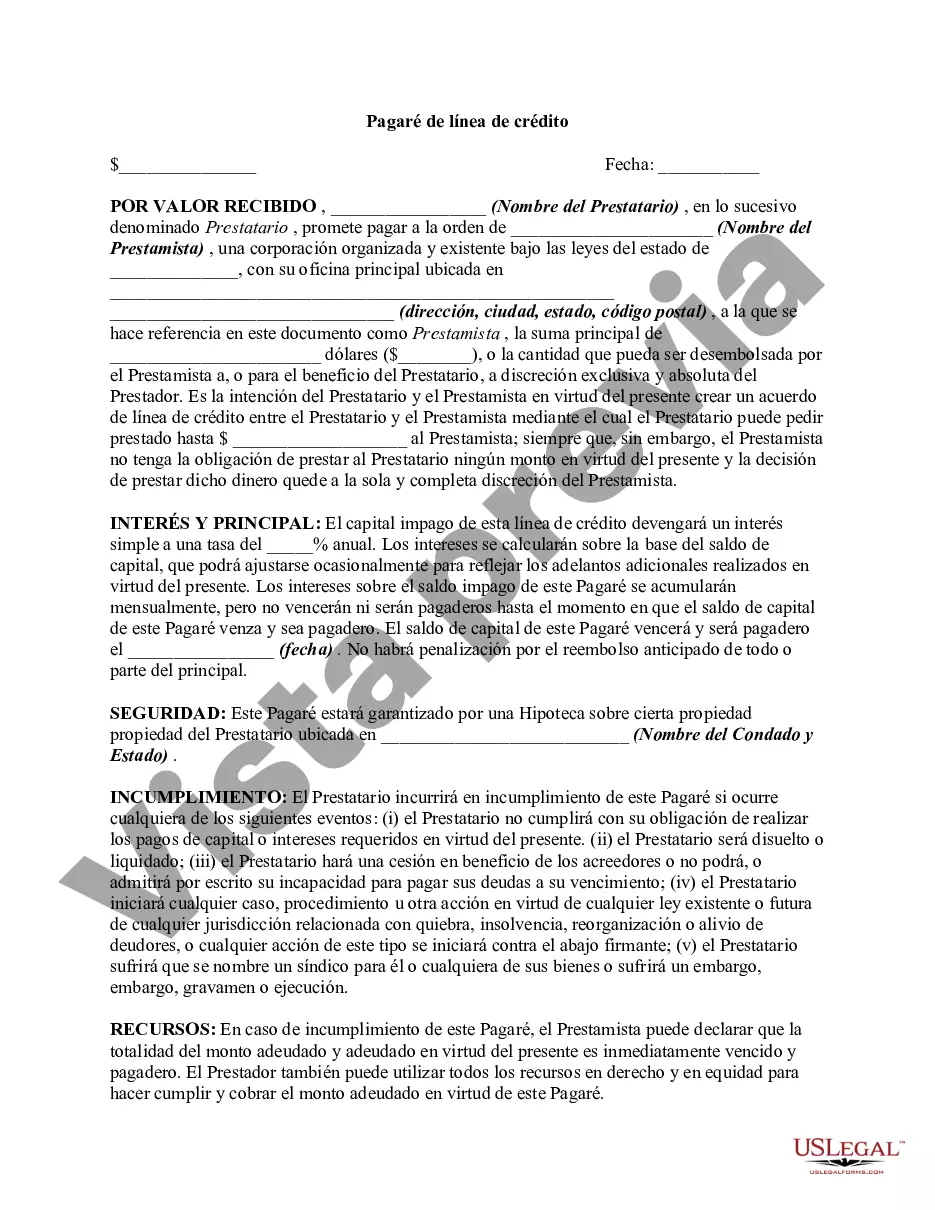

A Dallas Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a line of credit arrangement in the state of Texas, specifically in the city of Dallas. This document is typically used when individuals or businesses need access to a revolving line of credit for various financial needs. Keywords: Dallas Texas, Line of Credit, Promissory Note, legal document, terms and conditions, revolving line of credit, financial needs. There are different types of Dallas Texas Line of Credit Promissory Notes, each addressing specific requirements or circumstances. Some variations include: 1. Secured Line of Credit Promissory Note: This type of note is backed by collateral assets provided by the borrower, such as real estate or other valuable properties. It offers added security to the lender in case of default by the borrower. 2. Unsecured Line of Credit Promissory Note: In contrast to a secured note, this type of promissory note does not require any collateral. It is based solely on the borrower's creditworthiness and financial history, making it more accessible to those without significant assets. 3. Personal Line of Credit Promissory Note: Designed for individual borrowers, this note provides access to a revolving line of credit for personal financial needs. It can be used for various purposes, including debt consolidation, home improvement, education, or emergency expenses. 4. Business Line of Credit Promissory Note: Specifically tailored for businesses, this note allows companies to access a revolving line of credit to fund operational expenses, inventory purchases, payroll, or expansion initiatives. It is an essential tool for managing cash flow fluctuations and supporting day-to-day operations. 5. Construction Line of Credit Promissory Note: This note is commonly used in the construction industry. It enables builders and contractors to access funds for purchasing materials, paying subcontractors, and covering other project-related costs. The credit limit is typically increased as construction milestones are met. Each type of Line of Credit Promissory Note has its own specific provisions, including interest rates, repayment terms, default penalties, and conditions for fund usage. It is essential to carefully review and understand the terms stated in the document before entering into a line of credit agreement in Dallas, Texas.A Dallas Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a line of credit arrangement in the state of Texas, specifically in the city of Dallas. This document is typically used when individuals or businesses need access to a revolving line of credit for various financial needs. Keywords: Dallas Texas, Line of Credit, Promissory Note, legal document, terms and conditions, revolving line of credit, financial needs. There are different types of Dallas Texas Line of Credit Promissory Notes, each addressing specific requirements or circumstances. Some variations include: 1. Secured Line of Credit Promissory Note: This type of note is backed by collateral assets provided by the borrower, such as real estate or other valuable properties. It offers added security to the lender in case of default by the borrower. 2. Unsecured Line of Credit Promissory Note: In contrast to a secured note, this type of promissory note does not require any collateral. It is based solely on the borrower's creditworthiness and financial history, making it more accessible to those without significant assets. 3. Personal Line of Credit Promissory Note: Designed for individual borrowers, this note provides access to a revolving line of credit for personal financial needs. It can be used for various purposes, including debt consolidation, home improvement, education, or emergency expenses. 4. Business Line of Credit Promissory Note: Specifically tailored for businesses, this note allows companies to access a revolving line of credit to fund operational expenses, inventory purchases, payroll, or expansion initiatives. It is an essential tool for managing cash flow fluctuations and supporting day-to-day operations. 5. Construction Line of Credit Promissory Note: This note is commonly used in the construction industry. It enables builders and contractors to access funds for purchasing materials, paying subcontractors, and covering other project-related costs. The credit limit is typically increased as construction milestones are met. Each type of Line of Credit Promissory Note has its own specific provisions, including interest rates, repayment terms, default penalties, and conditions for fund usage. It is essential to carefully review and understand the terms stated in the document before entering into a line of credit agreement in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.