A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

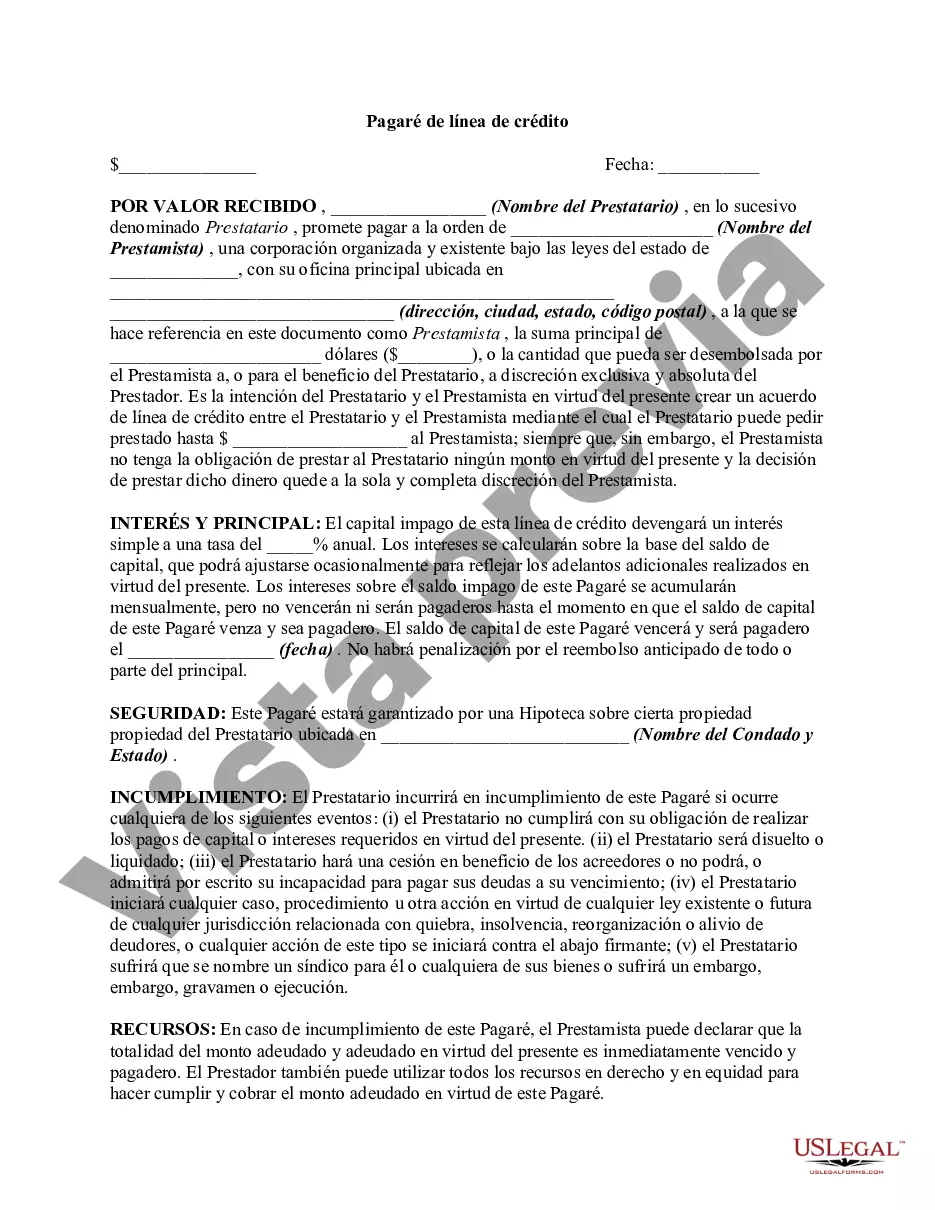

The Hennepin Minnesota Line of Credit Promissory Note is a legal document that outlines the terms and conditions for a line of credit transaction in Hennepin County, Minnesota. This promissory note serves as proof of a borrower's promise to repay the lender the principal amount borrowed, along with any accrued interest, according to the stated terms. The Hennepin Minnesota Line of Credit Promissory Note is designed to provide individuals and businesses with a flexible financing option. It allows borrowers to access funds as needed, up to a predetermined credit limit, without having to go through the loan application process each time they require capital. The note includes essential details such as the borrower's and lender's information, the loan amount or credit limit, interest rate, repayment schedule, and any applicable fees or penalties. Additionally, it states the consequences of defaulting on the loan, which may include legal action or damage to the borrower's credit rating. While the specific terms and conditions may vary depending on the lender, there are generally two main types of Hennepin Minnesota Line of Credit Promissory Notes: 1. Revolving Line of Credit Promissory Note: This type of promissory note allows borrowers to use the line of credit multiple times as long as they do not exceed the credit limit. Once the borrowed amount, known as the principal, is repaid, it becomes available to be borrowed again. Interest is typically charged only on the outstanding balance. 2. Non-Revolving Line of Credit Promissory Note: Unlike the revolving line of credit, this type provides the borrower with one-time access to a specific loan amount. Once the funds are fully utilized, the line of credit is no longer available until the borrower repays the outstanding balance. Interest is usually charged on the full amount borrowed from the beginning. It is crucial for both parties involved to carefully review and understand the details outlined in the Hennepin Minnesota Line of Credit Promissory Note. Seeking legal advice may be advisable to ensure compliance with state laws and regulations and to protect the rights and interests of both the borrower and lender.The Hennepin Minnesota Line of Credit Promissory Note is a legal document that outlines the terms and conditions for a line of credit transaction in Hennepin County, Minnesota. This promissory note serves as proof of a borrower's promise to repay the lender the principal amount borrowed, along with any accrued interest, according to the stated terms. The Hennepin Minnesota Line of Credit Promissory Note is designed to provide individuals and businesses with a flexible financing option. It allows borrowers to access funds as needed, up to a predetermined credit limit, without having to go through the loan application process each time they require capital. The note includes essential details such as the borrower's and lender's information, the loan amount or credit limit, interest rate, repayment schedule, and any applicable fees or penalties. Additionally, it states the consequences of defaulting on the loan, which may include legal action or damage to the borrower's credit rating. While the specific terms and conditions may vary depending on the lender, there are generally two main types of Hennepin Minnesota Line of Credit Promissory Notes: 1. Revolving Line of Credit Promissory Note: This type of promissory note allows borrowers to use the line of credit multiple times as long as they do not exceed the credit limit. Once the borrowed amount, known as the principal, is repaid, it becomes available to be borrowed again. Interest is typically charged only on the outstanding balance. 2. Non-Revolving Line of Credit Promissory Note: Unlike the revolving line of credit, this type provides the borrower with one-time access to a specific loan amount. Once the funds are fully utilized, the line of credit is no longer available until the borrower repays the outstanding balance. Interest is usually charged on the full amount borrowed from the beginning. It is crucial for both parties involved to carefully review and understand the details outlined in the Hennepin Minnesota Line of Credit Promissory Note. Seeking legal advice may be advisable to ensure compliance with state laws and regulations and to protect the rights and interests of both the borrower and lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.