A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

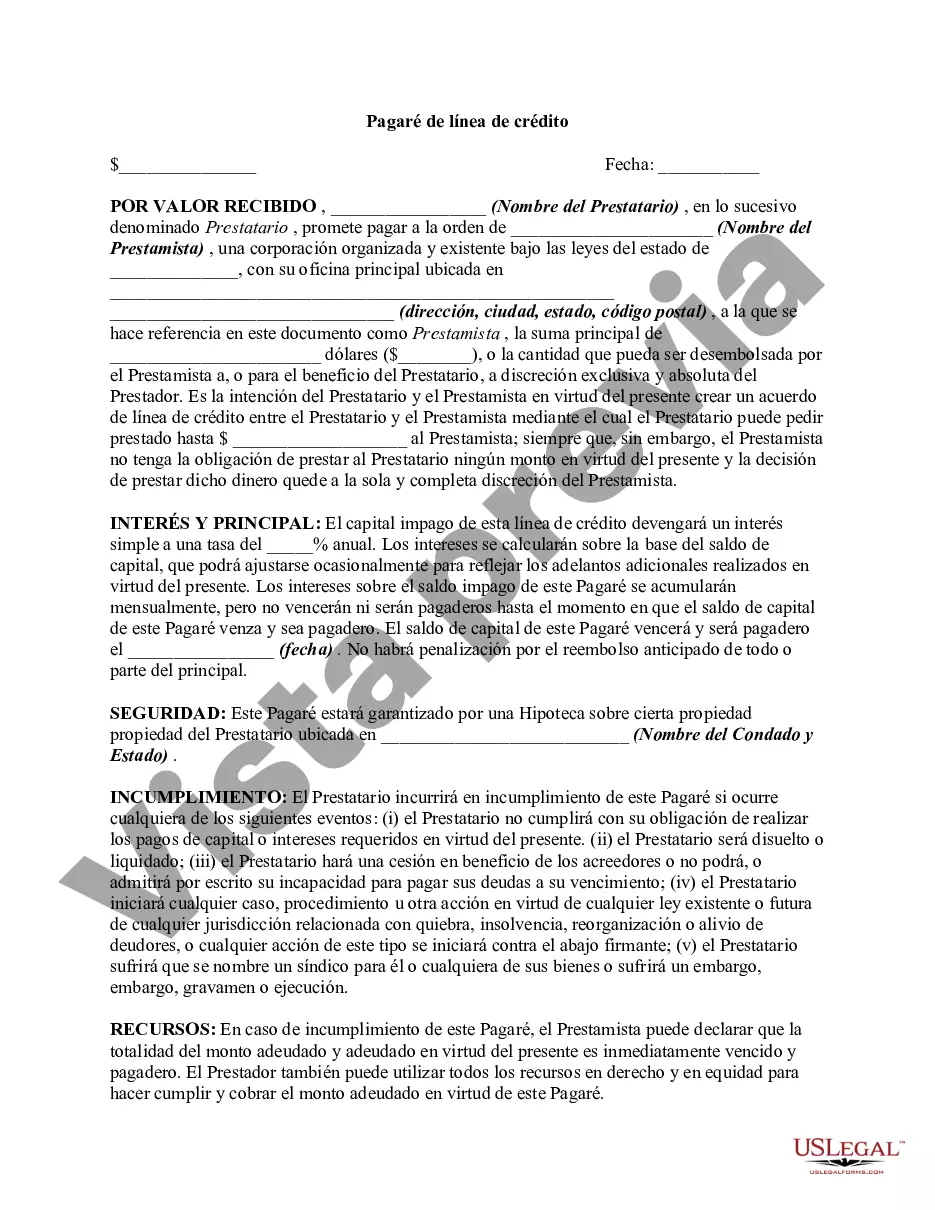

A Hillsborough Florida Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a financial agreement between a lender and a borrower in Hillsborough County, Florida. This note serves as evidence of debt and specifies the repayment terms, interest rate, and other relevant details. Keywords: Hillsborough Florida, Line of Credit, Promissory Note, lender, borrower, financial agreement, debt, repayment terms, interest rate There are several types of Hillsborough Florida Line of Credit Promissory Notes, each catering to specific financial needs. These may include: 1. Traditional Line of Credit Promissory Note: This type of promissory note establishes a revolving line of credit, allowing the borrower to access funds up to a pre-approved credit limit. The borrower can withdraw and repay funds flexibly, maintaining a continuous credit balance. 2. Home Equity Line of Credit (HELOT) Promissory Note: A HELOT promissory note is specific to borrowers who secure their credit line against the equity of their property in Hillsborough County, Florida. This type of note allows homeowners to access funds as needed, using their property as collateral. 3. Business Line of Credit Promissory Note: Designed for business purposes, this note enables companies and entrepreneurs to borrow funds as required for operational expenses, inventory purchases, or expansion plans. It provides financial flexibility and allows borrowing within a predetermined credit limit. 4. Personal Line of Credit Promissory Note: This type of promissory note is tailored for individual borrowers who need access to funds for personal reasons, such as emergencies, education expenses, or debt consolidation. It provides a predetermined credit limit that can be utilized as necessary. 5. Secured Line of Credit Promissory Note: This note requires the borrower to provide collateral for the line of credit, usually an asset of value. It offers the lender additional security and may result in more favorable terms and lower interest rates. 6. Unsecured Line of Credit Promissory Note: Unlike the secured option, an unsecured promissory note does not require collateral. The borrower's creditworthiness and financial history are the primary factors in determining eligibility and terms. Interest rates may be higher with this type of note. In conclusion, a Hillsborough Florida Line of Credit Promissory Note is a legal document that governs the terms and conditions of borrowing funds in Hillsborough County. Different types of promissory notes are available to cater to various financial needs, including traditional, home equity, business, personal, secured, and unsecured lines of credit.A Hillsborough Florida Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a financial agreement between a lender and a borrower in Hillsborough County, Florida. This note serves as evidence of debt and specifies the repayment terms, interest rate, and other relevant details. Keywords: Hillsborough Florida, Line of Credit, Promissory Note, lender, borrower, financial agreement, debt, repayment terms, interest rate There are several types of Hillsborough Florida Line of Credit Promissory Notes, each catering to specific financial needs. These may include: 1. Traditional Line of Credit Promissory Note: This type of promissory note establishes a revolving line of credit, allowing the borrower to access funds up to a pre-approved credit limit. The borrower can withdraw and repay funds flexibly, maintaining a continuous credit balance. 2. Home Equity Line of Credit (HELOT) Promissory Note: A HELOT promissory note is specific to borrowers who secure their credit line against the equity of their property in Hillsborough County, Florida. This type of note allows homeowners to access funds as needed, using their property as collateral. 3. Business Line of Credit Promissory Note: Designed for business purposes, this note enables companies and entrepreneurs to borrow funds as required for operational expenses, inventory purchases, or expansion plans. It provides financial flexibility and allows borrowing within a predetermined credit limit. 4. Personal Line of Credit Promissory Note: This type of promissory note is tailored for individual borrowers who need access to funds for personal reasons, such as emergencies, education expenses, or debt consolidation. It provides a predetermined credit limit that can be utilized as necessary. 5. Secured Line of Credit Promissory Note: This note requires the borrower to provide collateral for the line of credit, usually an asset of value. It offers the lender additional security and may result in more favorable terms and lower interest rates. 6. Unsecured Line of Credit Promissory Note: Unlike the secured option, an unsecured promissory note does not require collateral. The borrower's creditworthiness and financial history are the primary factors in determining eligibility and terms. Interest rates may be higher with this type of note. In conclusion, a Hillsborough Florida Line of Credit Promissory Note is a legal document that governs the terms and conditions of borrowing funds in Hillsborough County. Different types of promissory notes are available to cater to various financial needs, including traditional, home equity, business, personal, secured, and unsecured lines of credit.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.