A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

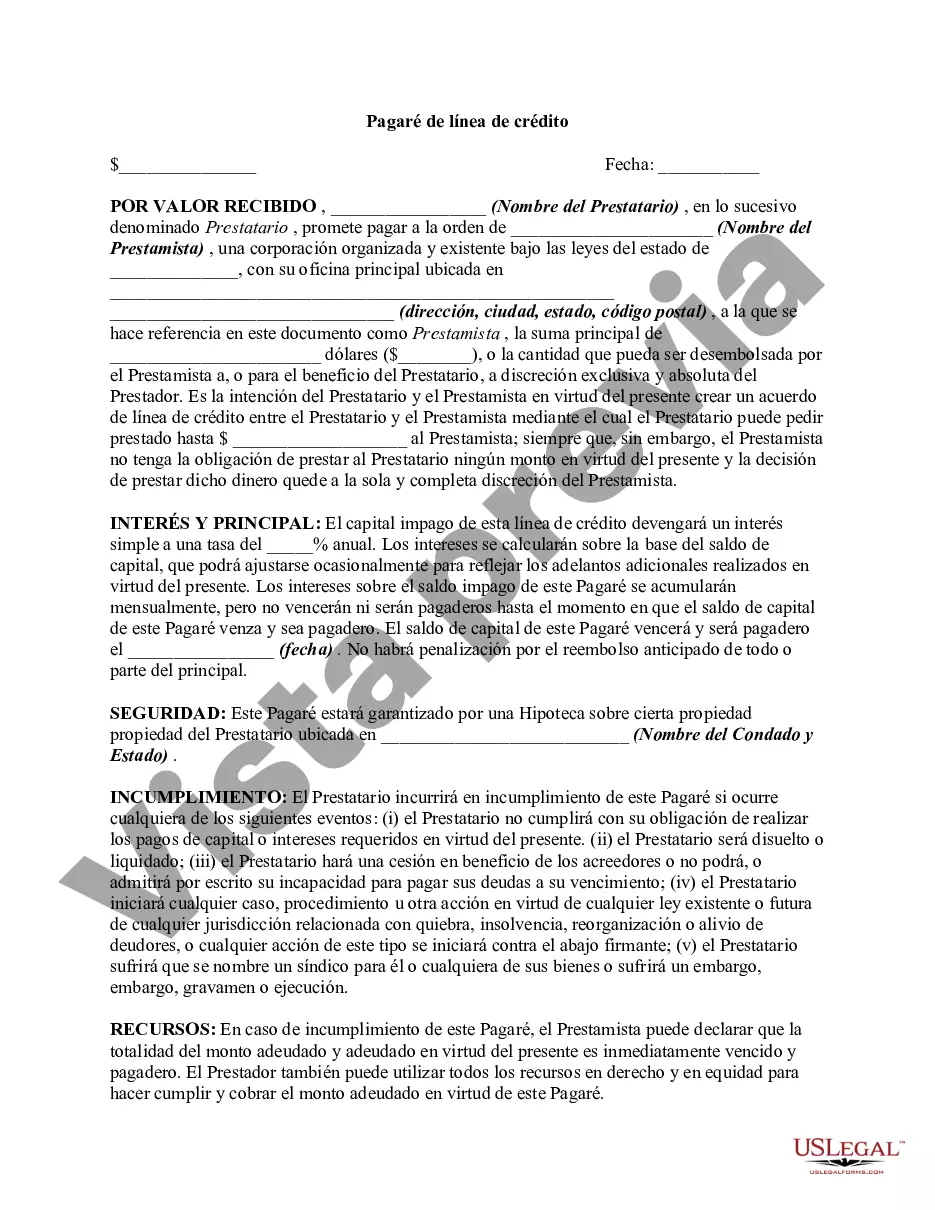

The Mecklenburg North Carolina Line of Credit Promissory Note is a legal document that outlines the terms and conditions for borrowers who wish to obtain a line of credit within the Mecklenburg County region in the state of North Carolina. This note serves as a binding agreement between the borrower and the lender, providing a clear understanding of the rights and obligations of both parties. Keywords: Mecklenburg North Carolina, Line of Credit Promissory Note, legal document, borrowers, line of credit, terms and conditions, Mecklenburg County, North Carolina, binding agreement, borrower, lender, rights, obligations. There are different types of Mecklenburg North Carolina Line of Credit Promissory Notes designed to cater to various needs and preferences: 1. Unsecured Line of Credit Promissory Note: This type of note does not require any collateral from the borrower. The loan amount is agreed upon based on the borrower's creditworthiness and financial history. 2. Secured Line of Credit Promissory Note: Unlike the unsecured option, this note requires the borrower to provide collateral, such as property or assets, to secure the line of credit. In case of default, the lender has the right to seize the collateral to recover the outstanding debt. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to access a specific credit limit whenever needed. It gives the borrower flexibility to borrow and repay funds within the agreed terms, often with no fixed repayment schedule. 4. Installment Line of Credit Promissory Note: This note requires the borrower to make regular payments, typically on a monthly basis, towards the outstanding debt. The repayment period and amounts are predetermined, offering more structure and predictability. 5. Business Line of Credit Promissory Note: Tailored specifically for business owners, this note provides access to funds for various business needs, such as working capital, inventory purchases, or expansion. The terms and limits are based on the borrower's business financials and anticipated cash flow. The Mecklenburg North Carolina Line of Credit Promissory Note is a crucial legal document that protects both the borrower and the lender's rights. It clearly defines the obligations, repayment terms, interest rates, and any penalties or fees associated with the line of credit. It is essential for both parties to thoroughly read and understand the terms before entering into this agreement to ensure a smooth borrowing experience.The Mecklenburg North Carolina Line of Credit Promissory Note is a legal document that outlines the terms and conditions for borrowers who wish to obtain a line of credit within the Mecklenburg County region in the state of North Carolina. This note serves as a binding agreement between the borrower and the lender, providing a clear understanding of the rights and obligations of both parties. Keywords: Mecklenburg North Carolina, Line of Credit Promissory Note, legal document, borrowers, line of credit, terms and conditions, Mecklenburg County, North Carolina, binding agreement, borrower, lender, rights, obligations. There are different types of Mecklenburg North Carolina Line of Credit Promissory Notes designed to cater to various needs and preferences: 1. Unsecured Line of Credit Promissory Note: This type of note does not require any collateral from the borrower. The loan amount is agreed upon based on the borrower's creditworthiness and financial history. 2. Secured Line of Credit Promissory Note: Unlike the unsecured option, this note requires the borrower to provide collateral, such as property or assets, to secure the line of credit. In case of default, the lender has the right to seize the collateral to recover the outstanding debt. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to access a specific credit limit whenever needed. It gives the borrower flexibility to borrow and repay funds within the agreed terms, often with no fixed repayment schedule. 4. Installment Line of Credit Promissory Note: This note requires the borrower to make regular payments, typically on a monthly basis, towards the outstanding debt. The repayment period and amounts are predetermined, offering more structure and predictability. 5. Business Line of Credit Promissory Note: Tailored specifically for business owners, this note provides access to funds for various business needs, such as working capital, inventory purchases, or expansion. The terms and limits are based on the borrower's business financials and anticipated cash flow. The Mecklenburg North Carolina Line of Credit Promissory Note is a crucial legal document that protects both the borrower and the lender's rights. It clearly defines the obligations, repayment terms, interest rates, and any penalties or fees associated with the line of credit. It is essential for both parties to thoroughly read and understand the terms before entering into this agreement to ensure a smooth borrowing experience.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.