A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

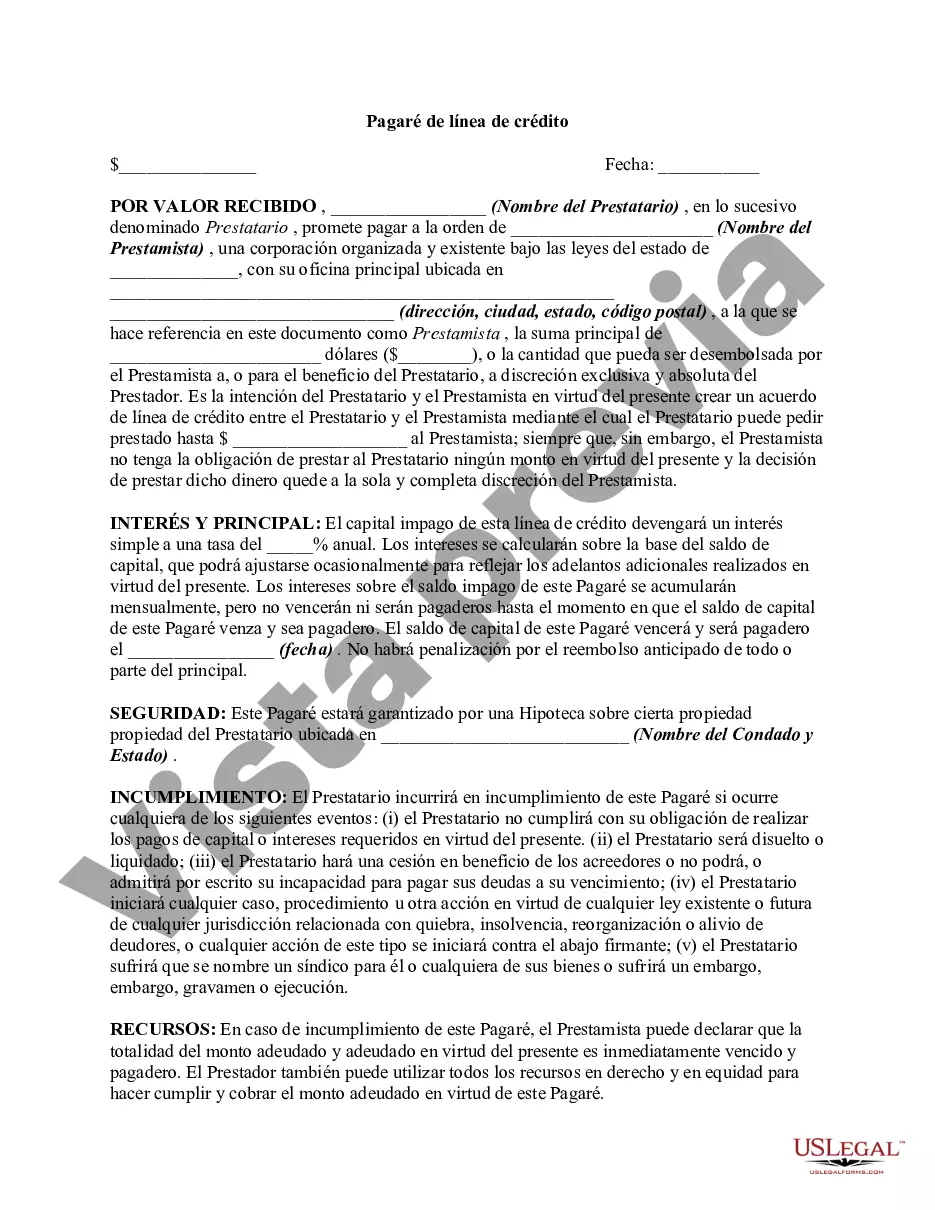

A Miami-Dade Florida Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a line of credit agreement between a borrower and a lender. This type of promissory note specifically applies to residents and businesses in Miami-Dade County, Florida. It serves as a binding contract between the parties involved, ensuring clarity and transparency regarding the line of credit arrangement. The Miami-Dade Florida Line of Credit Promissory Note includes essential information such as the names and contact details of the borrower and lender, the principal amount of credit, the interest rate, and any applicable fees or charges. It also outlines the repayment terms, including the due dates and frequency of payments, and any penalties for late or missed payments. Different types of Miami-Dade Florida Line of Credit Promissory Notes may vary based on specific characteristics or purposes. Here are a few examples: 1. Personal Line of Credit Promissory Note: This type of promissory note is designed for individuals seeking a line of credit for personal use, such as funding home renovations, education expenses, or unexpected bills. 2. Business Line of Credit Promissory Note: This promissory note caters to businesses operating in Miami-Dade County that require a line of credit for operational expenses, inventory management, or investment opportunities. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to access funds, repay them, and access them again within an agreed limit. It offers flexibility and convenience for ongoing credit needs. 4. Secured Line of Credit Promissory Note: This type of promissory note requires collateral, such as real estate, vehicles, or valuable assets, to secure the line of credit. It provides additional security for the lender and may offer more favorable terms for the borrower. When deciding to enter into a Miami-Dade Florida Line of Credit Promissory Note agreement, it is crucial for both parties to carefully review and understand the terms and conditions outlined in the document. Seeking legal and financial advice is advisable to ensure compliance with local laws and to protect the rights and interests of both the borrower and lender.A Miami-Dade Florida Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a line of credit agreement between a borrower and a lender. This type of promissory note specifically applies to residents and businesses in Miami-Dade County, Florida. It serves as a binding contract between the parties involved, ensuring clarity and transparency regarding the line of credit arrangement. The Miami-Dade Florida Line of Credit Promissory Note includes essential information such as the names and contact details of the borrower and lender, the principal amount of credit, the interest rate, and any applicable fees or charges. It also outlines the repayment terms, including the due dates and frequency of payments, and any penalties for late or missed payments. Different types of Miami-Dade Florida Line of Credit Promissory Notes may vary based on specific characteristics or purposes. Here are a few examples: 1. Personal Line of Credit Promissory Note: This type of promissory note is designed for individuals seeking a line of credit for personal use, such as funding home renovations, education expenses, or unexpected bills. 2. Business Line of Credit Promissory Note: This promissory note caters to businesses operating in Miami-Dade County that require a line of credit for operational expenses, inventory management, or investment opportunities. 3. Revolving Line of Credit Promissory Note: This note allows the borrower to access funds, repay them, and access them again within an agreed limit. It offers flexibility and convenience for ongoing credit needs. 4. Secured Line of Credit Promissory Note: This type of promissory note requires collateral, such as real estate, vehicles, or valuable assets, to secure the line of credit. It provides additional security for the lender and may offer more favorable terms for the borrower. When deciding to enter into a Miami-Dade Florida Line of Credit Promissory Note agreement, it is crucial for both parties to carefully review and understand the terms and conditions outlined in the document. Seeking legal and financial advice is advisable to ensure compliance with local laws and to protect the rights and interests of both the borrower and lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.