A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

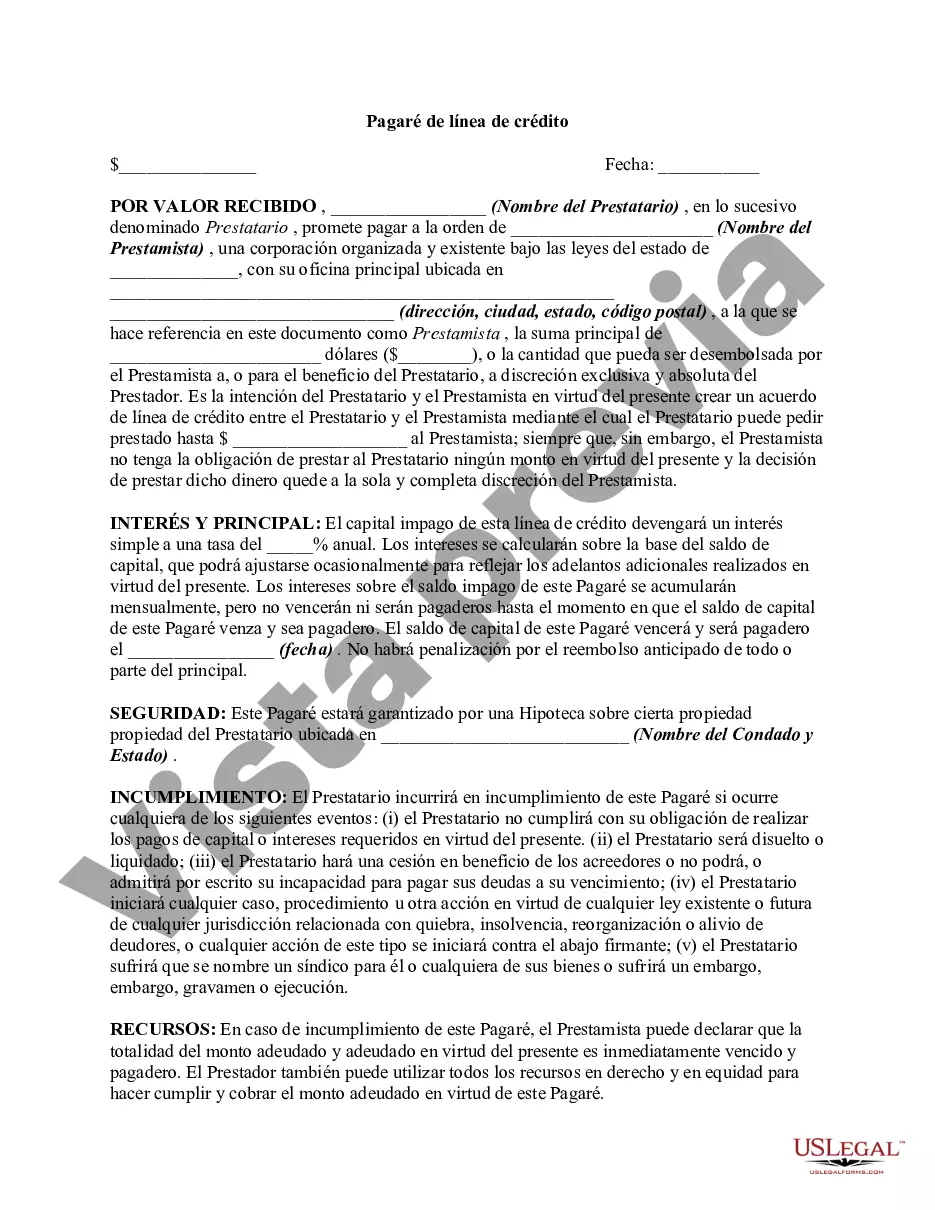

The Middlesex Massachusetts Line of Credit Promissory Note is a financial instrument that outlines the terms and conditions surrounding a line of credit provided by the Middlesex Massachusetts financial institution. It serves as a legally binding agreement between the borrower and the lender, establishing the borrower's obligation to repay the borrowed funds and the lender's rights and remedies in the event of non-payment. This promissory note is specifically tailored to line of credit arrangements, which differ from traditional loans in that they provide borrowers with a predetermined credit limit from which they can draw funds as needed. The borrower can access funds up to this predetermined limit, similar to a credit card, and is only required to pay interest on the amount actually borrowed. The Middlesex Massachusetts Line of Credit Promissory Note details various important components, including the borrower's and lender's information, the effective date of the agreement, the credit limit, interest rate, payment terms, and repayment period. It also outlines any specific conditions or requirements that the borrower must meet to maintain the line of credit. In addition to the standard Middlesex Massachusetts Line of Credit Promissory Note, there may be different types of notes offered by the financial institution to cater to specific needs or circumstances. Some possible variations could include: 1. Business Line of Credit Promissory Note: Designed specifically for businesses, this type of note might include additional clauses relating to the borrower's business activities, financial statements, and other relevant business-specific considerations. 2. Personal Line of Credit Promissory Note: This note is geared towards individual borrowers seeking a line of credit for personal use, such as home renovations, education expenses, or emergencies. 3. Home Equity Line of Credit Promissory Note: This type of promissory note pertains to a line of credit secured by the borrower's home equity, typically used for major expenses like home improvements or debt consolidation. 4. Revolving Line of Credit Promissory Note: A revolving line of credit note differs from a traditional line of credit in that it allows the borrower to continuously draw funds up to the credit limit as long as they repay the existing balances within specified terms. It is important for borrowers to carefully review and understand the terms outlined in the Middlesex Massachusetts Line of Credit Promissory Note before signing, ensuring compliance with all obligations and avoiding any potential legal issues. Consulting with a financial advisor or legal professional can provide further guidance in understanding the specifics of this financial agreement.The Middlesex Massachusetts Line of Credit Promissory Note is a financial instrument that outlines the terms and conditions surrounding a line of credit provided by the Middlesex Massachusetts financial institution. It serves as a legally binding agreement between the borrower and the lender, establishing the borrower's obligation to repay the borrowed funds and the lender's rights and remedies in the event of non-payment. This promissory note is specifically tailored to line of credit arrangements, which differ from traditional loans in that they provide borrowers with a predetermined credit limit from which they can draw funds as needed. The borrower can access funds up to this predetermined limit, similar to a credit card, and is only required to pay interest on the amount actually borrowed. The Middlesex Massachusetts Line of Credit Promissory Note details various important components, including the borrower's and lender's information, the effective date of the agreement, the credit limit, interest rate, payment terms, and repayment period. It also outlines any specific conditions or requirements that the borrower must meet to maintain the line of credit. In addition to the standard Middlesex Massachusetts Line of Credit Promissory Note, there may be different types of notes offered by the financial institution to cater to specific needs or circumstances. Some possible variations could include: 1. Business Line of Credit Promissory Note: Designed specifically for businesses, this type of note might include additional clauses relating to the borrower's business activities, financial statements, and other relevant business-specific considerations. 2. Personal Line of Credit Promissory Note: This note is geared towards individual borrowers seeking a line of credit for personal use, such as home renovations, education expenses, or emergencies. 3. Home Equity Line of Credit Promissory Note: This type of promissory note pertains to a line of credit secured by the borrower's home equity, typically used for major expenses like home improvements or debt consolidation. 4. Revolving Line of Credit Promissory Note: A revolving line of credit note differs from a traditional line of credit in that it allows the borrower to continuously draw funds up to the credit limit as long as they repay the existing balances within specified terms. It is important for borrowers to carefully review and understand the terms outlined in the Middlesex Massachusetts Line of Credit Promissory Note before signing, ensuring compliance with all obligations and avoiding any potential legal issues. Consulting with a financial advisor or legal professional can provide further guidance in understanding the specifics of this financial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.