A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

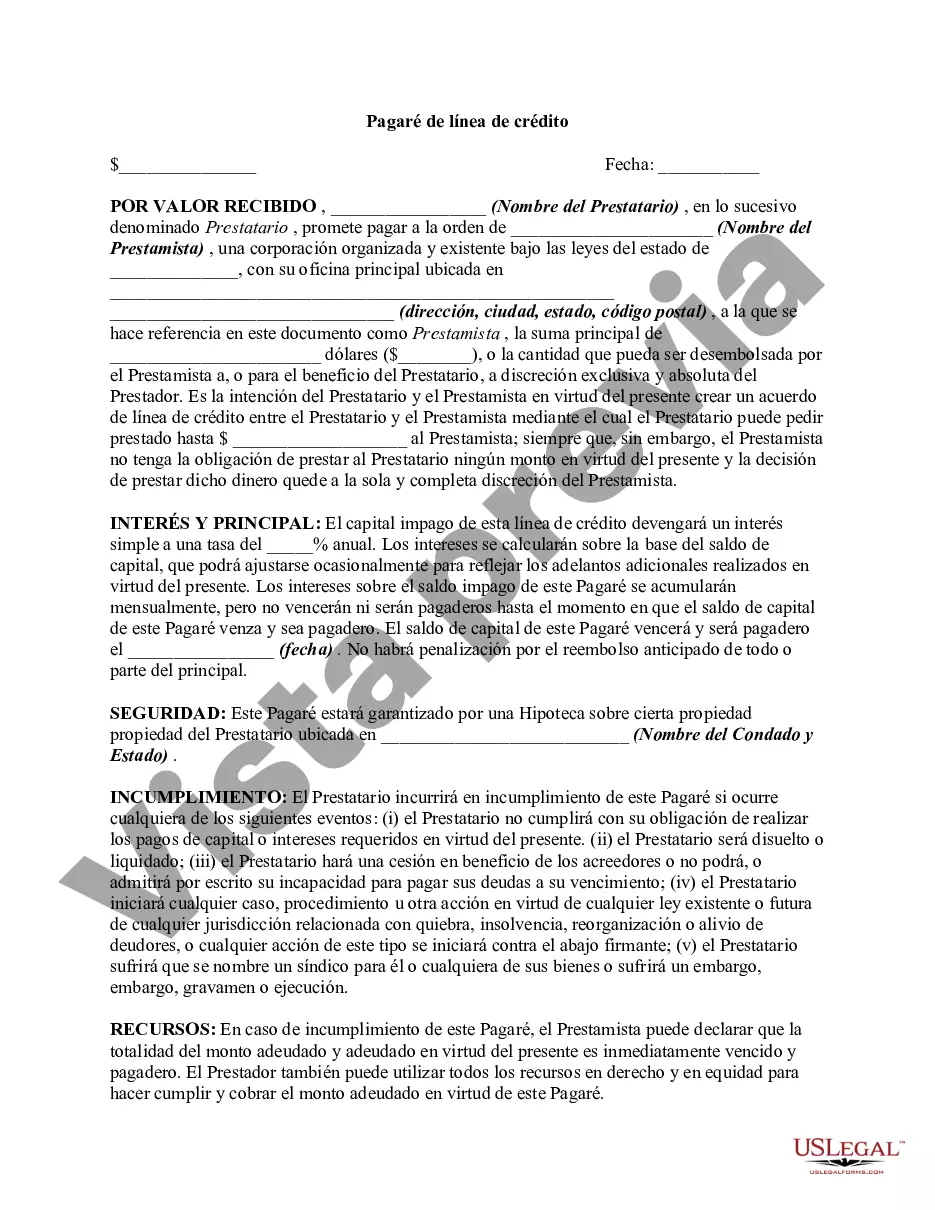

A Nassau New York Line of Credit Promissory Note is a legal document used for borrowing money from a lender. It serves as an agreement between the borrower and the lender, outlining the terms and conditions of the loan. This type of promissory note is specifically designed for individuals or businesses located in Nassau County, New York, seeking a line of credit. A line of credit promissory note offers borrowers the flexibility to access funds up to a predetermined limit whenever needed, similar to a credit card. This type of loan is often preferred by individuals or businesses with fluctuating cash flow needs. The Nassau New York Line of Credit Promissory Note outlines specific details such as interest rates, repayment terms, and collateral requirements, if any. There are several types of Nassau New York Line of Credit Promissory Notes available, depending on the specific requirements and preferences of the borrower and lender. Some common types include: 1. Secured Line of Credit Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate, inventory, or equipment, to secure the line of credit. If the borrower fails to repay the loan as agreed, the lender has the right to seize the collateral to recover their funds. 2. Unsecured Line of Credit Promissory Note: Unlike the secured version, this type of promissory note does not require collateral. It is mainly based on the borrower's creditworthiness and financial history. However, unsecured loans often come with higher interest rates to compensate for the increased risk for lenders. 3. Revolving Line of Credit Promissory Note: This type of promissory note allows borrowers to access funds repeatedly as long as they remain within the approved credit limit. Once the borrower repays the borrowed amount, the credit becomes available for future use again. This type of note is beneficial for businesses that experience fluctuating cash cycles. 4. Commercial Line of Credit Promissory Note: Designed specifically for businesses, this note provides a revolving line of credit for operational expenses, inventory purchases, or other business needs. It usually includes additional provisions related to the borrower's business activities and requirements. When considering a Nassau New York Line of Credit Promissory Note, borrowers should carefully review the terms and conditions outlined in the document, including interest rates, repayment schedules, any penalties for early repayment or late payments, and the consequences of defaulting on the loan. It is advisable to consult with legal professionals specializing in financial matters to ensure full comprehension and adherence to the terms of the promissory note.A Nassau New York Line of Credit Promissory Note is a legal document used for borrowing money from a lender. It serves as an agreement between the borrower and the lender, outlining the terms and conditions of the loan. This type of promissory note is specifically designed for individuals or businesses located in Nassau County, New York, seeking a line of credit. A line of credit promissory note offers borrowers the flexibility to access funds up to a predetermined limit whenever needed, similar to a credit card. This type of loan is often preferred by individuals or businesses with fluctuating cash flow needs. The Nassau New York Line of Credit Promissory Note outlines specific details such as interest rates, repayment terms, and collateral requirements, if any. There are several types of Nassau New York Line of Credit Promissory Notes available, depending on the specific requirements and preferences of the borrower and lender. Some common types include: 1. Secured Line of Credit Promissory Note: This type of promissory note requires the borrower to provide collateral, such as real estate, inventory, or equipment, to secure the line of credit. If the borrower fails to repay the loan as agreed, the lender has the right to seize the collateral to recover their funds. 2. Unsecured Line of Credit Promissory Note: Unlike the secured version, this type of promissory note does not require collateral. It is mainly based on the borrower's creditworthiness and financial history. However, unsecured loans often come with higher interest rates to compensate for the increased risk for lenders. 3. Revolving Line of Credit Promissory Note: This type of promissory note allows borrowers to access funds repeatedly as long as they remain within the approved credit limit. Once the borrower repays the borrowed amount, the credit becomes available for future use again. This type of note is beneficial for businesses that experience fluctuating cash cycles. 4. Commercial Line of Credit Promissory Note: Designed specifically for businesses, this note provides a revolving line of credit for operational expenses, inventory purchases, or other business needs. It usually includes additional provisions related to the borrower's business activities and requirements. When considering a Nassau New York Line of Credit Promissory Note, borrowers should carefully review the terms and conditions outlined in the document, including interest rates, repayment schedules, any penalties for early repayment or late payments, and the consequences of defaulting on the loan. It is advisable to consult with legal professionals specializing in financial matters to ensure full comprehension and adherence to the terms of the promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.