A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

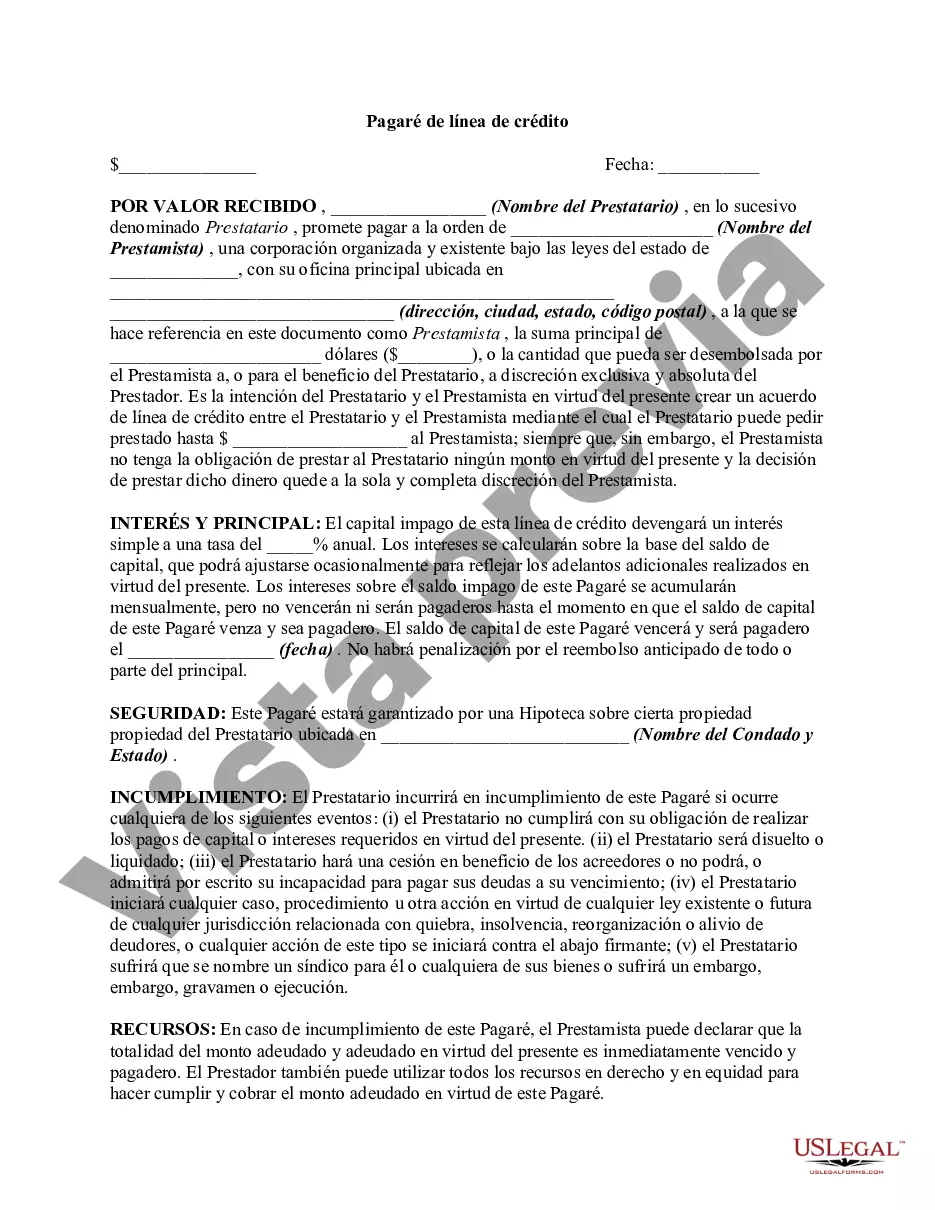

A San Diego California Line of Credit Promissory Note is a legal document that outlines the terms and conditions under which a borrower can access a line of credit in San Diego, California. This type of promissory note is used when a borrower wants to have the flexibility of drawing funds from a predefined credit limit as per their financial needs. The Line of Credit Promissory Note typically includes crucial information such as the borrower's and lender's details, the principal amount of the credit line, the interest rate, repayment terms, and any fees or penalties applicable. This document serves as a contractual agreement between the borrower and lender regarding the use and repayment of the line of credit. San Diego, being a vibrant city in California, has several types of Line of Credit Promissory Notes available to cater to varying requirements. Some common types include: 1. Personal Line of Credit Promissory Note: This type of note is utilized by individuals for personal financial needs, such as home renovations, education expenses, or medical bills. It provides a pre-approved credit limit that the borrower can access as necessary. 2. Business Line of Credit Promissory Note: Businesses in San Diego often require access to working capital, which can be obtained through a business line of credit. This note allows businesses to draw funds for operations, inventory purchase, or investment opportunities, providing much-needed flexibility. 3. Home Equity Line of Credit Promissory Note: Homeowners in San Diego can utilize the equity built in their property to secure a line of credit. This type of promissory note allows homeowners to borrow against the appraised value of their homes for various purposes, such as home improvements or debt consolidation. 4. Secured Line of Credit Promissory Note: Sometimes, lenders may require collateral to mitigate their risk while extending a line of credit. This type of note involves pledging assets, such as a vehicle or real estate, as security against the borrowed amount. It is important for both borrowers and lenders in San Diego to understand the specific terms and conditions associated with the chosen Line of Credit Promissory Note. Seeking professional legal advice is advisable to ensure compliance with local laws and regulations.A San Diego California Line of Credit Promissory Note is a legal document that outlines the terms and conditions under which a borrower can access a line of credit in San Diego, California. This type of promissory note is used when a borrower wants to have the flexibility of drawing funds from a predefined credit limit as per their financial needs. The Line of Credit Promissory Note typically includes crucial information such as the borrower's and lender's details, the principal amount of the credit line, the interest rate, repayment terms, and any fees or penalties applicable. This document serves as a contractual agreement between the borrower and lender regarding the use and repayment of the line of credit. San Diego, being a vibrant city in California, has several types of Line of Credit Promissory Notes available to cater to varying requirements. Some common types include: 1. Personal Line of Credit Promissory Note: This type of note is utilized by individuals for personal financial needs, such as home renovations, education expenses, or medical bills. It provides a pre-approved credit limit that the borrower can access as necessary. 2. Business Line of Credit Promissory Note: Businesses in San Diego often require access to working capital, which can be obtained through a business line of credit. This note allows businesses to draw funds for operations, inventory purchase, or investment opportunities, providing much-needed flexibility. 3. Home Equity Line of Credit Promissory Note: Homeowners in San Diego can utilize the equity built in their property to secure a line of credit. This type of promissory note allows homeowners to borrow against the appraised value of their homes for various purposes, such as home improvements or debt consolidation. 4. Secured Line of Credit Promissory Note: Sometimes, lenders may require collateral to mitigate their risk while extending a line of credit. This type of note involves pledging assets, such as a vehicle or real estate, as security against the borrowed amount. It is important for both borrowers and lenders in San Diego to understand the specific terms and conditions associated with the chosen Line of Credit Promissory Note. Seeking professional legal advice is advisable to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.