A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

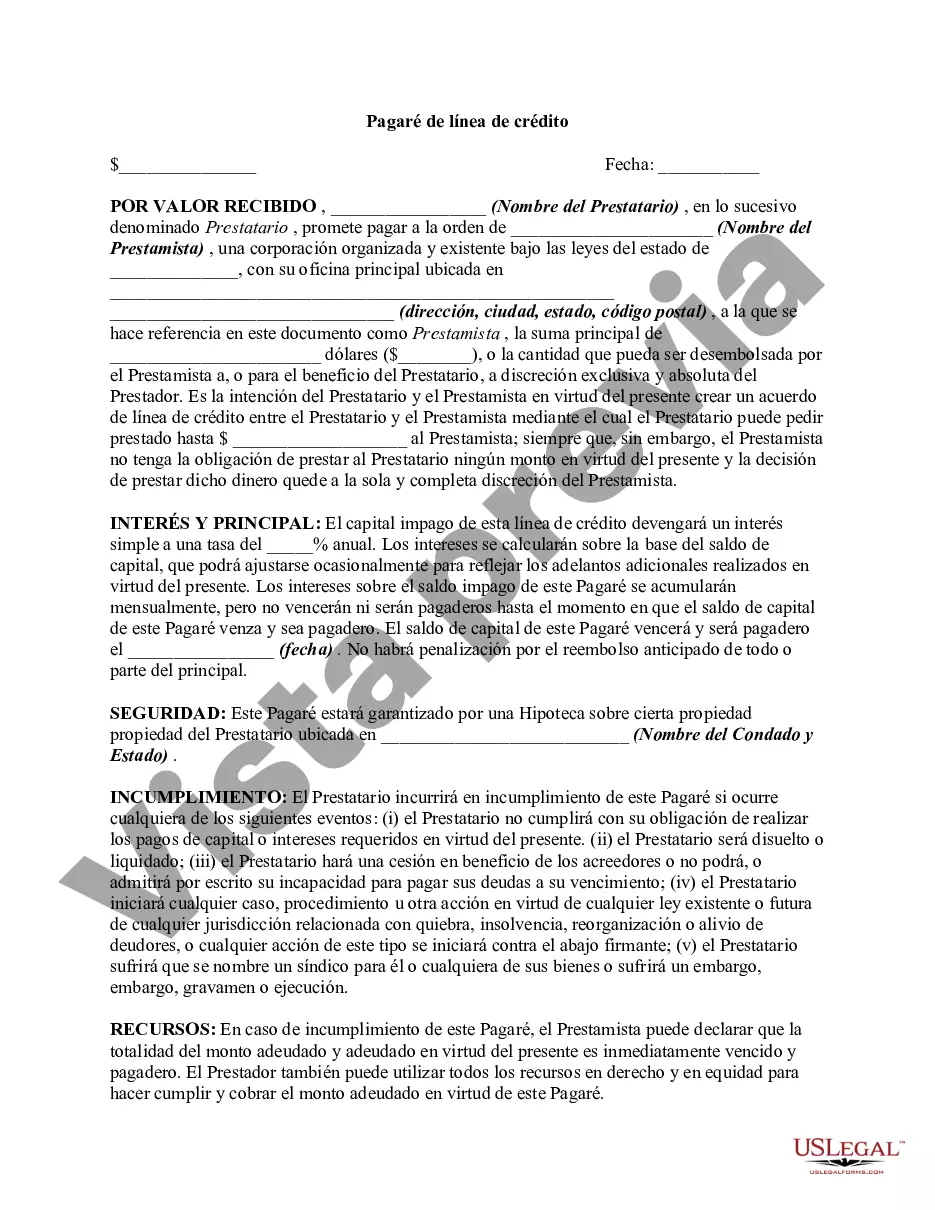

A Tarrant Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions regarding a line of credit extended to a borrower in Tarrant County, Texas. This financial instrument serves as evidence of the borrower's promise to repay the borrowed funds according to the established terms. The Tarrant Texas Line of Credit Promissory Note typically includes the following key elements: 1. Parties Involved: It identifies the involved parties, namely the borrower (also known as the mayor) and the lender (also known as the payee). Their legal names, addresses, and contact information are clearly stated in the document. 2. Loan Details: This section outlines the specific details related to the line of credit. It includes the initial credit limit, the available credit amount, the interest rate applied to the outstanding balance, and any additional fees or charges applicable (such as late payment fees or annual renewal fees). 3. Repayment Terms: The promissory note specifies the repayment terms agreed upon between the borrower and the lender. This includes the payment frequency (monthly, quarterly, or as otherwise agreed), the due date of each payment, any grace periods allowed, and how the payments should be made (by check, electronic transfer, etc.). 4. Interest Calculation: If interest is charged on the outstanding balance, the promissory note delineates the method used to calculate interest (e.g., simple interest or compound interest) and whether the rate is fixed or variable. 5. Events of Default: This section outlines the conditions or events that would be considered default by the borrower. It typically includes non-payment or late payment for a specified number of installment periods, bankruptcy, or breach of any other terms of the agreement. The note then describes the consequences of default, such as the lender's ability to accelerate the balance, charge additional fees, or pursue legal action. 6. Governing Law: The Tarrant Texas Line of Credit Promissory Note specifies the governing law that will apply to the interpretation and enforcement of the document. In this case, it would be the laws of the state of Texas and specifically Tarrant County. 7. Secured or Unsecured: Depending on the circumstances, this note can be either secured or unsecured. If secured, it would detail the collateral pledged as security for the credit line. If unsecured, it would explicitly state that the note is not secured by any specific assets. Types of Tarrant Texas Line of Credit Promissory Notes: — Revolving Line of Credit Promissory Note: This type of note allows the borrower to withdraw, repay, and redraw funds as needed within the credit limit. — Non-Revolving Line of Credit Promissory Note: Unlike the revolving line of credit, this note provides a one-time disbursement of funds up to the agreed credit limit. Once repaid, the amount cannot be borrowed again. Overall, a Tarrant Texas Line of Credit Promissory Note is a legally binding agreement that protects the rights and obligations of both borrowers and lenders in Tarrant County, Texas, providing clear terms for the extension and repayment of a line of credit.A Tarrant Texas Line of Credit Promissory Note is a legal document that outlines the terms and conditions regarding a line of credit extended to a borrower in Tarrant County, Texas. This financial instrument serves as evidence of the borrower's promise to repay the borrowed funds according to the established terms. The Tarrant Texas Line of Credit Promissory Note typically includes the following key elements: 1. Parties Involved: It identifies the involved parties, namely the borrower (also known as the mayor) and the lender (also known as the payee). Their legal names, addresses, and contact information are clearly stated in the document. 2. Loan Details: This section outlines the specific details related to the line of credit. It includes the initial credit limit, the available credit amount, the interest rate applied to the outstanding balance, and any additional fees or charges applicable (such as late payment fees or annual renewal fees). 3. Repayment Terms: The promissory note specifies the repayment terms agreed upon between the borrower and the lender. This includes the payment frequency (monthly, quarterly, or as otherwise agreed), the due date of each payment, any grace periods allowed, and how the payments should be made (by check, electronic transfer, etc.). 4. Interest Calculation: If interest is charged on the outstanding balance, the promissory note delineates the method used to calculate interest (e.g., simple interest or compound interest) and whether the rate is fixed or variable. 5. Events of Default: This section outlines the conditions or events that would be considered default by the borrower. It typically includes non-payment or late payment for a specified number of installment periods, bankruptcy, or breach of any other terms of the agreement. The note then describes the consequences of default, such as the lender's ability to accelerate the balance, charge additional fees, or pursue legal action. 6. Governing Law: The Tarrant Texas Line of Credit Promissory Note specifies the governing law that will apply to the interpretation and enforcement of the document. In this case, it would be the laws of the state of Texas and specifically Tarrant County. 7. Secured or Unsecured: Depending on the circumstances, this note can be either secured or unsecured. If secured, it would detail the collateral pledged as security for the credit line. If unsecured, it would explicitly state that the note is not secured by any specific assets. Types of Tarrant Texas Line of Credit Promissory Notes: — Revolving Line of Credit Promissory Note: This type of note allows the borrower to withdraw, repay, and redraw funds as needed within the credit limit. — Non-Revolving Line of Credit Promissory Note: Unlike the revolving line of credit, this note provides a one-time disbursement of funds up to the agreed credit limit. Once repaid, the amount cannot be borrowed again. Overall, a Tarrant Texas Line of Credit Promissory Note is a legally binding agreement that protects the rights and obligations of both borrowers and lenders in Tarrant County, Texas, providing clear terms for the extension and repayment of a line of credit.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.