A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

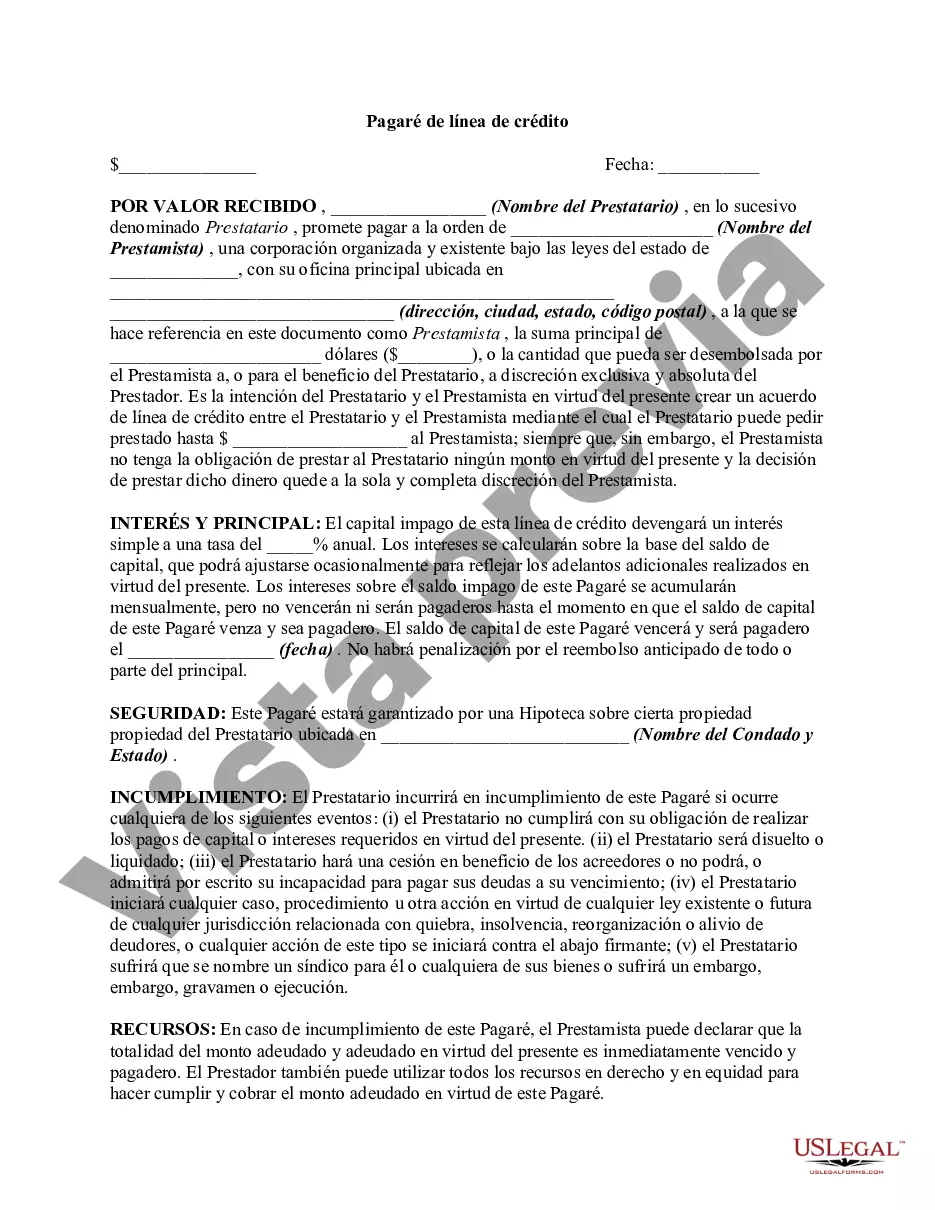

The Wayne Michigan Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a borrower and a lender in Wayne, Michigan. It serves as a promissory note, which means the borrower promises to repay the borrowed amount along with any accrued interest within a specified time frame. This particular type of promissory note is designed to facilitate a line of credit arrangement in Wayne, Michigan. A line of credit is a flexible form of borrowing that allows the borrower to access funds as needed, up to a predetermined limit. It offers a convenient financial solution for both individuals and businesses in Wayne, Michigan, providing a readily available source of funds for various purposes, such as paying for unexpected expenses, managing cash flow, or funding investments. The Wayne Michigan Line of Credit Promissory Note typically includes crucial details such as the names and contact information of both the borrower and the lender, the principal amount being borrowed, the interest rate, payment terms, and any additional fees or charges. It also specifies the repayment schedule, stating when and how the borrower will make the scheduled payments. Different types of Wayne Michigan Line of Credit Promissory Notes may exist based on specific variations related to interest rates, repayment terms, or collateral requirements. For example, there could be fixed-rate line of credit promissory notes where the interest rate remains constant throughout the borrowing period. Conversely, there may be adjustable-rate line of credit promissory notes where the interest rate fluctuates based on changes in the market conditions. Furthermore, secured line of credit promissory notes may demand collateral, such as real estate, to secure the loan, while unsecured notes do not require such assets. It is essential for borrowers and lenders in Wayne, Michigan, to carefully review and understand the terms and conditions of the Line of Credit Promissory Note before entering into an agreement. Seeking legal advice or consulting with a financial professional can ensure that all parties involved are aware of their rights, responsibilities, and potential risks associated with the line of credit. Compliance with applicable laws and regulations related to lending in Wayne, Michigan, is crucial for both parties to protect their interests and maintain a mutually beneficial relationship.The Wayne Michigan Line of Credit Promissory Note is a legally binding document that outlines the terms and conditions of a line of credit agreement between a borrower and a lender in Wayne, Michigan. It serves as a promissory note, which means the borrower promises to repay the borrowed amount along with any accrued interest within a specified time frame. This particular type of promissory note is designed to facilitate a line of credit arrangement in Wayne, Michigan. A line of credit is a flexible form of borrowing that allows the borrower to access funds as needed, up to a predetermined limit. It offers a convenient financial solution for both individuals and businesses in Wayne, Michigan, providing a readily available source of funds for various purposes, such as paying for unexpected expenses, managing cash flow, or funding investments. The Wayne Michigan Line of Credit Promissory Note typically includes crucial details such as the names and contact information of both the borrower and the lender, the principal amount being borrowed, the interest rate, payment terms, and any additional fees or charges. It also specifies the repayment schedule, stating when and how the borrower will make the scheduled payments. Different types of Wayne Michigan Line of Credit Promissory Notes may exist based on specific variations related to interest rates, repayment terms, or collateral requirements. For example, there could be fixed-rate line of credit promissory notes where the interest rate remains constant throughout the borrowing period. Conversely, there may be adjustable-rate line of credit promissory notes where the interest rate fluctuates based on changes in the market conditions. Furthermore, secured line of credit promissory notes may demand collateral, such as real estate, to secure the loan, while unsecured notes do not require such assets. It is essential for borrowers and lenders in Wayne, Michigan, to carefully review and understand the terms and conditions of the Line of Credit Promissory Note before entering into an agreement. Seeking legal advice or consulting with a financial professional can ensure that all parties involved are aware of their rights, responsibilities, and potential risks associated with the line of credit. Compliance with applicable laws and regulations related to lending in Wayne, Michigan, is crucial for both parties to protect their interests and maintain a mutually beneficial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.