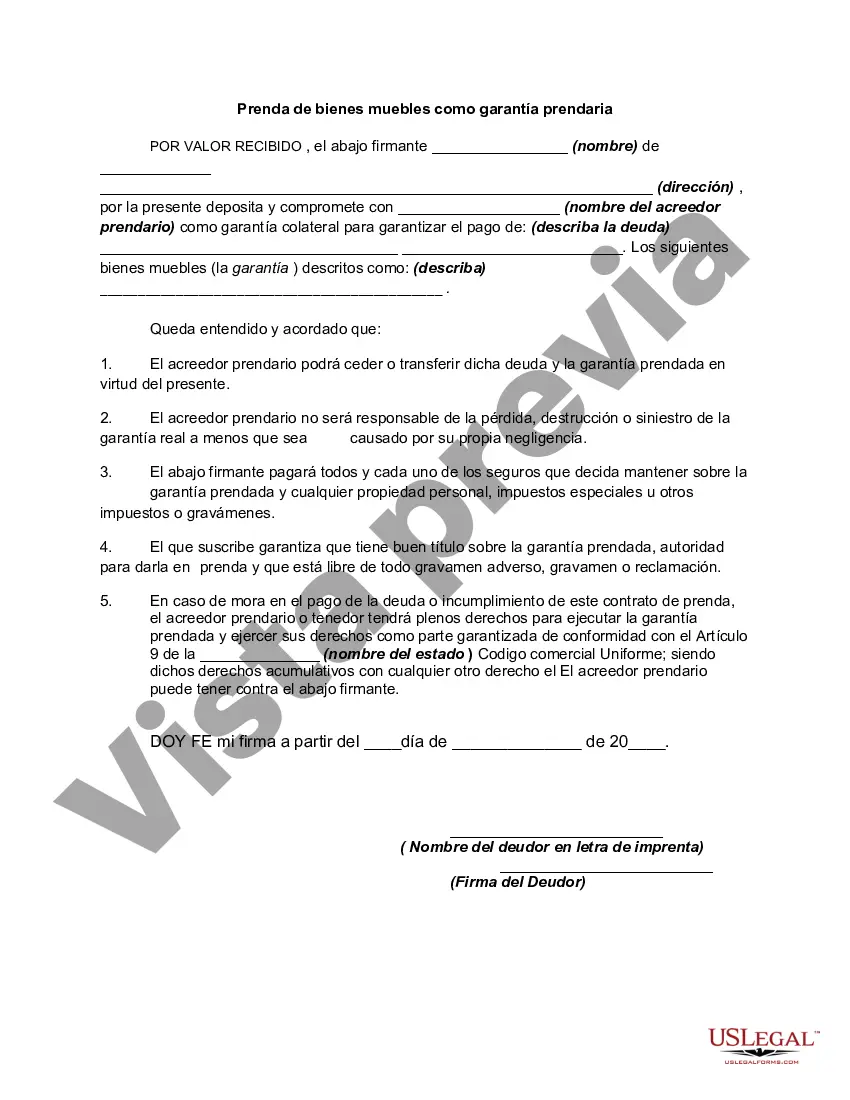

The Broward Florida Pledge of Personal Property as Collateral Security is a legal agreement that is often used in financial transactions to secure loans with movable or personal property. This pledge serves as a way for borrowers to offer an assurance to lenders that they will repay their debts by pledging their personal property as collateral. Under this agreement, the borrower transfers ownership of certain personal property assets to the lender as collateral to secure the loan. This ensures that if the borrower defaults on the loan, the lender has the right to take possession of the pledged property and sell it to recover the outstanding debt. There are different types of Broward Florida Pledge of Personal Property as Collateral Security that borrowers and lenders can agree upon depending on the nature and value of the property being pledged. These may include: 1. Tangible Personal Property: This type of collateral includes physical assets such as vehicles, machinery, equipment, inventory, or other valuable personal property that can be easily assessed and evaluated. 2. Intangible Personal Property: This refers to assets that hold value without having a physical presence. Examples include patents, copyrights, trademarks, shares of stock, and intellectual property rights. These assets require a more meticulous evaluation process to determine their value and liquidation potential. 3. Accounts Receivable: Borrowers can also pledge their outstanding accounts receivable as collateral security. This refers to the money owed to the borrower by its customers or clients. Lenders may permit borrowers to pledge their accounts receivable to increase the collateral if they are confident about the borrower's ability to collect these funds. 4. Securities: Borrowers can pledge financial instruments such as stocks, bonds, mutual funds, or other securities as collateral security. These can provide lenders with an additional layer of security as they hold intrinsic value and can be readily sold in the stock market if the borrower defaults. The Broward Florida Pledge of Personal Property as Collateral Security is crucial in protecting the interests of lenders and mitigating their risk exposure. It provides a legal framework for borrowers and lenders to secure loans with personal property, ensuring the lender has a claim on specific assets in case of default. This agreement allows lenders to have a measure of security, which ultimately facilitates the availability of credit to individuals and businesses in the Broward County, Florida area.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Broward Florida Prenda De Bienes Muebles Como Garantía Prendaria?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Broward Pledge of Personal Property as Collateral Security, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the recent version of the Broward Pledge of Personal Property as Collateral Security, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Broward Pledge of Personal Property as Collateral Security:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Broward Pledge of Personal Property as Collateral Security and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!