The Contra Costa California Pledge of Personal Property as Collateral Security refers to a legal agreement in which a borrower pledges their personal property as collateral to secure a loan or debt. This agreement protects the lender's interests by allowing them to seize and liquidate the pledged property in the event of default. It is crucial to understand the terms and implications of this pledge before entering into such an agreement. In Contra Costa California, there are primarily two different types of Pledge of Personal Property as Collateral Security: 1. Traditional Pledge Agreement: This is the most common type where a borrower pledges their personal property, such as vehicles, jewelry, electronics, or other valuable assets, to secure a loan or debt. The lender holds a security interest in the pledged property until the borrower fulfills their obligations. In case of default, the lender can seize and sell the pledged property to recover the unpaid debt. 2. Intellectual Property Pledge Agreement: This type of pledge agreement involves the use of intellectual property rights, such as patents, copyrights, or trademarks, as collateral security. It is commonly utilized by businesses or individuals who possess valuable intellectual property assets. The borrower grants the lender a security interest in their intellectual property, allowing the lender to exercise control or sell these rights in case of loan default. When entering into a Contra Costa California Pledge of Personal Property as Collateral Security, it is essential to consider the following key aspects: 1. Identification of the Pledged Property: The agreement must clearly identify the personal property being pledged to prevent any ambiguity or confusion. 2. Comprehensive Description: The document should provide a detailed description of the condition, value, and location of the pledged property to offer a clear understanding to the lender. 3. Right to Inspect: The lender may include a provision in the agreement allowing them to inspect the pledged property periodically to ensure its value and condition are maintained. 4. Default and Remedies: The agreement should outline the specific events that constitute default and the subsequent actions the lender can take, such as repossession or sale of the collateral. 5. Priority of Liens: If the borrower has other liens or encumbrances against the pledged property, the agreement should address the priority of the lender's security interest. 6. Release and Collateral Disposition: The document should mention the circumstances under which the lender agrees to release the pledged property upon complete repayment or other agreed-upon conditions. 7. Legal Implications: Both parties must understand the legal implications of the pledge agreement, including any consequences of non-compliance. By understanding the different types and key considerations of a Contra Costa California Pledge of Personal Property as Collateral Security, borrowers and lenders can enter into agreements that protect their respective interests effectively. It is advisable to consult legal professionals to ensure all the necessary legal requirements are addressed and to provide counsel throughout the entire process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Contra Costa California Prenda De Bienes Muebles Como Garantía Prendaria?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Contra Costa Pledge of Personal Property as Collateral Security, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any tasks related to document execution straightforward.

Here's how to locate and download Contra Costa Pledge of Personal Property as Collateral Security.

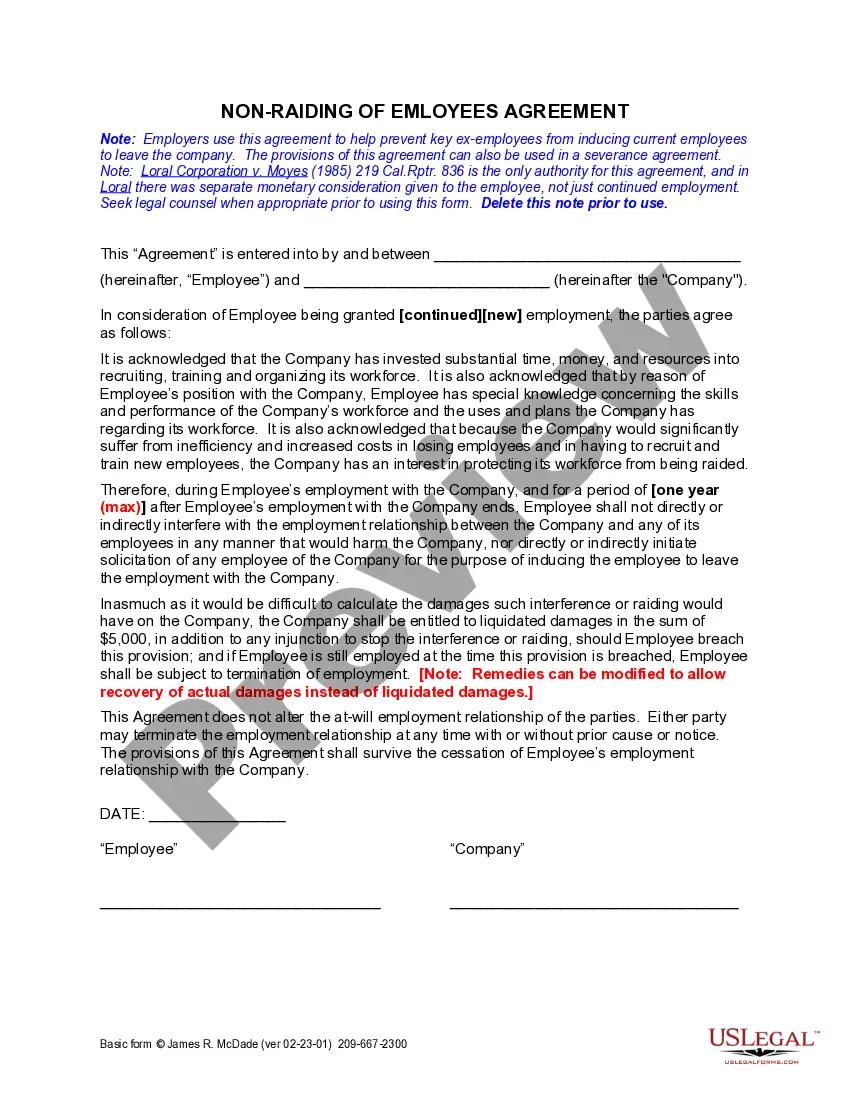

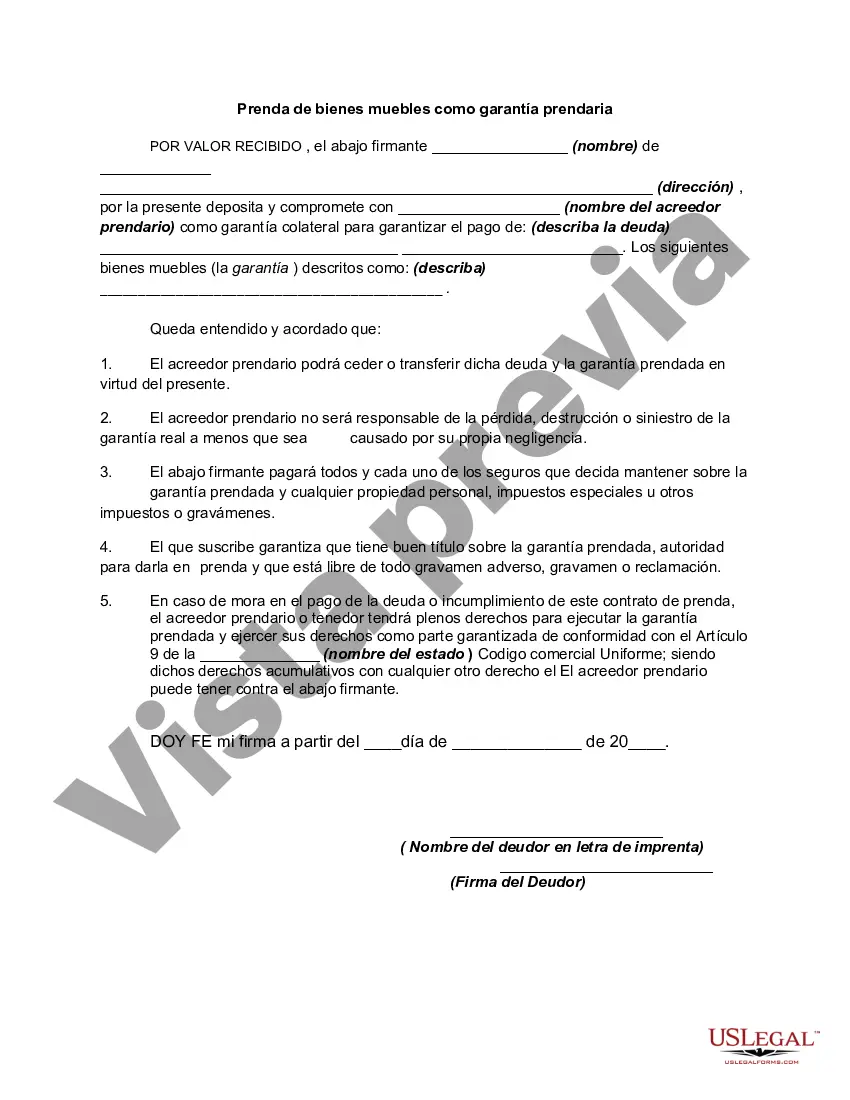

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Contra Costa Pledge of Personal Property as Collateral Security.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Contra Costa Pledge of Personal Property as Collateral Security, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to cope with an extremely complicated situation, we recommend using the services of an attorney to review your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!