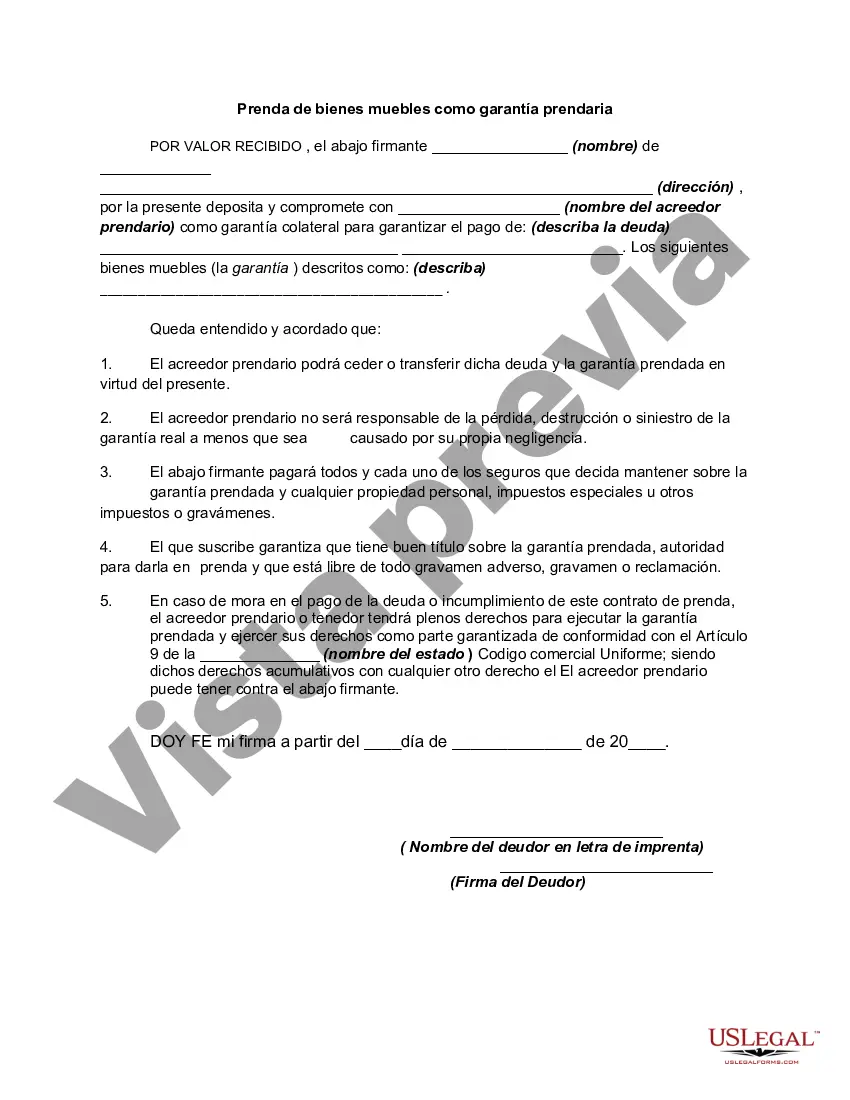

The Fairfax Virginia Pledge of Personal Property as Collateral Security is a legal agreement that allows individuals or businesses to use their personal property as a form of collateral in securing a loan or credit. This type of security agreement is commonly used in various financial transactions, such as obtaining a mortgage, car loan, or business loan. Personal property refers to movable possessions, including but not limited to vehicles, machinery, equipment, inventory, securities, accounts receivable, and even intellectual property rights. By pledging their personal property as collateral, borrowers provide lenders with a form of guarantee that if they fail to repay the loan or meet their financial obligations, the lender can seize and sell the pledged property to recover the debt. The Fairfax Virginia Pledge of Personal Property as Collateral Security provides a legal framework for this arrangement, outlining the terms and conditions under which the collateral can be used, sold, or transferred. It also establishes the rights and responsibilities of both the borrower (pledge) and lender (pledge). Important elements typically included in the agreement are a detailed description of the pledged property, its estimated value, and any specific restrictions on its use or transfer. The agreement may also outline the consequences of default, including the lender's rights to possession, repossession, and sale of the collateral. Different types of Fairfax Virginia Pledge of Personal Property as Collateral Security may include: 1. Chattel Mortgage: This type of collateral security involves the transfer of ownership of movable property to the lender until the loan is fully repaid. Once the debt is satisfied, ownership of the pledged property is returned to the borrower. 2. Floating Lien: In this case, a borrower pledges a revolving pool of personal property as collateral, such as inventory, accounts receivable, or equipment. As the borrower's assets fluctuate, the collateral for the loan may change, allowing the borrower to use and sell assets within certain agreed-upon limits. 3. UCC (Uniform Commercial Code) Financing Statement: This type of pledge relies on the establishment of a public record. The borrower files a financing statement with the appropriate government agency, disclosing the details of the pledged property. This serves as public notice to other creditors that the lender has a security interest in the designated property. In summary, the Fairfax Virginia Pledge of Personal Property as Collateral Security is a legally binding agreement that provides a framework for borrowers to offer their personal property as security for loans or credit. By pledging collateral, borrowers can secure financing while allowing lenders to have recourse in the event of default. Different types of collateral security, such as chattel mortgages, floating liens, and UCC financing statements, accommodate various lending scenarios and preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Fairfax Virginia Prenda De Bienes Muebles Como Garantía Prendaria?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life scenario, finding a Fairfax Pledge of Personal Property as Collateral Security suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Fairfax Pledge of Personal Property as Collateral Security, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Fairfax Pledge of Personal Property as Collateral Security:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Pledge of Personal Property as Collateral Security.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!