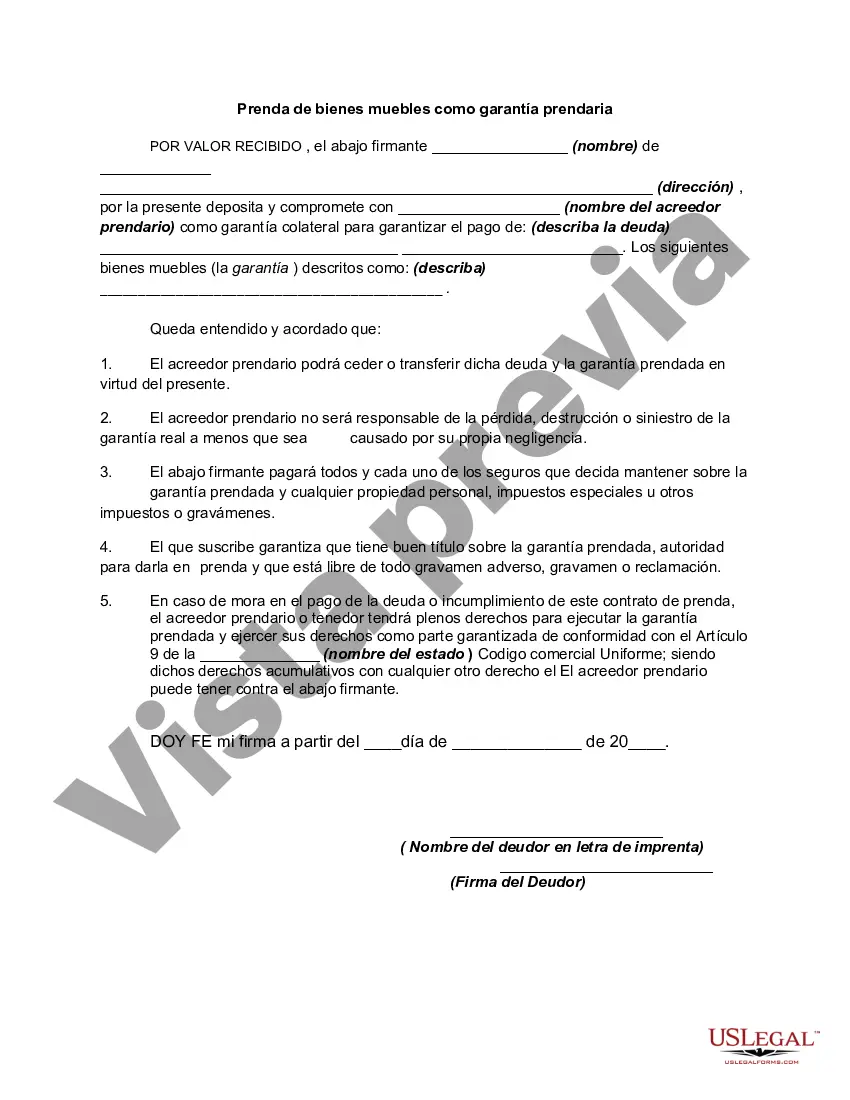

Keywords: Franklin Ohio, pledge of personal property, collateral security, detailed description, types Description: The Franklin Ohio Pledge of Personal Property as Collateral Security is a legal mechanism that allows individuals or businesses to secure a loan by pledging their personal property as collateral. This provides lenders with added assurance of repayment, reducing the risk associated with extending credit. One of the main types of the Franklin Ohio Pledge of Personal Property as Collateral Security is the chattel mortgage. This type of pledge involves the transfer of ownership rights to the lender while the borrower retains possession and use of the property. In the event of default, the lender can seize and sell the property to recover the outstanding debt. Another variation is the security agreement, which is a contractual arrangement between the borrower and the lender. This agreement specifies the details of the pledged property, such as its description, value, and any restrictions on its use. It also outlines the borrower's obligations and the consequences of default. The Franklin Ohio Pledge of Personal Property as Collateral Security covers a wide range of assets that can be pledged, including but not limited to vehicles, machinery, equipment, inventory, and accounts receivable. However, it is essential to note that certain types of property may be excluded, such as real estate or intangible assets like patents or trademarks. When executing a Franklin Ohio Pledge of Personal Property as Collateral Security, it is crucial to follow the proper legal procedures. This typically involves creating a written agreement, properly identifying the collateral, and filing relevant documents with the appropriate authorities. Working with legal professionals experienced in collateral security transactions is recommended to ensure compliance with all applicable laws and regulations. In conclusion, the Franklin Ohio Pledge of Personal Property as Collateral Security provides borrowers with access to financing while offering lenders a means to mitigate risk. By pledging personal property, individuals and businesses can obtain loans with more favorable terms and interest rates. Understanding the different types of pledges available and the legal requirements involved is crucial to effectively utilize this mechanism for securing credit in Franklin Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Franklin Ohio Prenda De Bienes Muebles Como Garantía Prendaria?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Franklin Pledge of Personal Property as Collateral Security, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any tasks related to paperwork execution simple.

Here's how you can find and download Franklin Pledge of Personal Property as Collateral Security.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the related forms or start the search over to locate the right file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Franklin Pledge of Personal Property as Collateral Security.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Franklin Pledge of Personal Property as Collateral Security, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to cope with an extremely difficult case, we recommend using the services of a lawyer to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!