The Hillsborough Florida Pledge of Personal Property as Collateral Security is an essential legal document used in financial transactions to secure a loan or debt repayment by offering personal property as collateral. This pledge provides a way for individuals, businesses, or organizations in Hillsborough County, Florida, to use their personal property as security to ensure reimbursement to lenders in case of default or non-payment. In simple terms, the pledge acts as a binding agreement between the borrower and the lender, where the borrower agrees to transfer the ownership rights of their personal property to the lender temporarily. This property can include various valuable assets such as vehicles, equipment, inventory, accounts receivable, investments, or any other valuable personal belongings. By pledging personal property as collateral security, borrowers in Hillsborough County have the opportunity to obtain loans at potentially more favorable terms, such as lower interest rates or increased borrowing capacity. This is because lenders have more confidence in loan recovery when they have legal rights over specific assets in case of default. It's important to note that there could be different types or variations of the Hillsborough Florida Pledge of Personal Property as Collateral Security, tailored to specific situations or types of personal property. Some examples of these specific types might include: 1. Vehicle Pledge: This type of pledge typically involves using an automobile or any other vehicle as collateral security for the loan. The vehicle ownership rights are temporarily transferred to the lender until the loan is repaid. 2. Equipment Pledge: Borrowers can pledge valuable equipment, machinery, or tools they own for business purposes to secure a loan. This type of pledge is commonly utilized by businesses or individuals involved in industries such as manufacturing, construction, or agriculture. 3. Inventory Pledge: In some cases, businesses may use their existing inventory or stock as collateral. This type of pledge is particularly useful for retail or wholesale businesses that maintain significant amounts of inventory. 4. Accounts Receivable Pledge: Companies can pledge their outstanding accounts receivable, which represent money owed to them by their customers, as collateral. This type of pledge is typically employed by businesses facing temporary cash flow shortages or looking to finance their ongoing operations. Ultimately, the specific terms and conditions of the Hillsborough Florida Pledge of Personal Property as Collateral Security may vary depending on the agreements reached between lenders and borrowers. However, the underlying objective remains the same: to provide a legal framework for securing loans using personal property as collateral in Hillsborough County, Florida.

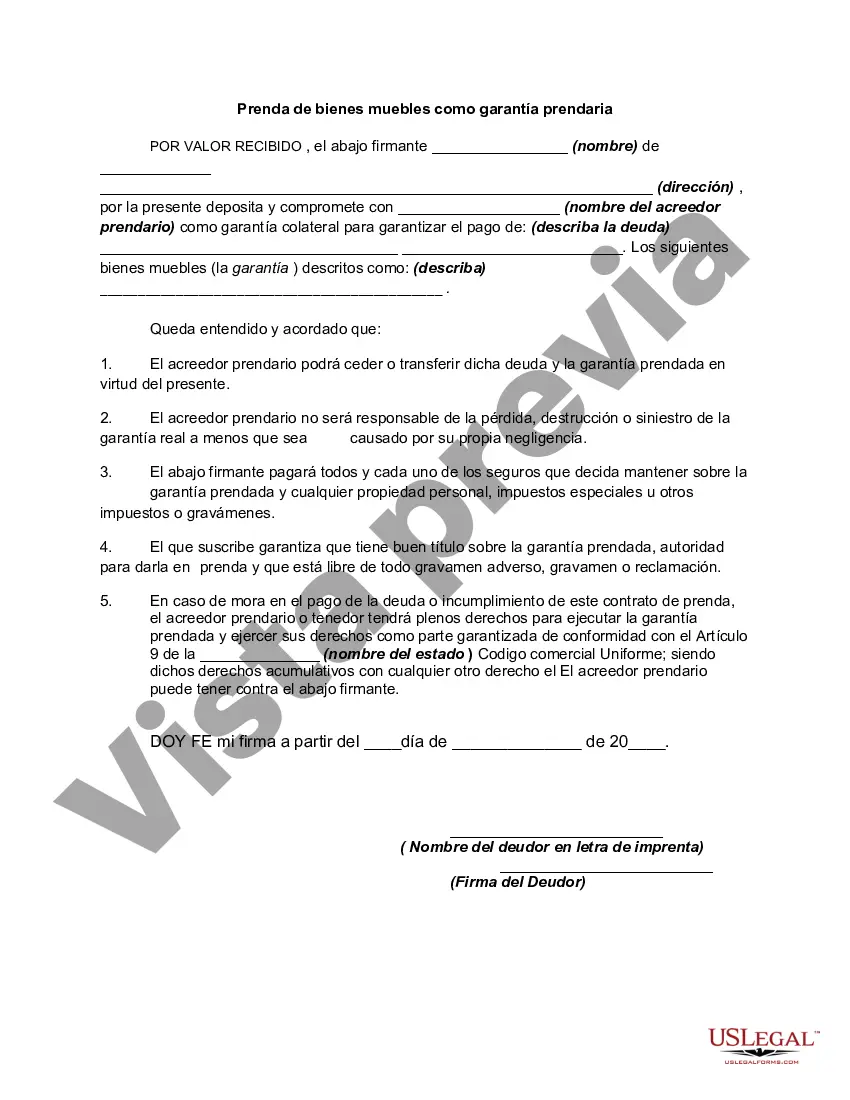

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Hillsborough Florida Prenda De Bienes Muebles Como Garantía Prendaria?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Hillsborough Pledge of Personal Property as Collateral Security, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can find and download Hillsborough Pledge of Personal Property as Collateral Security.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and buy Hillsborough Pledge of Personal Property as Collateral Security.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Hillsborough Pledge of Personal Property as Collateral Security, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you need to cope with an extremely complicated case, we recommend using the services of a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents with ease!