The Mecklenburg County Pledge of Personal Property as Collateral Security is a legal agreement used in North Carolina to secure a loan or debt. This collateral security agreement allows individuals or businesses to pledge their personal property as a form of security to the lender. By entering into this pledge, the borrower consents to use their personal property as collateral to ensure repayment of the loan. There are several types of Mecklenburg County Pledge of Personal Property as Collateral Security, including: 1. Consumer Pledge: This type of pledge is used by individuals who are borrowing money for personal use, such as buying a car or financing household expenses. The borrower pledges personal property, such as vehicles, electronics, or jewelry, as collateral to the lender. In case of default on the loan, the lender can seize and sell the pledged personal property to recover their losses. 2. Commercial Pledge: A commercial pledge is utilized by businesses or organizations seeking to secure a loan using their personal property assets. Companies can pledge valuable assets like equipment, inventory, or accounts receivables as collateral to gain access to the required funds. This pledge helps provide assurance to the lender that if the borrower defaults on the loan, they can recover their investment by selling the pledged assets. 3. Real Estate Pledge: This type of pledge specifically involves pledging personal property related to real estate, such as land, buildings, or houses. Real estate pledges are commonly used in mortgage agreements, where the borrower pledges their property to the lender as collateral for the loan. The lender holds a lien against the property, allowing them to foreclose and sell the property in the event of default. The Mecklenburg County Pledge of Personal Property as Collateral Security is a crucial legal instrument that facilitates borrowing and lending processes. Both borrowers and lenders must carefully understand the terms and conditions of this pledge, including the rights and responsibilities associated with the pledged personal property. It is crucial to consult with legal professionals to ensure compliance with relevant laws and regulations and to protect the interests of all parties involved.

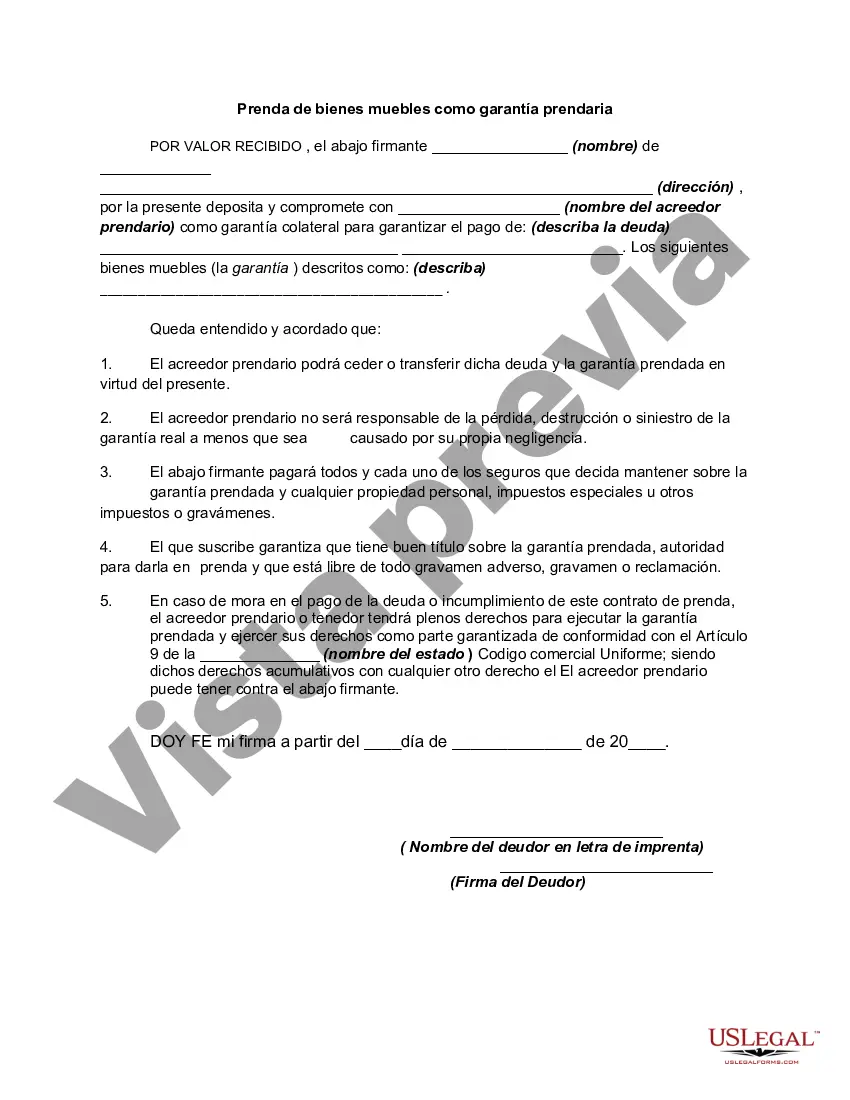

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Mecklenburg North Carolina Prenda De Bienes Muebles Como Garantía Prendaria?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Mecklenburg Pledge of Personal Property as Collateral Security, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any tasks associated with document completion straightforward.

Here's how to find and download Mecklenburg Pledge of Personal Property as Collateral Security.

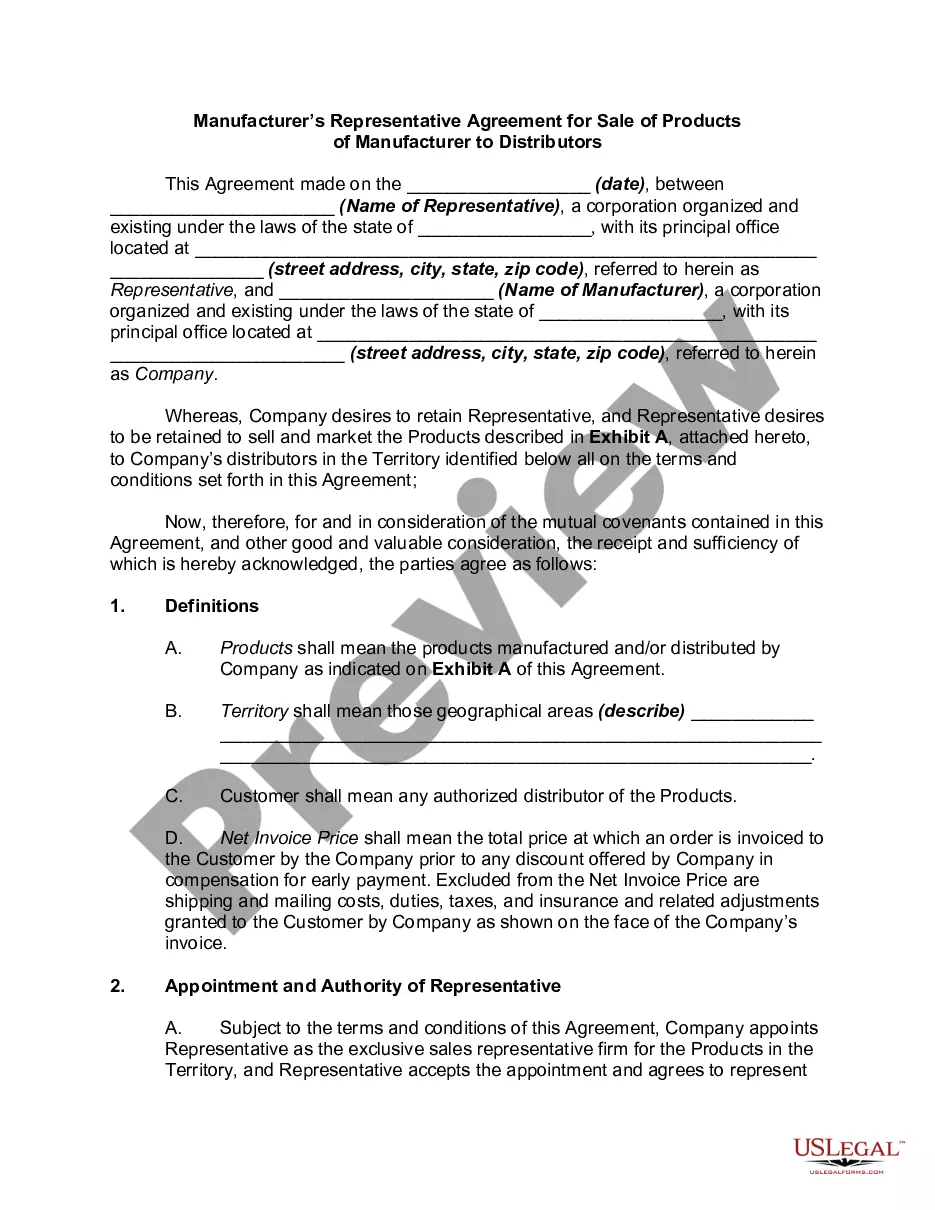

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Mecklenburg Pledge of Personal Property as Collateral Security.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Mecklenburg Pledge of Personal Property as Collateral Security, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to cope with an exceptionally complicated case, we advise getting an attorney to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork with ease!