The Miami-Dade Florida Pledge of Personal Property as Collateral Security is a legally binding agreement that allows an individual or business to secure a loan or debt by pledging their personal property as collateral. This pledge provides a sense of security to the lender, ensuring that they have an avenue to recover their investment if the borrower fails to meet their financial obligations. In Miami-Dade County, Florida, the Pledge of Personal Property is a widely accepted method to obtain financing for various purposes, such as purchasing a new vehicle, funding a business venture, or securing a mortgage. It is a form of alternative collateral security that allows borrowers to use their personal assets, excluding real estate, to obtain the necessary funds. The pledge can be made on a wide range of personal property items, which may include luxury goods, jewelry, artwork, valuable collectibles, stocks, bonds, inventory, or equipment. This allows borrowers to access funds without having to sell or transfer ownership of their assets, providing them with more flexibility in managing their finances. There are different types of Miami-Dade Florida Pledge of Personal Property as Collateral Security, each tailored to meet specific financing needs. These types may include: 1. Asset-Backed Loans: This type of pledge involves securing a loan by pledging high-value assets like luxury cars, yachts, or fine art as collateral. The lender holds the right to claim and sell the pledged asset if the borrower defaults on the loan. 2. Inventory Financing: In this type of pledge, a business pledges its inventory as collateral to obtain financing. This enables the business owner to leverage their inventory to generate working capital or support growth. 3. Equipment Financing: Borrowers can pledge their business equipment, such as machinery, vehicles, or technology, as collateral in exchange for a loan. This type of pledge is common for businesses that require specialized equipment to operate. 4. Stock Collateral: Investors can pledge their stock portfolio as collateral security for a loan. This allows them to access funds without selling their stocks, potentially avoiding capital gains tax or maintaining control over their investment portfolio. Regardless of the type of Miami-Dade Florida Pledge of Personal Property as Collateral Security, it is essential for both parties to carefully assess the terms and conditions of the agreement. The lender should evaluate the value and marketability of the assets, while the borrower must consider the potential risks associated with defaulting on the loan. In conclusion, the Miami-Dade Florida Pledge of Personal Property as Collateral Security provides individuals and businesses with a viable option to secure loans and debts. By pledging personal assets, borrowers can access funds without selling or transferring ownership of their property, gaining financial flexibility to meet their various needs.

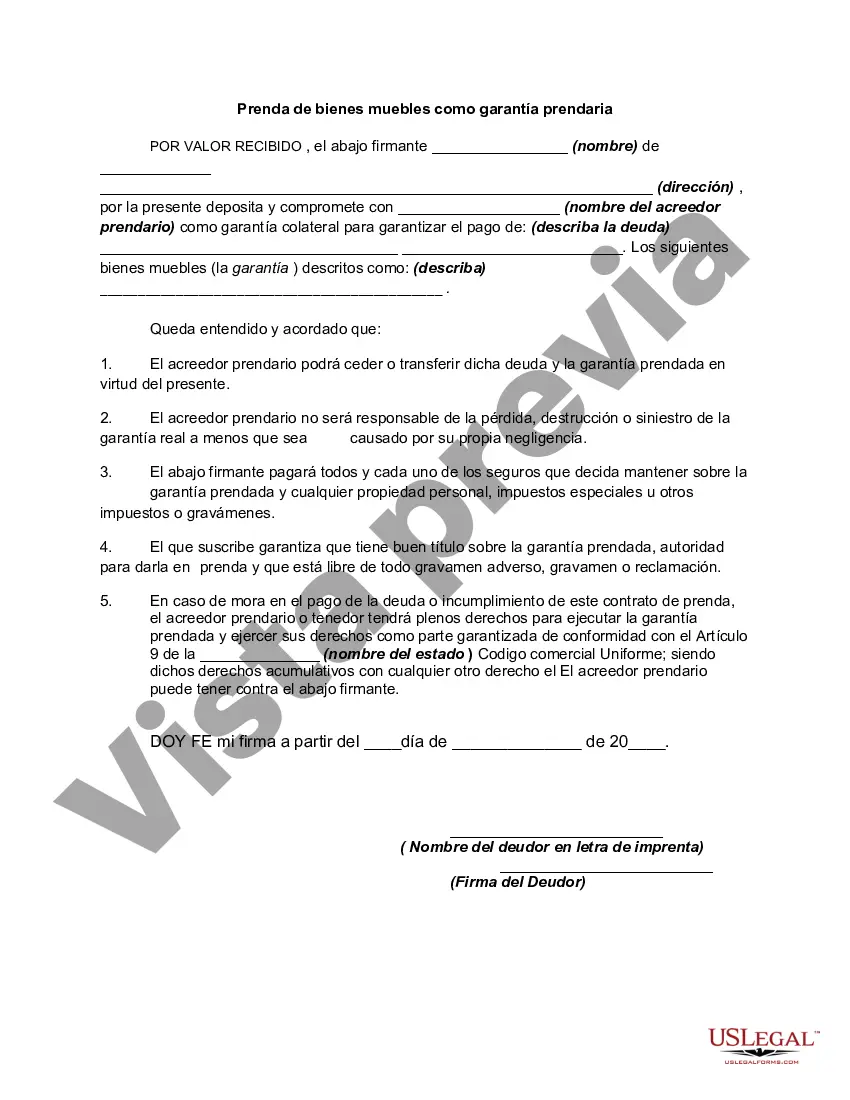

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

State:

Multi-State

County:

Miami-Dade

Control #:

US-03128BG

Format:

Word

Instant download

Description

A pledge is a deposit of personal property as security for a personal loan of money. If the loan is not repaid when due, the personal property pledged is forfeited to the lender. The property is known as collateral. A pledge occurs when someone gives property to a pawnbroker in exchange for money.

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

The Miami-Dade Florida Pledge of Personal Property as Collateral Security is a legally binding agreement that allows an individual or business to secure a loan or debt by pledging their personal property as collateral. This pledge provides a sense of security to the lender, ensuring that they have an avenue to recover their investment if the borrower fails to meet their financial obligations. In Miami-Dade County, Florida, the Pledge of Personal Property is a widely accepted method to obtain financing for various purposes, such as purchasing a new vehicle, funding a business venture, or securing a mortgage. It is a form of alternative collateral security that allows borrowers to use their personal assets, excluding real estate, to obtain the necessary funds. The pledge can be made on a wide range of personal property items, which may include luxury goods, jewelry, artwork, valuable collectibles, stocks, bonds, inventory, or equipment. This allows borrowers to access funds without having to sell or transfer ownership of their assets, providing them with more flexibility in managing their finances. There are different types of Miami-Dade Florida Pledge of Personal Property as Collateral Security, each tailored to meet specific financing needs. These types may include: 1. Asset-Backed Loans: This type of pledge involves securing a loan by pledging high-value assets like luxury cars, yachts, or fine art as collateral. The lender holds the right to claim and sell the pledged asset if the borrower defaults on the loan. 2. Inventory Financing: In this type of pledge, a business pledges its inventory as collateral to obtain financing. This enables the business owner to leverage their inventory to generate working capital or support growth. 3. Equipment Financing: Borrowers can pledge their business equipment, such as machinery, vehicles, or technology, as collateral in exchange for a loan. This type of pledge is common for businesses that require specialized equipment to operate. 4. Stock Collateral: Investors can pledge their stock portfolio as collateral security for a loan. This allows them to access funds without selling their stocks, potentially avoiding capital gains tax or maintaining control over their investment portfolio. Regardless of the type of Miami-Dade Florida Pledge of Personal Property as Collateral Security, it is essential for both parties to carefully assess the terms and conditions of the agreement. The lender should evaluate the value and marketability of the assets, while the borrower must consider the potential risks associated with defaulting on the loan. In conclusion, the Miami-Dade Florida Pledge of Personal Property as Collateral Security provides individuals and businesses with a viable option to secure loans and debts. By pledging personal assets, borrowers can access funds without selling or transferring ownership of their property, gaining financial flexibility to meet their various needs.