The Montgomery Maryland Pledge of Personal Property as Collateral Security is a legal agreement that allows individuals or businesses in Montgomery, Maryland to use their personal property as collateral for a loan or debt. This agreement provides the lender with a security interest in the pledged property, giving them the right to take possession or sell it if the borrower fails to repay the loan. In Montgomery, Maryland, there are several types of pledges of personal property as collateral security that can be utilized, depending on the nature of the loan or debt: 1. Chattel Mortgage: A chattel mortgage is a type of pledge where movable personal property, such as vehicles, equipment, or inventory, is used as collateral. This agreement establishes a lien on the pledged property, giving the lender the right to seize and sell it if the borrower defaults on their obligations. 2. Security Agreement: A security agreement is a broader form of pledge that can encompass various types of personal property, including both movable and immovable assets. This agreement provides the lender with a security interest in the designated property and typically requires registration with the appropriate government authority. 3. Floating Lien: A floating lien is another type of pledge commonly used in Montgomery, Maryland. It allows the borrower to use a constantly changing pool of personal property, such as inventory or accounts receivable, as collateral. The lender's security interest "floats" over the changing assets, providing a flexible form of collateral security. 4. Crop Pledge: In agricultural settings, a crop pledge can be employed, where future crops or agricultural products serve as collateral for the loan. This type of pledge is often used in Montgomery, Maryland's rural areas, where farming and agricultural activities are prevalent. The Montgomery Maryland Pledge of Personal Property as Collateral Security offers a crucial mechanism for borrowers to access credit while providing lenders with a level of protection against default. However, it is essential for both parties involved to fully understand the terms and conditions outlined in the agreement to ensure a fair and transparent transaction. Seek legal advice or consult with financial experts to navigate the complexities of this type of arrangement effectively.

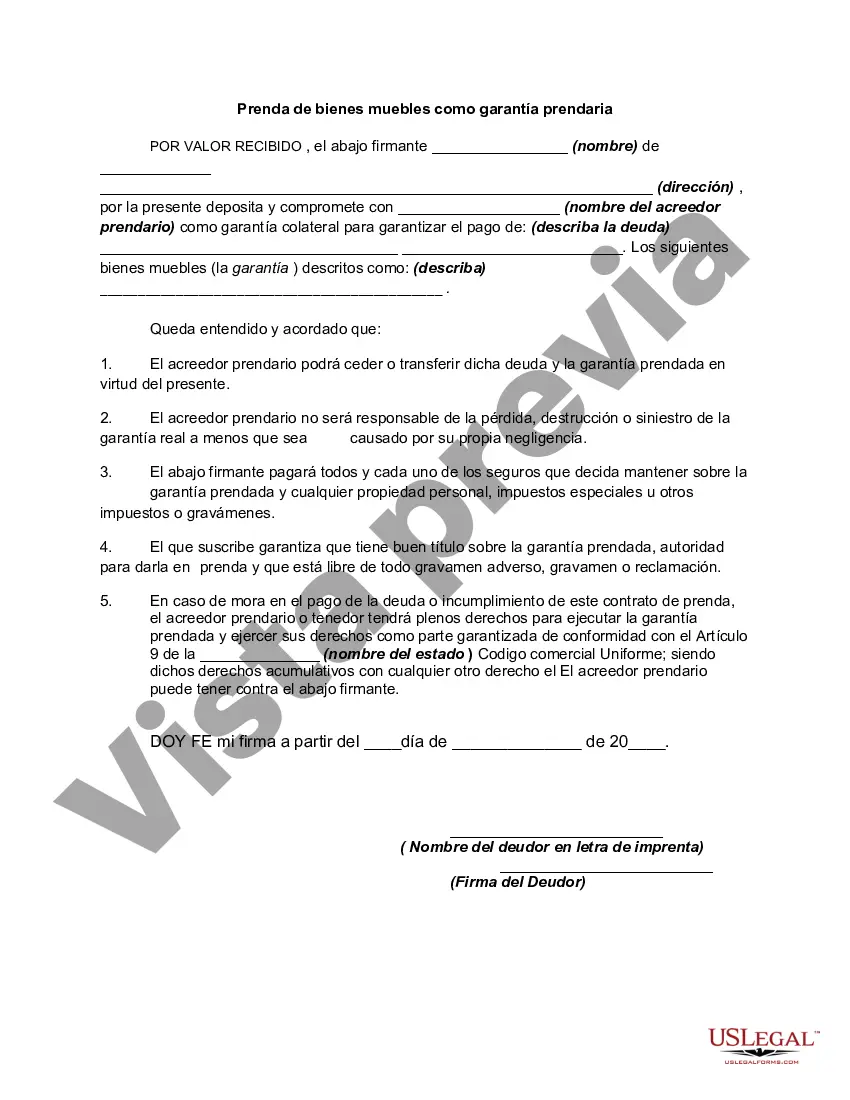

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Montgomery Maryland Prenda De Bienes Muebles Como Garantía Prendaria?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Montgomery Pledge of Personal Property as Collateral Security is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Montgomery Pledge of Personal Property as Collateral Security. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Montgomery Pledge of Personal Property as Collateral Security in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!