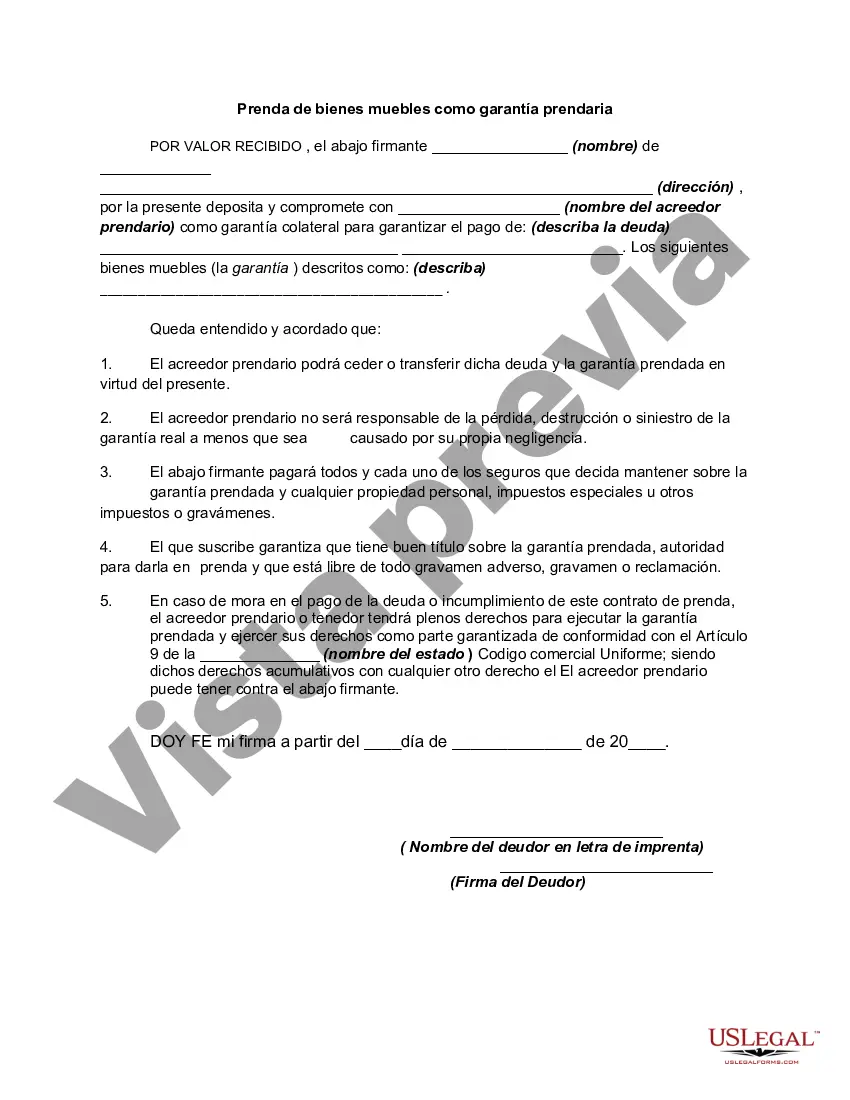

The Palm Beach Florida Pledge of Personal Property as Collateral Security is a legally binding agreement that is commonly used to secure a loan or debt. It allows individuals or businesses in Palm Beach, Florida to use their personal property as collateral, providing assurance to the lender in the event of non-payment or default. In this agreement, the borrower pledges specific personal property items as collateral, which can include tangible assets such as vehicles, real estate, jewelry, stocks, bonds, or even intellectual property rights. The pledged property serves as security until the borrower repays the loan or fulfills their financial obligations. There are various types of Palm Beach Florida Pledge of Personal Property as Collateral Security, each with its specific characteristics and applications. Some common forms include: 1. Real Estate Pledge: This type of collateral security involves using property or land as collateral. The property's value is assessed, and if the borrower defaults, the lender can foreclose or sell it to recoup their funds. 2. Vehicle Pledge: Borrowers can pledge their cars, trucks, or motorcycles as collateral. The lender may hold the vehicle's title until the loan is repaid or may undergo repossession processes if the borrower fails to meet their obligations. 3. Securities Pledge: Individuals or businesses can pledge their stocks, bonds, or other investment securities as collateral. If the borrower defaults, the lender can liquidate the securities to recover their funds. 4. Jewelry or Fine Art Pledge: Valuable jewelry, precious gems, or exquisite art pieces can be pledged as collateral. These items often require professional appraisal to establish their worth. 5. Intellectual Property Pledge: This collateral security involves pledging patents, copyrights, trademarks, or other intellectual property rights. Intellectual property can be quite valuable, making it an attractive option for lenders seeking assurance. It's important to note that the specific terms and conditions of the Palm Beach Florida Pledge of Personal Property as Collateral Security can vary depending on the lender, borrower, and the type of property being pledged. Legal assistance and professional advice are recommended to ensure compliance with local regulations and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Palm Beach Florida Prenda De Bienes Muebles Como Garantía Prendaria?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Palm Beach Pledge of Personal Property as Collateral Security, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Palm Beach Pledge of Personal Property as Collateral Security, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Palm Beach Pledge of Personal Property as Collateral Security:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Palm Beach Pledge of Personal Property as Collateral Security and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!