The San Jose California Pledge of Personal Property as Collateral Security refers to a legal agreement in which personal property is used as collateral to secure a loan or debt repayment. This type of pledge serves as a guarantee to the lender that, in case of default, they have the right to possess and sell the pledged property to recover their investment. The San Jose California Pledge of Personal Property as Collateral Security is a binding agreement between the borrower (pledge) and the lender (pledge) that outlines the terms and conditions of the pledge. It specifies the rights and obligations of both parties, providing details on the property being pledged, the loan amount, the interest rate, and the duration of the loan. In San Jose, California, there are various types of Personal Property Pledges that can be utilized as collateral security: 1. Chattel Mortgage: This pledge involves securing a loan using movable property such as vehicles, equipment, or inventory as collateral. The borrower retains possession of the property while the lender holds a lien on it until the loan is repaid. 2. Security Agreement: In this type of pledge, a borrower grants a security interest in personal property to a lender. The pledged property may vary, including business assets, accounts receivable, or intellectual property rights. 3. Pawnshop Agreement: This pledge occurs when an individual pledges personal property such as jewelry, electronics, or other valuable items to a pawnbroker in exchange for a loan. The borrower can redeem the pledged property by repaying the loan within a specified timeframe. 4. Accounts Receivable Financing: This type of pledge involves using accounts receivable as collateral security. Businesses in San Jose, California, can pledge their unpaid customer invoices to secure a loan, providing immediate cash flow while waiting for their customers to make payments. The San Jose California Pledge of Personal Property as Collateral Security plays a crucial role in facilitating borrowing and lending in various industries. It provides lenders with a level of security and confidence, allowing them to extend credit and support economic growth. Borrowers, on the other hand, can utilize their personal property to access necessary funds while retaining possession and ownership, subject to repayment obligations. In conclusion, the San Jose California Pledge of Personal Property as Collateral Security has different types, including chattel mortgages, security agreements, pawnshop agreements, and accounts receivable financing. These pledges serve as legal agreements between borrowers and lenders to secure loans using personal property as collateral, ensuring the protection of the lender's investment.

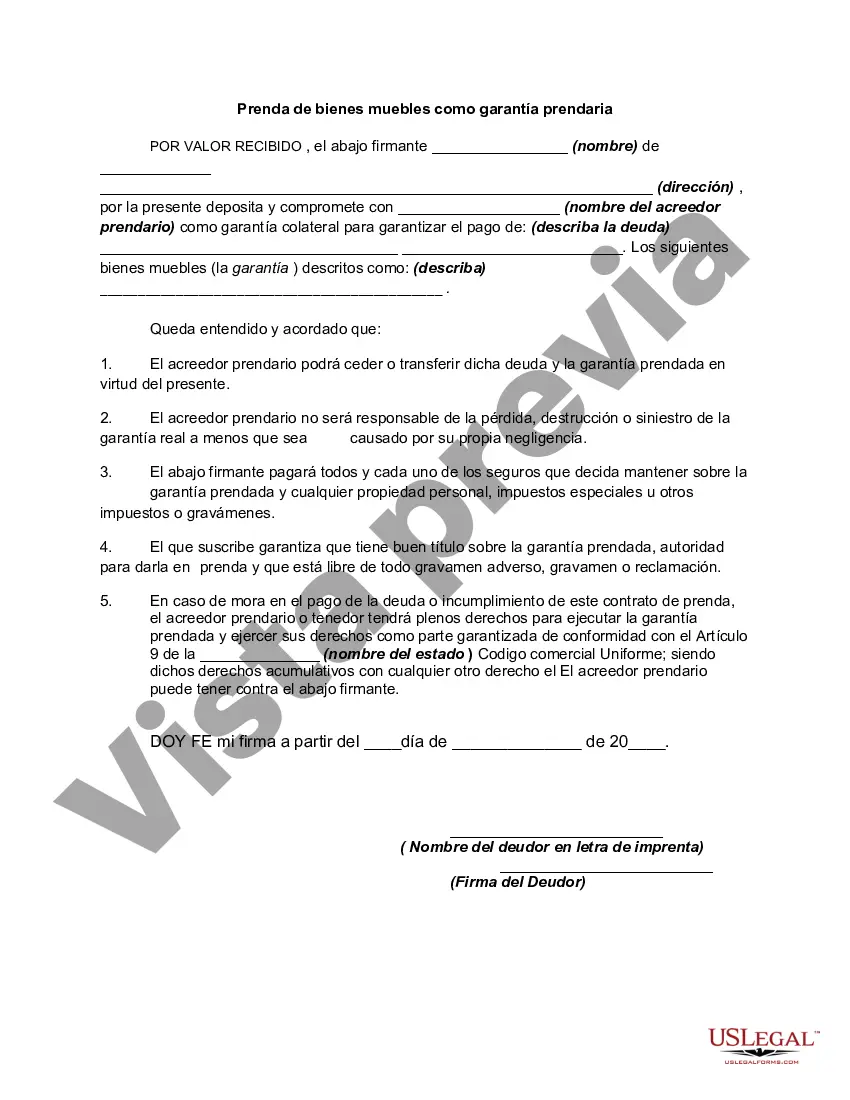

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out San Jose California Prenda De Bienes Muebles Como Garantía Prendaria?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the San Jose Pledge of Personal Property as Collateral Security, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Jose Pledge of Personal Property as Collateral Security from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Jose Pledge of Personal Property as Collateral Security:

- Take a look at the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!