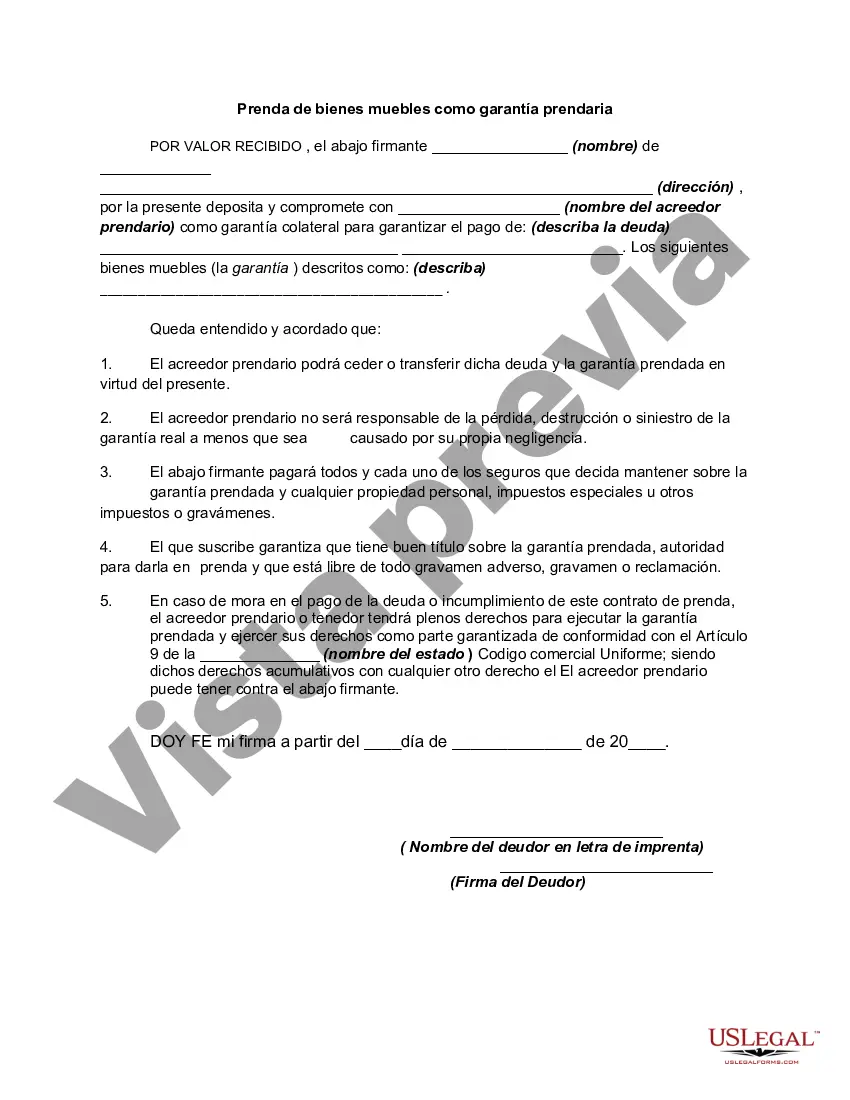

Santa Clara California is known for its vibrant economy and as a hub for technological advancement. As part of its legal system, Santa Clara California has provisions for pledging personal property as collateral security. A Pledge of Personal Property as Collateral Security is a legal agreement that allows an individual or entity to secure a loan or fulfill a financial obligation by providing personal property as collateral. This agreement offers lenders a legal claim on the pledged property in case the borrower defaults on their payment. There are different types of Pledge of Personal Property as Collateral Security available in Santa Clara California: 1. General Pledge: This type of pledge involves providing personal property, such as vehicles, electronics, or valuable assets, as collateral for a loan. The lender has the right to take ownership of the pledged property if the borrower fails to repay the loan. 2. Special Pledge: Special pledge refers to pledging specific personal property, such as artwork, jewelry, or rare collectibles, as collateral security. In this case, the lender possesses a legal interest in the pledged property until the debt is repaid. 3. Floating Pledge: A floating pledge allows the borrower to use personal property, such as inventory or accounts receivable, as collateral security. Unlike specific pledges, the borrower retains ownership of the property until default occurs, at which point the lender can seize the property. 4. Partial Pledge: This type of pledge involves pledging a portion of personal property as collateral security. It allows the borrower to use the remaining portion for other purposes while maintaining ownership and control over the pledged property. 5. Open-End Pledge: Open-end pledge refers to an agreement where the borrower pledges personal property as collateral security, which can be replaced or replenished over time. This type of pledge can be beneficial for businesses that require continual access to collateralized assets. 6. Closed-End Pledge: A closed-end pledge involves the borrower pledging personal property as collateral security, which cannot be replaced or replenished during the loan tenure. It provides a fixed and defined collateral for the lender. In Santa Clara California, the Pledge of Personal Property as Collateral Security follows legal procedures to ensure the rights and obligations of both lenders and borrowers. By understanding the various types of pledges, individuals and businesses can make informed decisions regarding their financial engagements and ensure the security of their valuable assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Santa Clara California Prenda De Bienes Muebles Como Garantía Prendaria?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Santa Clara Pledge of Personal Property as Collateral Security is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Santa Clara Pledge of Personal Property as Collateral Security. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Pledge of Personal Property as Collateral Security in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!