The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

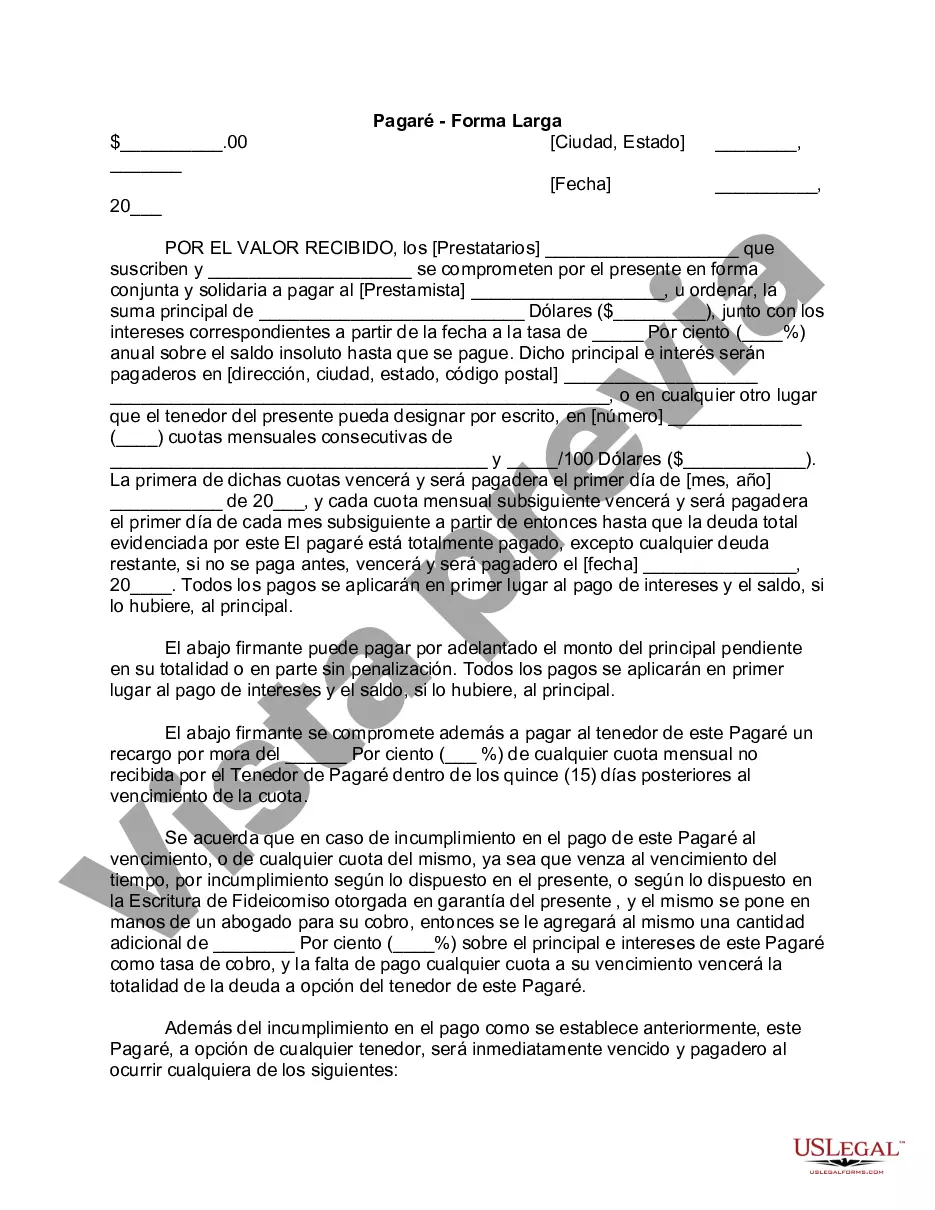

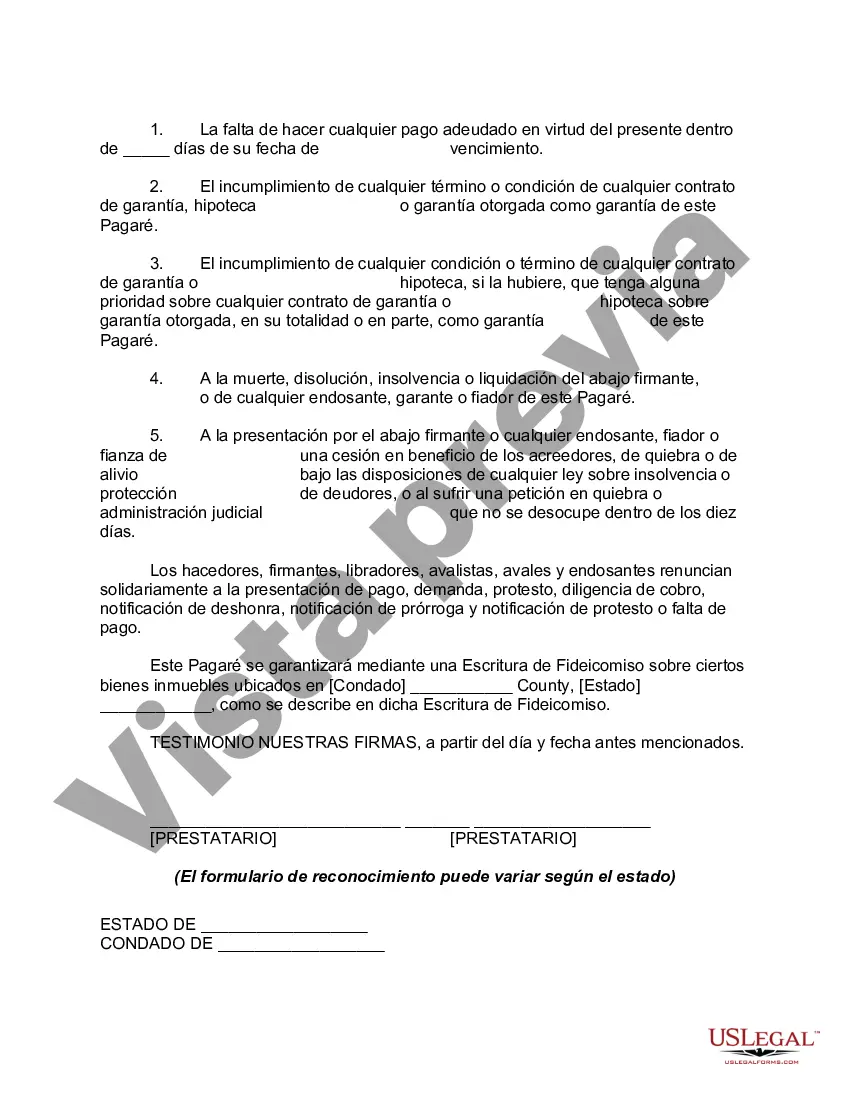

A King Washington Promissory Note — With Acknowledgment is a legal document that serves as evidence of a loan agreement between a lender (creditor) and a borrower (debtor). The promissory note outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional provisions that both parties have agreed upon. This type of promissory note is usually used in situations where a creditor wants to ensure that the borrower provides a written promise to repay the loan amount along with the agreed-upon interest. It adds an extra layer of protection for the lender by requiring the borrower to acknowledge the debt and their obligation to repay it within a specified period. There may be different variations or types of King Washington Promissory Note — With Acknowledgment based on specific legal jurisdictions or requirements. However, it is important to consult with a legal professional or visit a reputable legal website to obtain accurate information regarding these variations. By including relevant keywords in your content, it can help improve its visibility and attract the right audience. Some possible keywords for this topic could be: King Washington Promissory Note, promissory note with acknowledgment, legal loan agreement, borrower's obligation to repay, lender's protection, loan terms and conditions, loan repayment schedule, loan interest rate, loan agreement provisions, legal document, lender requirements, borrower responsibilities. Remember to use these keywords in a natural and coherent manner to ensure that your content is informative, engaging, and easily understood by your intended readers.A King Washington Promissory Note — With Acknowledgment is a legal document that serves as evidence of a loan agreement between a lender (creditor) and a borrower (debtor). The promissory note outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional provisions that both parties have agreed upon. This type of promissory note is usually used in situations where a creditor wants to ensure that the borrower provides a written promise to repay the loan amount along with the agreed-upon interest. It adds an extra layer of protection for the lender by requiring the borrower to acknowledge the debt and their obligation to repay it within a specified period. There may be different variations or types of King Washington Promissory Note — With Acknowledgment based on specific legal jurisdictions or requirements. However, it is important to consult with a legal professional or visit a reputable legal website to obtain accurate information regarding these variations. By including relevant keywords in your content, it can help improve its visibility and attract the right audience. Some possible keywords for this topic could be: King Washington Promissory Note, promissory note with acknowledgment, legal loan agreement, borrower's obligation to repay, lender's protection, loan terms and conditions, loan repayment schedule, loan interest rate, loan agreement provisions, legal document, lender requirements, borrower responsibilities. Remember to use these keywords in a natural and coherent manner to ensure that your content is informative, engaging, and easily understood by your intended readers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.