The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

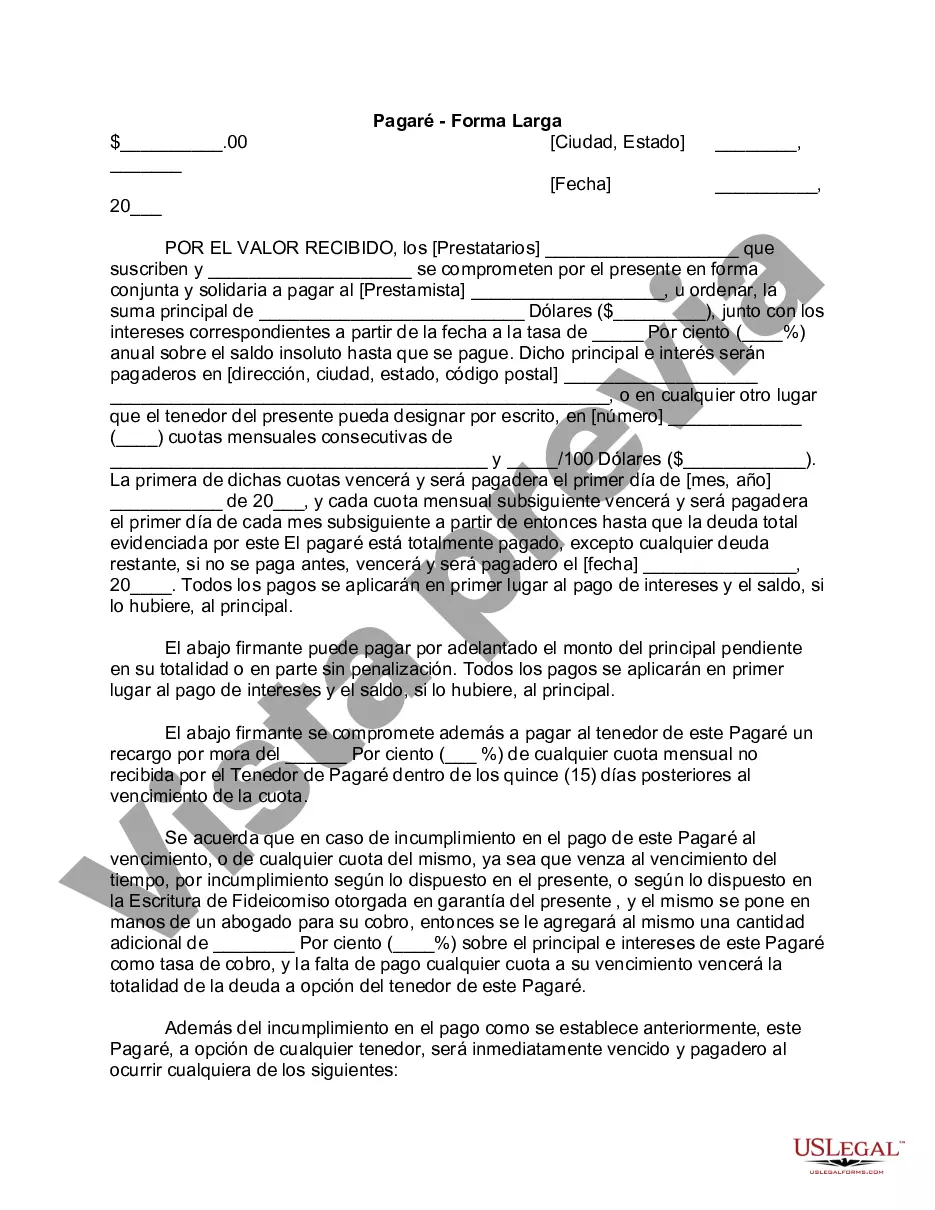

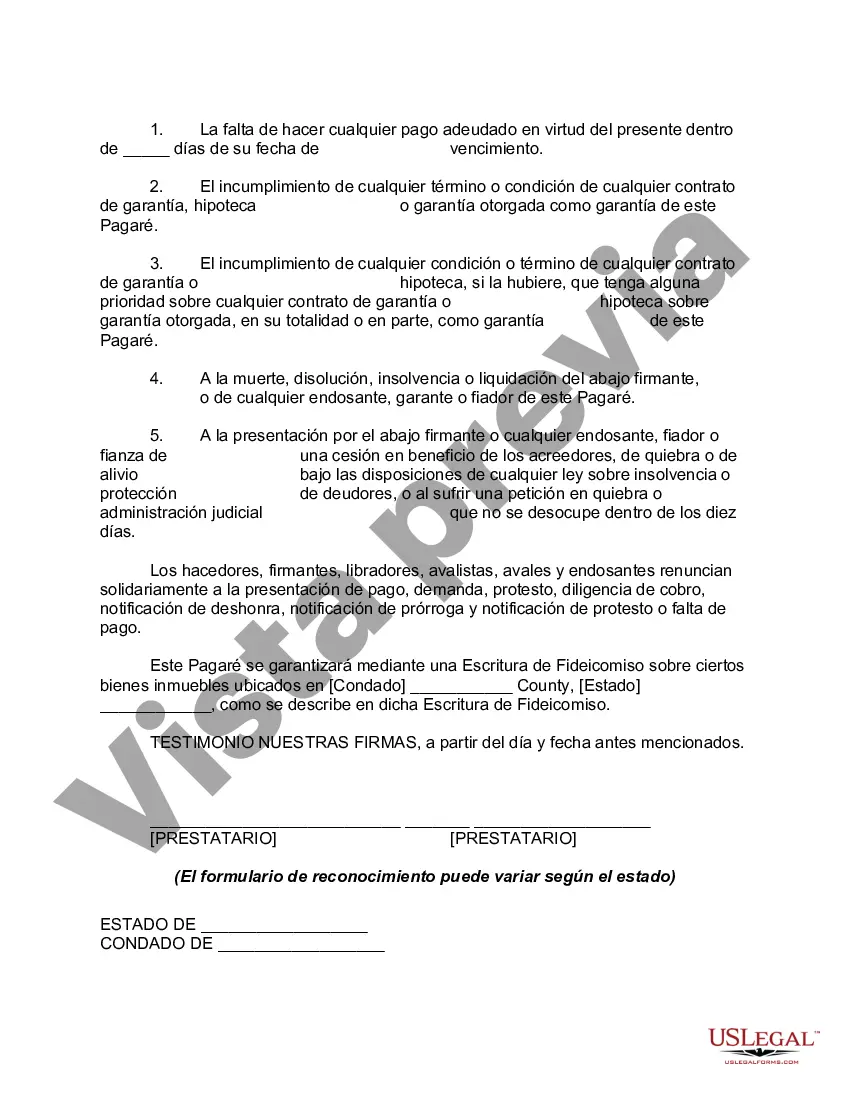

A Miami-Dade Florida Promissory Note — With Acknowledgment is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This note serves as a written promise from the borrower to repay the specified amount of money borrowed, along with any applicable interest, within a specific timeframe. The term "promissory note" refers to a written agreement in which the borrower promises to repay the borrowed sum to the lender, usually with interest, over a set period. In Miami-Dade County, Florida, a Promissory Note — With Acknowledgment must comply with the state's laws and regulations to be considered valid and enforceable. The Acknowledgment section of the note includes a statement where the borrower acknowledges their intention to repay the loan and confirms that they understand the terms and conditions outlined in the document. There may be different types of Miami-Dade Florida Promissory Note — With Acknowledgment, depending on the specific terms and conditions agreed upon by the parties involved: 1. Simple Promissory Note: This is the most basic type of promissory note, where the borrower promises to repay the borrowed sum within a set period, usually without any additional charges or interest. 2. Secured Promissory Note: In this type of note, the borrower pledges collateral, such as a property or asset, to secure the loan. This provides the lender with a form of security in case the borrower defaults on the payment. 3. Installment Promissory Note: With an installment note, the borrower agrees to repay the loan in fixed monthly installments over a specified period, including the principal amount and interest. 4. Balloon Payment Promissory Note: This note allows the borrower to make lower monthly payments for a certain period, with a larger "balloon" payment due at the end of the term, typically covering the remaining loan balance. When creating or signing a Miami-Dade Florida Promissory Note — With Acknowledgment, it is essential to consult with a legal professional to ensure compliance with local laws and to protect the interests of both parties involved in the loan agreement.A Miami-Dade Florida Promissory Note — With Acknowledgment is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This note serves as a written promise from the borrower to repay the specified amount of money borrowed, along with any applicable interest, within a specific timeframe. The term "promissory note" refers to a written agreement in which the borrower promises to repay the borrowed sum to the lender, usually with interest, over a set period. In Miami-Dade County, Florida, a Promissory Note — With Acknowledgment must comply with the state's laws and regulations to be considered valid and enforceable. The Acknowledgment section of the note includes a statement where the borrower acknowledges their intention to repay the loan and confirms that they understand the terms and conditions outlined in the document. There may be different types of Miami-Dade Florida Promissory Note — With Acknowledgment, depending on the specific terms and conditions agreed upon by the parties involved: 1. Simple Promissory Note: This is the most basic type of promissory note, where the borrower promises to repay the borrowed sum within a set period, usually without any additional charges or interest. 2. Secured Promissory Note: In this type of note, the borrower pledges collateral, such as a property or asset, to secure the loan. This provides the lender with a form of security in case the borrower defaults on the payment. 3. Installment Promissory Note: With an installment note, the borrower agrees to repay the loan in fixed monthly installments over a specified period, including the principal amount and interest. 4. Balloon Payment Promissory Note: This note allows the borrower to make lower monthly payments for a certain period, with a larger "balloon" payment due at the end of the term, typically covering the remaining loan balance. When creating or signing a Miami-Dade Florida Promissory Note — With Acknowledgment, it is essential to consult with a legal professional to ensure compliance with local laws and to protect the interests of both parties involved in the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.