This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Harris Texas Proxy of Member of Nonprofit Corporation refers to the authorized representation given by a member of a nonprofit corporation in Harris County, Texas, enabling another individual to vote or act on their behalf at official meetings and decision-making processes. This proxy is vital as it ensures that members who cannot attend these meetings due to various reasons can still have their voices heard and participate in the organization's affairs. The Harris Texas Proxy of Member of Nonprofit Corporation comes in various types, depending on the specific needs and requirements of the nonprofit corporation. These types can include: 1. General Proxy: This type of proxy grants broad authority to the designated individual, allowing them to vote on all matters presented at the meeting on behalf of the member. It is commonly used when the member is unable to attend multiple meetings. 2. Limited Proxy: In contrast to general proxy, a limited proxy restricts the authorized individual to vote only on specific matters as stated in the proxy form. This type of proxy is often used when the member wants to retain control over certain decisions while still needing representation for others. 3. Revocable Proxy: A revocable proxy enables the member to cancel or withdraw the proxy at any time before the meeting takes place. This type offers flexibility and allows the member to reconsider their choice if circumstances change. 4. Irrevocable Proxy: As the name suggests, an irrevocable proxy cannot be canceled or withdrawn once it is granted by the member. This type ensures that the designated representative will have the authority to act on the member's behalf even if the member later wishes to revoke their proxy. It is crucial for nonprofit corporations in Harris County, Texas, to establish clear guidelines and procedures regarding the use of proxies to ensure transparency and democratic decision-making within the organization. Members should familiarize themselves with the proxy types and choose the most suitable option based on their individual circumstances. The nonprofit corporation should also provide easy access to proxy forms and instructions to ensure that members who wish to grant a proxy can do so efficiently. Regular communication and transparency regarding proxy usage help build trust and engagement among members of the nonprofit corporation in Harris County, Texas.Harris Texas Proxy of Member of Nonprofit Corporation refers to the authorized representation given by a member of a nonprofit corporation in Harris County, Texas, enabling another individual to vote or act on their behalf at official meetings and decision-making processes. This proxy is vital as it ensures that members who cannot attend these meetings due to various reasons can still have their voices heard and participate in the organization's affairs. The Harris Texas Proxy of Member of Nonprofit Corporation comes in various types, depending on the specific needs and requirements of the nonprofit corporation. These types can include: 1. General Proxy: This type of proxy grants broad authority to the designated individual, allowing them to vote on all matters presented at the meeting on behalf of the member. It is commonly used when the member is unable to attend multiple meetings. 2. Limited Proxy: In contrast to general proxy, a limited proxy restricts the authorized individual to vote only on specific matters as stated in the proxy form. This type of proxy is often used when the member wants to retain control over certain decisions while still needing representation for others. 3. Revocable Proxy: A revocable proxy enables the member to cancel or withdraw the proxy at any time before the meeting takes place. This type offers flexibility and allows the member to reconsider their choice if circumstances change. 4. Irrevocable Proxy: As the name suggests, an irrevocable proxy cannot be canceled or withdrawn once it is granted by the member. This type ensures that the designated representative will have the authority to act on the member's behalf even if the member later wishes to revoke their proxy. It is crucial for nonprofit corporations in Harris County, Texas, to establish clear guidelines and procedures regarding the use of proxies to ensure transparency and democratic decision-making within the organization. Members should familiarize themselves with the proxy types and choose the most suitable option based on their individual circumstances. The nonprofit corporation should also provide easy access to proxy forms and instructions to ensure that members who wish to grant a proxy can do so efficiently. Regular communication and transparency regarding proxy usage help build trust and engagement among members of the nonprofit corporation in Harris County, Texas.

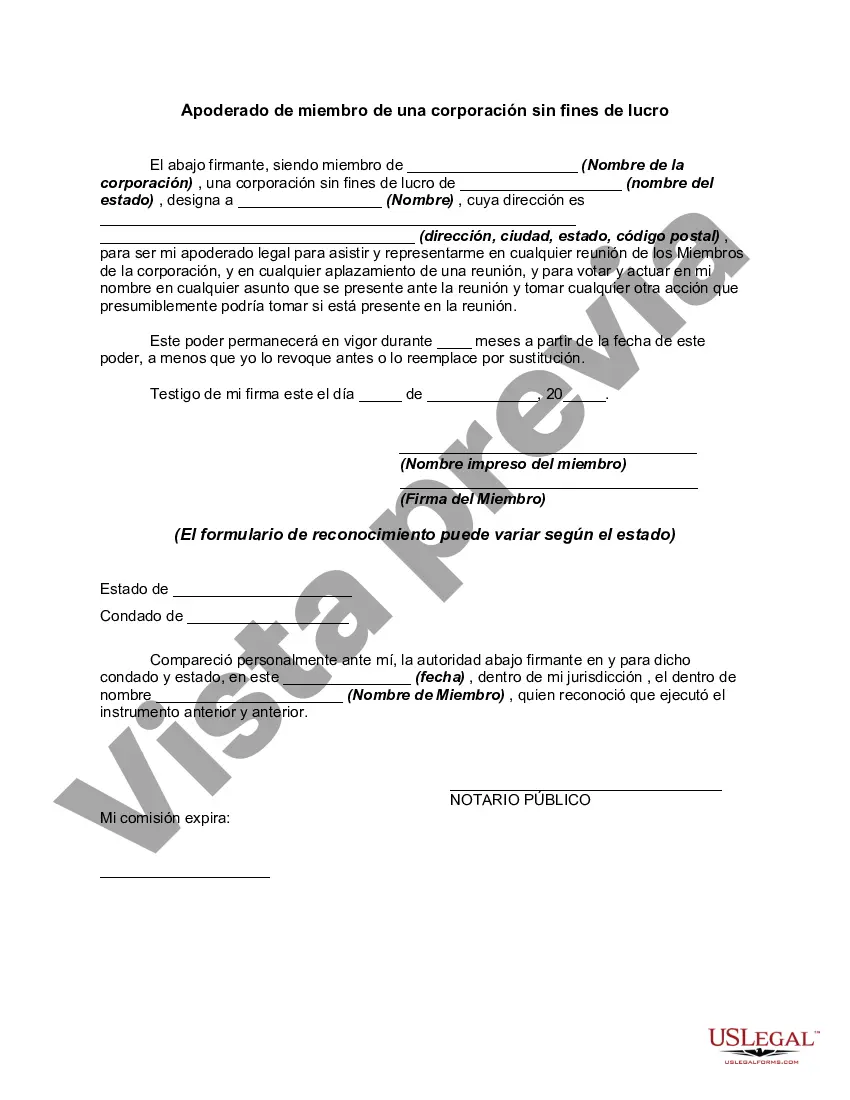

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.