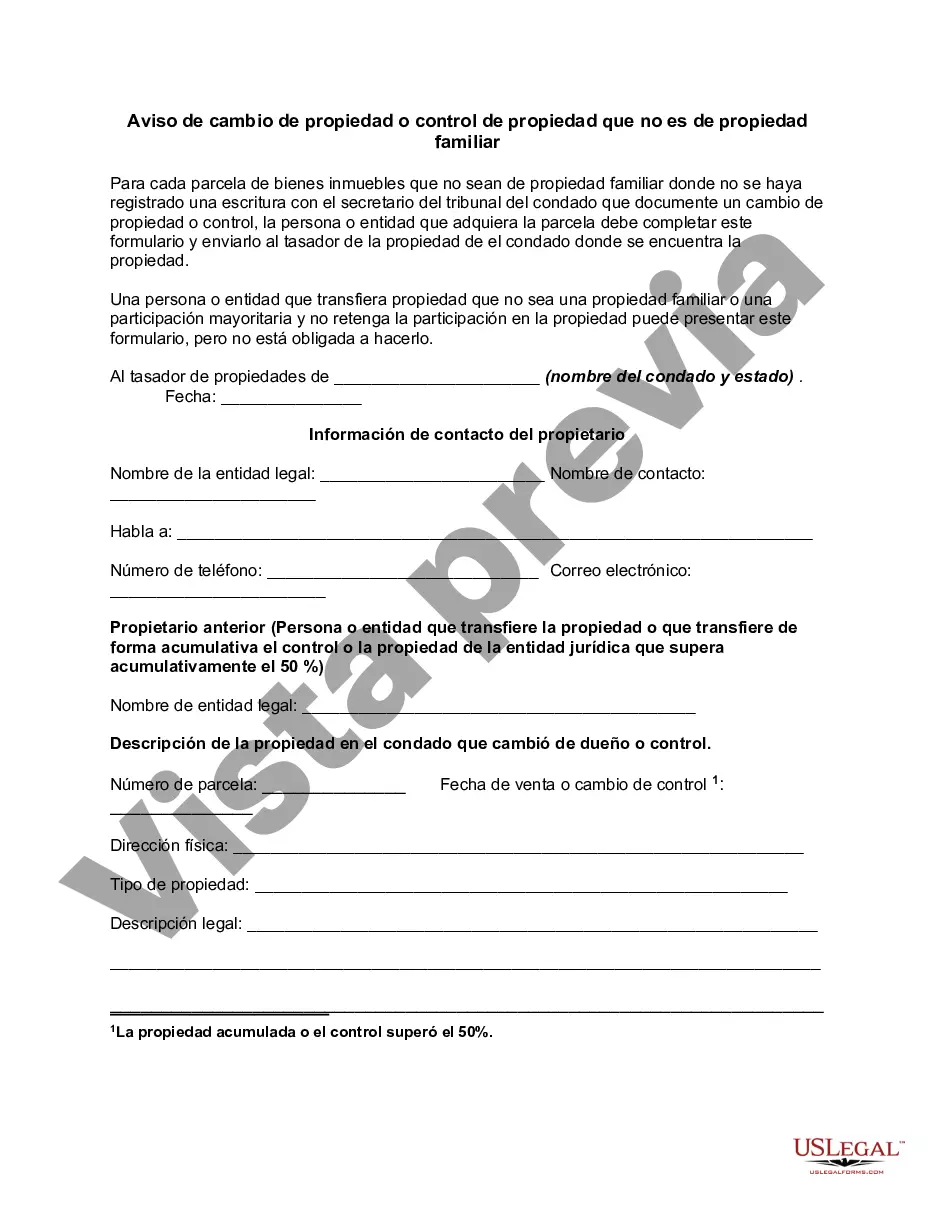

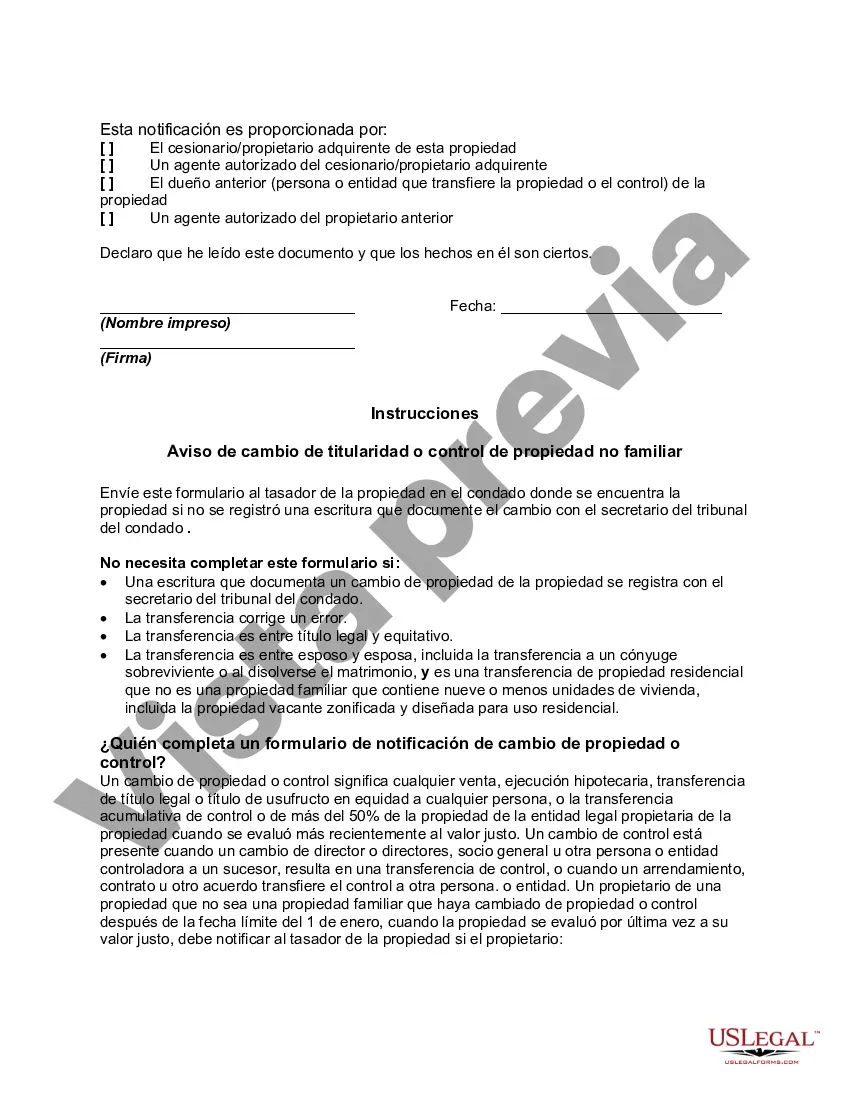

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

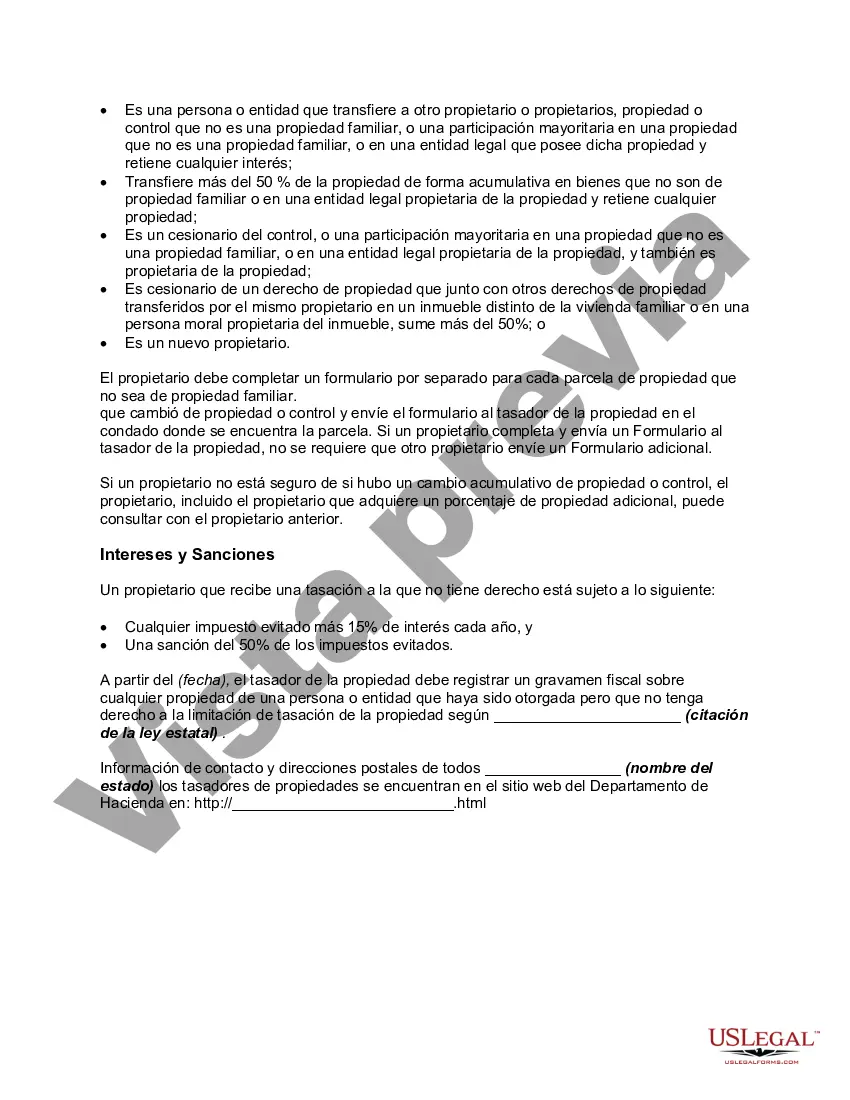

Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property is a legal document used in Allegheny County, Pennsylvania, to notify the county tax assessment office of any changes in ownership or control of non-homestead properties. This notice is required by law to ensure transparency and accuracy in property ownership records. The notice provides crucial information regarding the transfer of ownership or control, which may include changes in the property's ownership structure, such as the sale or purchase of the property, refinancing, leasing, or any other form of transfer. It helps the county maintain up-to-date records and ensures that property taxes are properly assessed and billed to the correct individuals or entities. Different types of Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property can be categorized based on the nature of the change being reported. Some common types include: 1. Sale of Non-Homestead Property: This notice is submitted when a non-homestead property is sold to a new owner. It provides details about the buyer and seller, the sale price, and any relevant transaction information. 2. Transfer of Ownership via Inheritance: In cases where a non-homestead property is transferred to a new owner due to inheritance, this notice is required. It outlines the deceased owner's information, the beneficiary's details, and any associated documentation. 3. Change in Ownership Structure: When there is a change in the ownership structure of a non-homestead property, such as the creation or dissolution of a partnership or corporation, a notice is submitted to inform the county. It includes information about the existing and new owners, their respective ownership percentages, and any legal documentation supporting the change. 4. Lease or Rental Agreements: If a non-homestead property is leased or rented, a notice is filed to indicate the change in control. It includes details about the landlord or lessor, tenant or lessee, duration of the lease agreement, and any other relevant terms. Submitting the Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property is an important step to ensure compliance with local laws and regulations. Failure to file this notice within the specified time limits may result in penalties or complications during property assessments and tax billing processes. Property owners or their authorized representatives should consult Allegheny County's tax assessment office or website for specific instructions, forms, and deadlines associated with submitting the Notice of Change of Ownership or Control Non-Homestead Property. It is advisable to seek legal guidance or consult a real estate professional for accurate and compliant completion of the notice.Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property is a legal document used in Allegheny County, Pennsylvania, to notify the county tax assessment office of any changes in ownership or control of non-homestead properties. This notice is required by law to ensure transparency and accuracy in property ownership records. The notice provides crucial information regarding the transfer of ownership or control, which may include changes in the property's ownership structure, such as the sale or purchase of the property, refinancing, leasing, or any other form of transfer. It helps the county maintain up-to-date records and ensures that property taxes are properly assessed and billed to the correct individuals or entities. Different types of Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property can be categorized based on the nature of the change being reported. Some common types include: 1. Sale of Non-Homestead Property: This notice is submitted when a non-homestead property is sold to a new owner. It provides details about the buyer and seller, the sale price, and any relevant transaction information. 2. Transfer of Ownership via Inheritance: In cases where a non-homestead property is transferred to a new owner due to inheritance, this notice is required. It outlines the deceased owner's information, the beneficiary's details, and any associated documentation. 3. Change in Ownership Structure: When there is a change in the ownership structure of a non-homestead property, such as the creation or dissolution of a partnership or corporation, a notice is submitted to inform the county. It includes information about the existing and new owners, their respective ownership percentages, and any legal documentation supporting the change. 4. Lease or Rental Agreements: If a non-homestead property is leased or rented, a notice is filed to indicate the change in control. It includes details about the landlord or lessor, tenant or lessee, duration of the lease agreement, and any other relevant terms. Submitting the Allegheny Pennsylvania Notice of Change of Ownership or Control Non-Homestead Property is an important step to ensure compliance with local laws and regulations. Failure to file this notice within the specified time limits may result in penalties or complications during property assessments and tax billing processes. Property owners or their authorized representatives should consult Allegheny County's tax assessment office or website for specific instructions, forms, and deadlines associated with submitting the Notice of Change of Ownership or Control Non-Homestead Property. It is advisable to seek legal guidance or consult a real estate professional for accurate and compliant completion of the notice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.