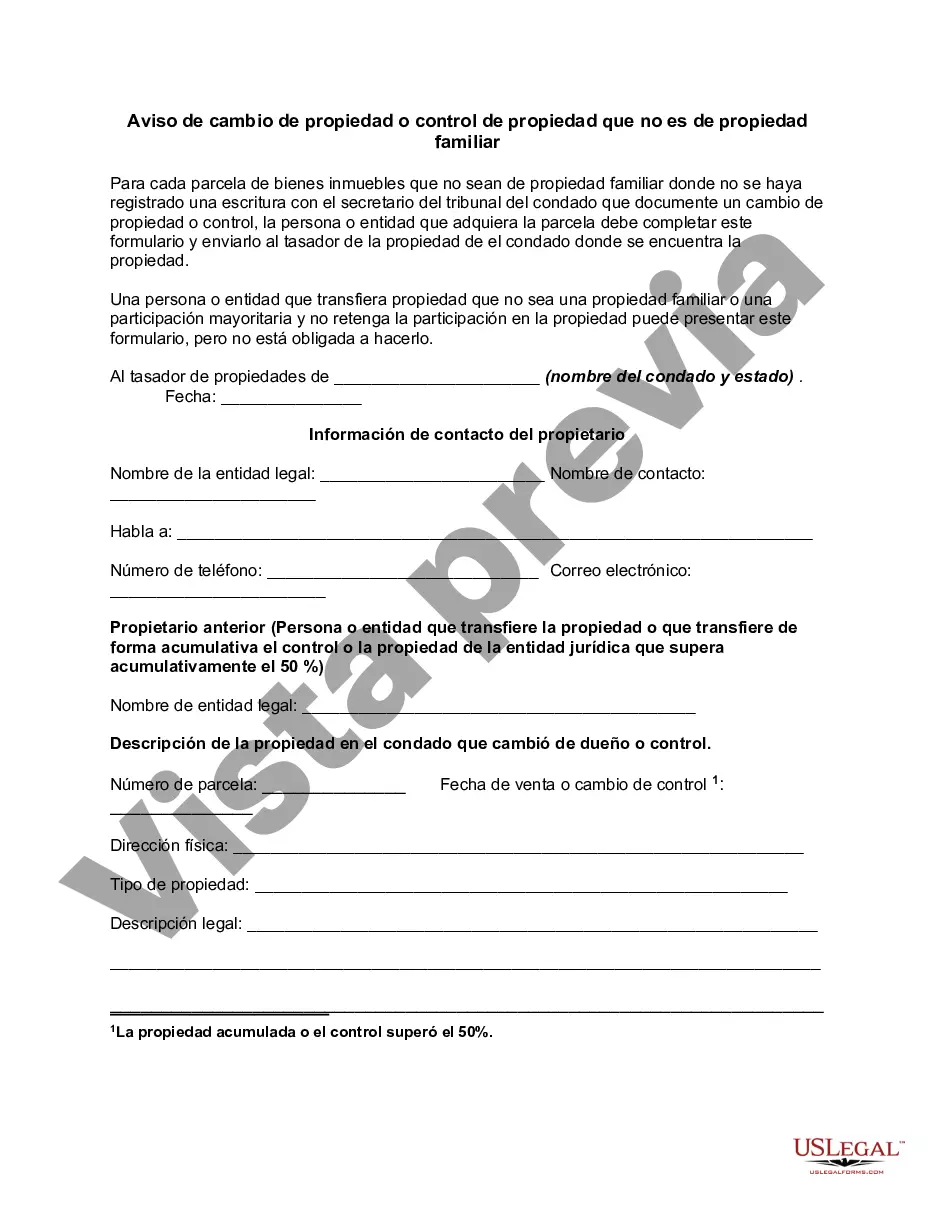

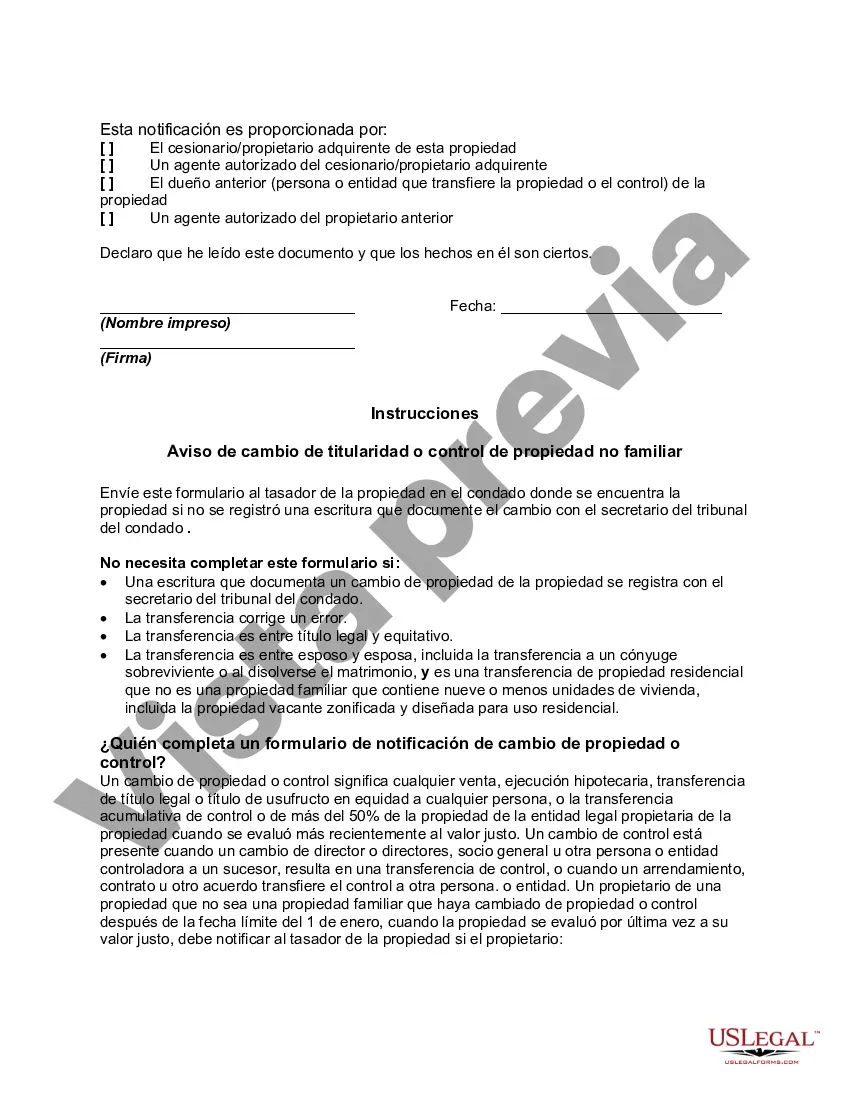

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Collin Texas Notice of Change of Ownership or Control Non-Homestead Property Introduction: The Collin Texas Notice of Change of Ownership or Control Non-Homestead Property refers to a legal document filed with the Collin County authorities when there is a change in ownership or control of non-homestead properties. This article aims to provide a detailed description of what this notice entails, the reasons behind filing, and its significance in Collin County, Texas. Types of Collin Texas Notice of Change of Ownership or Control Non-Homestead Property: While the notice generally applies to all non-homestead properties, there are different types of situations that may require filing this notice. Some notable instances include: 1. Commercial Real Estate Transfers: When a transfer of ownership or control occurs in commercial properties such as office buildings, retail spaces, industrial units, or vacant lands, Collin County requires the filing of the Notice of Change of Ownership or Control. 2. Rental Investment Properties: If an individual or entity owns non-homestead rental properties, such as apartments, townhouses, or single-family homes, and there is a change in ownership or control, this notice must be filed in compliance with county regulations. 3. Agricultural Properties: Non-homestead properties used for agricultural purposes, including farm land, ranches, or any land used for crop cultivation or livestock rearing, are also subject to this notice when there is a change in ownership or control. 4. Other Non-Homestead Properties: This notice is not limited to the mentioned categories and may extend to other types of non-homestead properties, including commercial buildings undergoing major renovations, parcels designated for future development, or properties leased to government entities. Importance of Collin Texas Notice of Change of Ownership or Control Non-Homestead Property: Filing the Collin Texas Notice of Change of Ownership or Control Non-Homestead Property is vital due to the following reasons: 1. Compliance with County Regulations: Collin County requires property owners to file this notice promptly when there is a change in ownership or control of non-homestead properties. By adhering to this requirement, property owners ensure they comply with applicable laws and avoid potential penalties. 2. Assessment and Taxation: The notice allows the county to accurately assess and determine property values, ensuring fair tax assessment and billing. This process helps in calculating property taxes, which contribute to funding vital county services, infrastructure, and educational institutions. 3. Record Keeping: Filing the Notice of Change of Ownership or Control ensures an updated public record of property ownership. This helps maintain transparency and allows interested parties, such as tenants, neighboring property owners, or potential buyers to access essential information about property ownership changes. Conclusion: The Collin Texas Notice of Change of Ownership or Control Non-Homestead Property is a critical document illustrating the transfer of ownership or control of non-homestead properties in Collin County. By complying with the filing requirement, property owners contribute to the proper assessment and taxation of these properties, ensuring transparency and accurate record-keeping within the county's jurisdiction.Title: Understanding the Collin Texas Notice of Change of Ownership or Control Non-Homestead Property Introduction: The Collin Texas Notice of Change of Ownership or Control Non-Homestead Property refers to a legal document filed with the Collin County authorities when there is a change in ownership or control of non-homestead properties. This article aims to provide a detailed description of what this notice entails, the reasons behind filing, and its significance in Collin County, Texas. Types of Collin Texas Notice of Change of Ownership or Control Non-Homestead Property: While the notice generally applies to all non-homestead properties, there are different types of situations that may require filing this notice. Some notable instances include: 1. Commercial Real Estate Transfers: When a transfer of ownership or control occurs in commercial properties such as office buildings, retail spaces, industrial units, or vacant lands, Collin County requires the filing of the Notice of Change of Ownership or Control. 2. Rental Investment Properties: If an individual or entity owns non-homestead rental properties, such as apartments, townhouses, or single-family homes, and there is a change in ownership or control, this notice must be filed in compliance with county regulations. 3. Agricultural Properties: Non-homestead properties used for agricultural purposes, including farm land, ranches, or any land used for crop cultivation or livestock rearing, are also subject to this notice when there is a change in ownership or control. 4. Other Non-Homestead Properties: This notice is not limited to the mentioned categories and may extend to other types of non-homestead properties, including commercial buildings undergoing major renovations, parcels designated for future development, or properties leased to government entities. Importance of Collin Texas Notice of Change of Ownership or Control Non-Homestead Property: Filing the Collin Texas Notice of Change of Ownership or Control Non-Homestead Property is vital due to the following reasons: 1. Compliance with County Regulations: Collin County requires property owners to file this notice promptly when there is a change in ownership or control of non-homestead properties. By adhering to this requirement, property owners ensure they comply with applicable laws and avoid potential penalties. 2. Assessment and Taxation: The notice allows the county to accurately assess and determine property values, ensuring fair tax assessment and billing. This process helps in calculating property taxes, which contribute to funding vital county services, infrastructure, and educational institutions. 3. Record Keeping: Filing the Notice of Change of Ownership or Control ensures an updated public record of property ownership. This helps maintain transparency and allows interested parties, such as tenants, neighboring property owners, or potential buyers to access essential information about property ownership changes. Conclusion: The Collin Texas Notice of Change of Ownership or Control Non-Homestead Property is a critical document illustrating the transfer of ownership or control of non-homestead properties in Collin County. By complying with the filing requirement, property owners contribute to the proper assessment and taxation of these properties, ensuring transparency and accurate record-keeping within the county's jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.