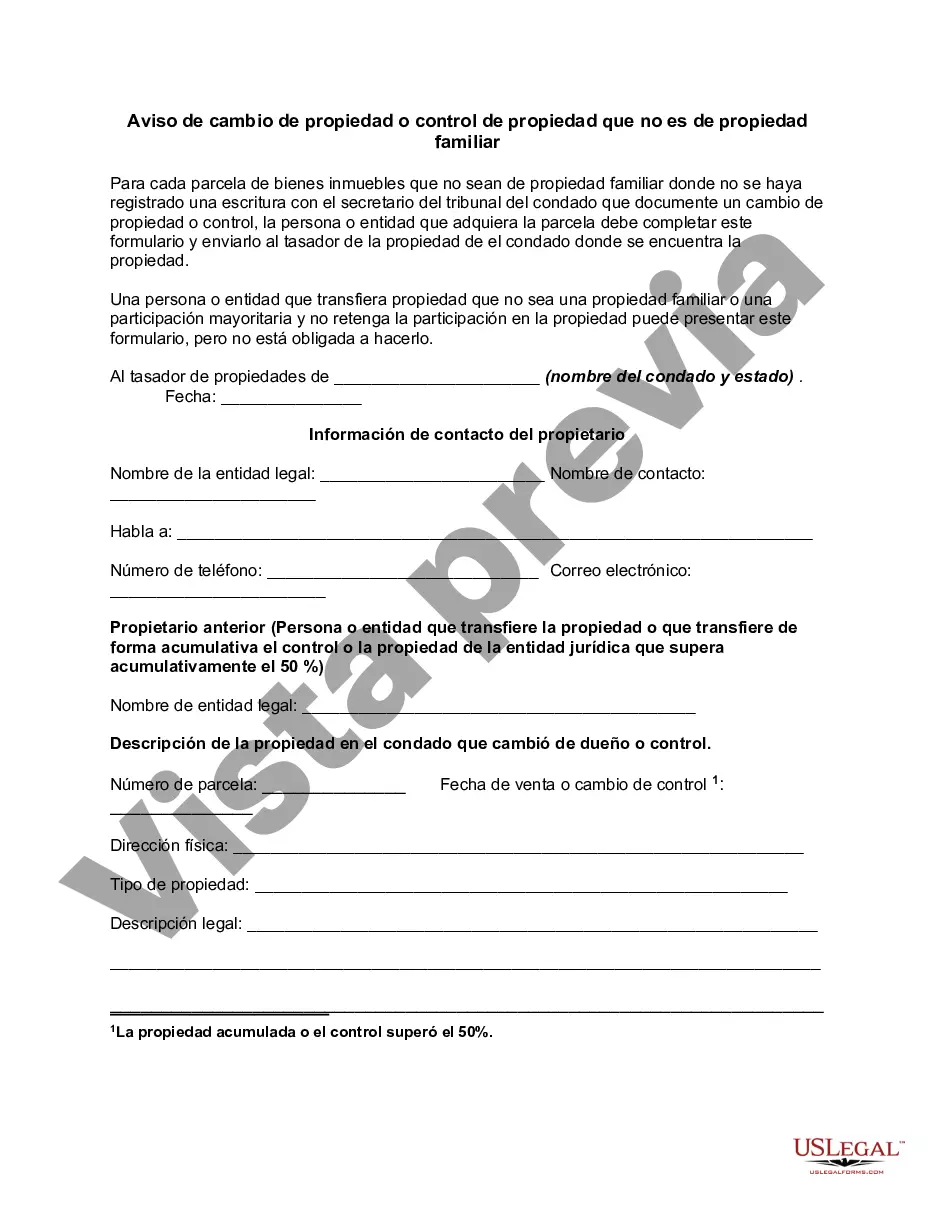

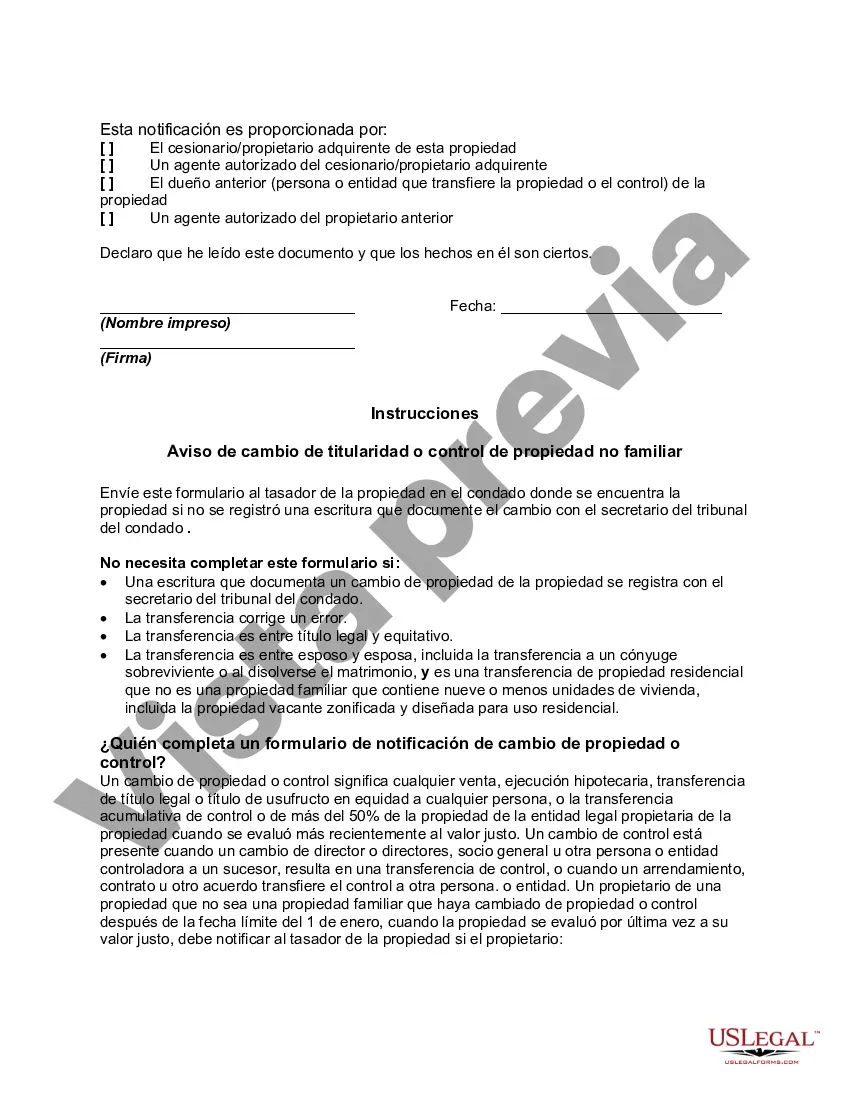

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

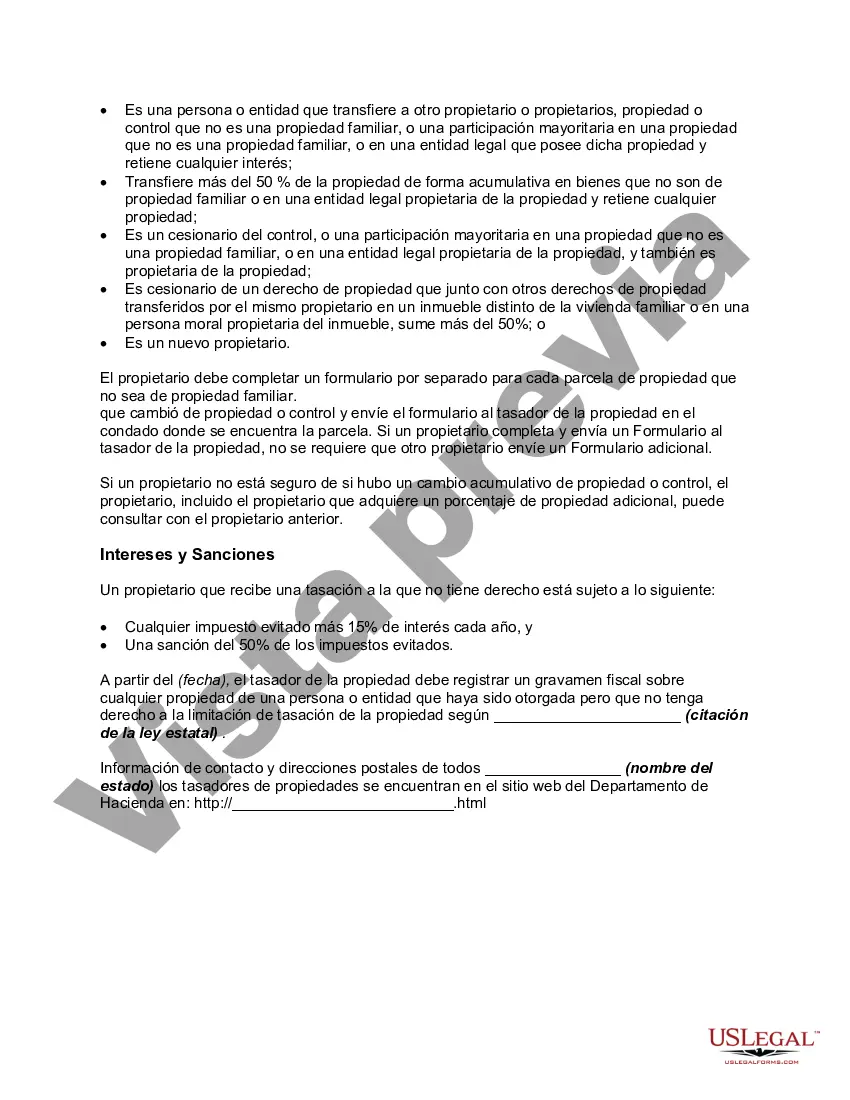

Title: Kings New York Notice of Change of Ownership or Control Non-Homestead Property — Everything You Need to Know Introduction: In Kings County, New York, property sales and transfers are an integral part of the real estate landscape. To maintain transparency and compliance, the Kings New York Notice of Change of Ownership or Control Non-Homestead Property serves as a legal document informing relevant parties about the transfer of ownership or control of non-homestead properties. This detailed description will help you understand the purpose, process, and types of Kings New York Notice of Change of Ownership or Control Non-Homestead Property. 1. What is Kings New York Notice of Change of Ownership or Control Non-Homestead Property? The Kings New York Notice of Change of Ownership or Control Non-Homestead Property is a legal document required by law to be filed with the appropriate authorities in Kings County, New York, whenever there is a transfer of ownership or control of non-homestead properties. This notice ensures stakeholders, including the local government, taxpayers, and lenders, are aware of the change and can accurately assess property taxes, mortgages, and relevant financial obligations. 2. Purpose and Importance: a. Maintaining Records: The notice helps the local government maintain accurate records of property ownership changes, ensuring efficient tax assessment and collection processes. b. Legally Binding: The notice establishes the legal proof that a transfer of ownership or control of a non-homestead property has occurred, protecting the rights of all parties involved. c. Transparency and Accountability: By disclosing changes in property ownership, the notice promotes transparency, preventing fraudulent activities and ensuring compliance with local regulations. 3. Process of Filing: a. Timing and Requirements: Owners or controlling entities are responsible for filing the Notice of Change promptly after the transfer within specified timeframes, along with the necessary supporting documents. b. Documentation: The notice generally requires providing details such as property address, owner's information, transfer date, buyer information, and any associated mortgage or lien information. c. Filing Method: The notice is typically filed with the Kings County Clerk's Office or any designated local agency responsible for property records and transfers. 4. Types of Kings New York Notice of Change of Ownership or Control Non-Homestead Property: a. Commercial Property: This category includes office buildings, retail spaces, warehouses, and any non-homestead property used for commercial purposes. b. Industrial Property: The notice applies to properties zoned for industrial use, including manufacturing plants, storage facilities, and distribution centers. c. Vacant Land: Transfers of non-homestead vacant land, such as development sites, agricultural land, or unused lots, require this notice. d. Mixed-Use Property: When a non-homestead property combines both commercial and residential uses, the notice accounts for the respective shares transferred. Conclusion: The Kings New York Notice of Change of Ownership or Control Non-Homestead Property plays a crucial role in tracking property ownership changes in Kings County. By understanding its purpose, filing process, and the various property types it applies to, property owners, buyers, lenders, and the local government can ensure compliance, transparency, and accurate taxation. Remember, timely filing of this notice is essential to maintain a complete and up-to-date property ownership record.Title: Kings New York Notice of Change of Ownership or Control Non-Homestead Property — Everything You Need to Know Introduction: In Kings County, New York, property sales and transfers are an integral part of the real estate landscape. To maintain transparency and compliance, the Kings New York Notice of Change of Ownership or Control Non-Homestead Property serves as a legal document informing relevant parties about the transfer of ownership or control of non-homestead properties. This detailed description will help you understand the purpose, process, and types of Kings New York Notice of Change of Ownership or Control Non-Homestead Property. 1. What is Kings New York Notice of Change of Ownership or Control Non-Homestead Property? The Kings New York Notice of Change of Ownership or Control Non-Homestead Property is a legal document required by law to be filed with the appropriate authorities in Kings County, New York, whenever there is a transfer of ownership or control of non-homestead properties. This notice ensures stakeholders, including the local government, taxpayers, and lenders, are aware of the change and can accurately assess property taxes, mortgages, and relevant financial obligations. 2. Purpose and Importance: a. Maintaining Records: The notice helps the local government maintain accurate records of property ownership changes, ensuring efficient tax assessment and collection processes. b. Legally Binding: The notice establishes the legal proof that a transfer of ownership or control of a non-homestead property has occurred, protecting the rights of all parties involved. c. Transparency and Accountability: By disclosing changes in property ownership, the notice promotes transparency, preventing fraudulent activities and ensuring compliance with local regulations. 3. Process of Filing: a. Timing and Requirements: Owners or controlling entities are responsible for filing the Notice of Change promptly after the transfer within specified timeframes, along with the necessary supporting documents. b. Documentation: The notice generally requires providing details such as property address, owner's information, transfer date, buyer information, and any associated mortgage or lien information. c. Filing Method: The notice is typically filed with the Kings County Clerk's Office or any designated local agency responsible for property records and transfers. 4. Types of Kings New York Notice of Change of Ownership or Control Non-Homestead Property: a. Commercial Property: This category includes office buildings, retail spaces, warehouses, and any non-homestead property used for commercial purposes. b. Industrial Property: The notice applies to properties zoned for industrial use, including manufacturing plants, storage facilities, and distribution centers. c. Vacant Land: Transfers of non-homestead vacant land, such as development sites, agricultural land, or unused lots, require this notice. d. Mixed-Use Property: When a non-homestead property combines both commercial and residential uses, the notice accounts for the respective shares transferred. Conclusion: The Kings New York Notice of Change of Ownership or Control Non-Homestead Property plays a crucial role in tracking property ownership changes in Kings County. By understanding its purpose, filing process, and the various property types it applies to, property owners, buyers, lenders, and the local government can ensure compliance, transparency, and accurate taxation. Remember, timely filing of this notice is essential to maintain a complete and up-to-date property ownership record.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.