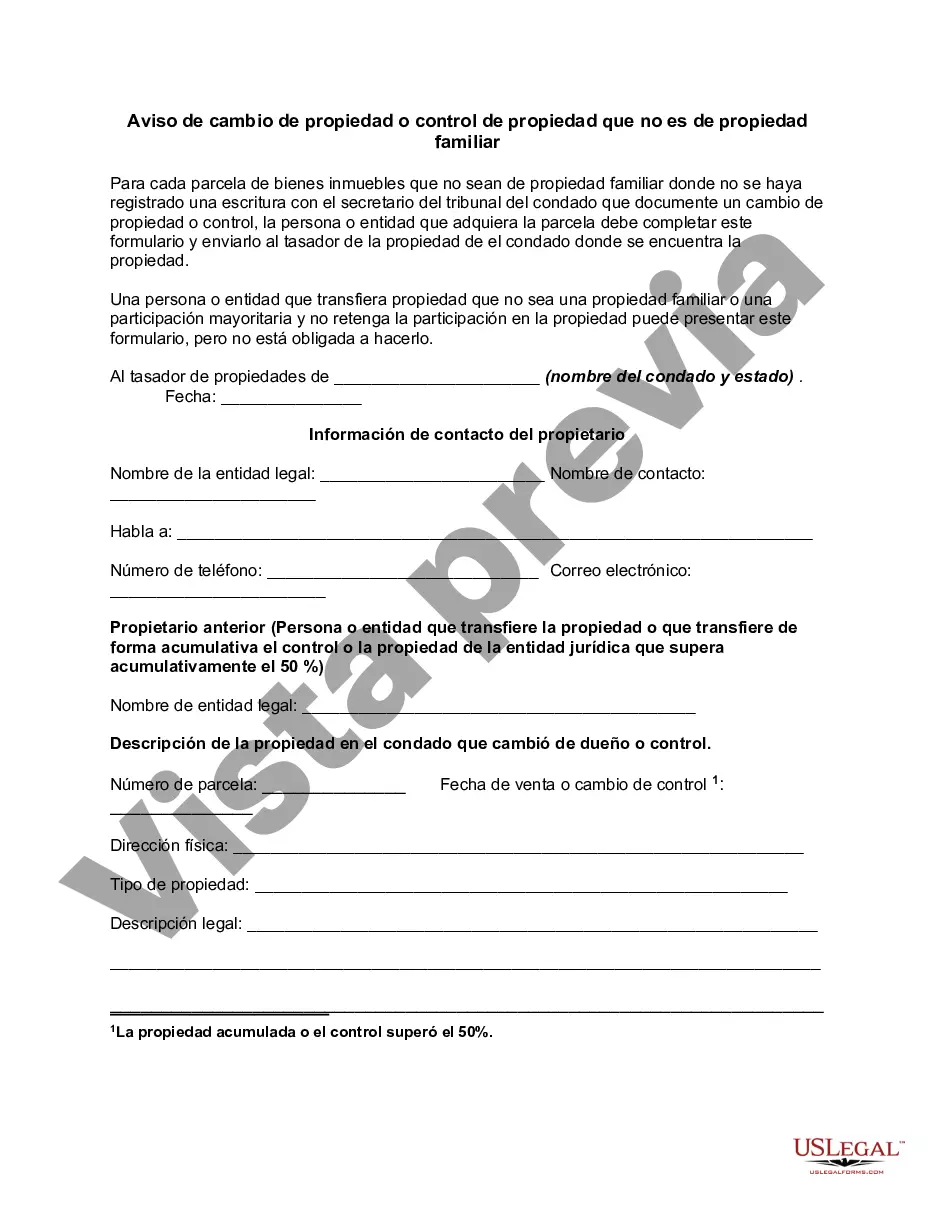

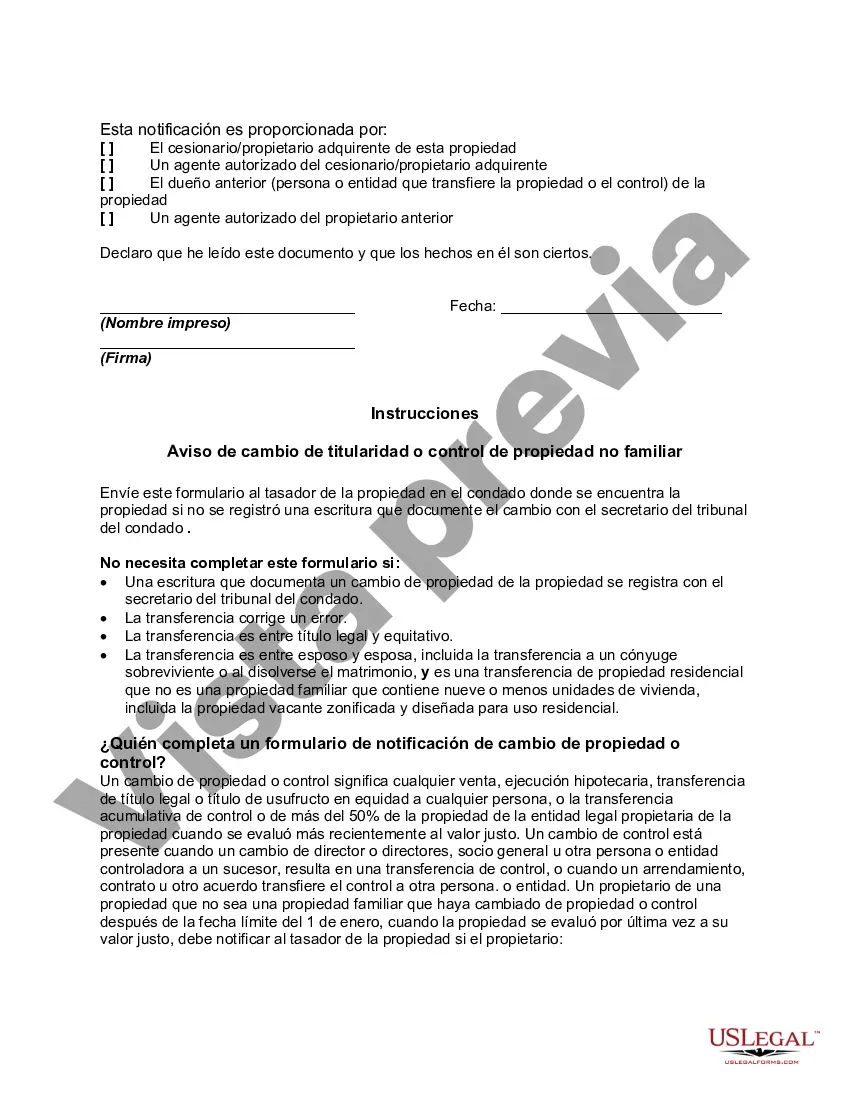

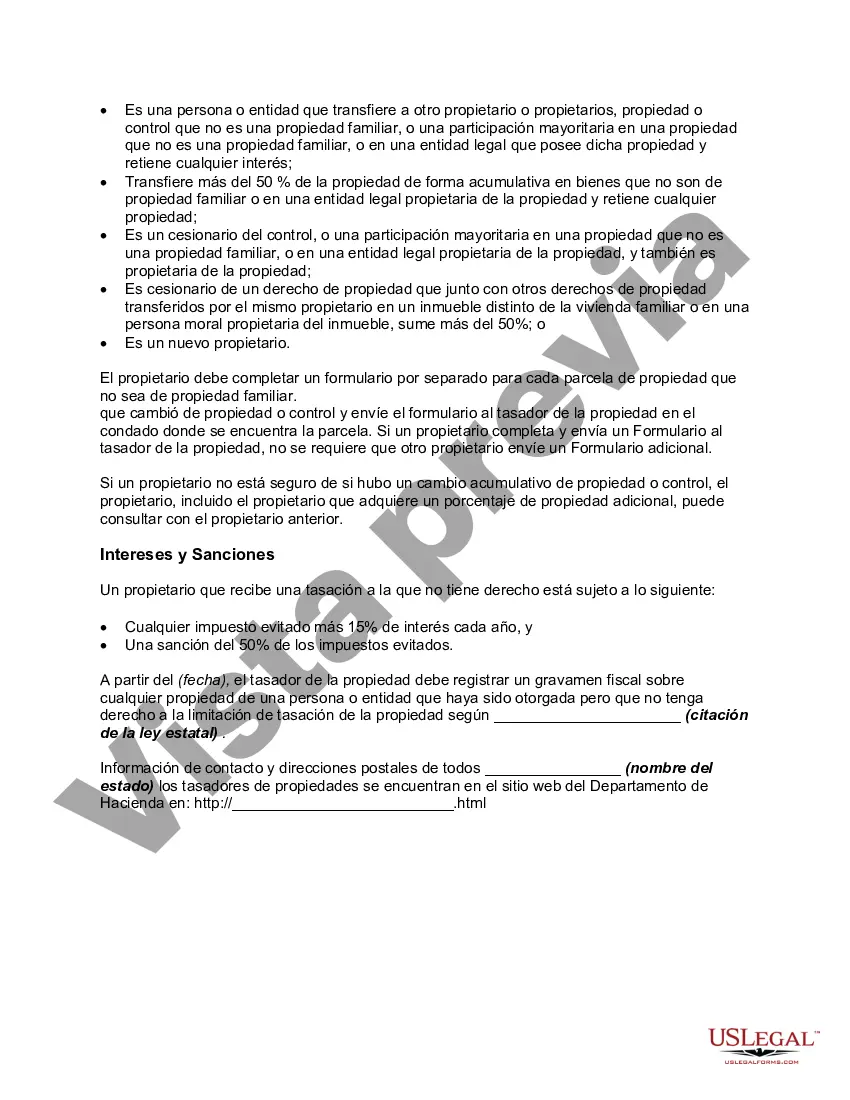

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

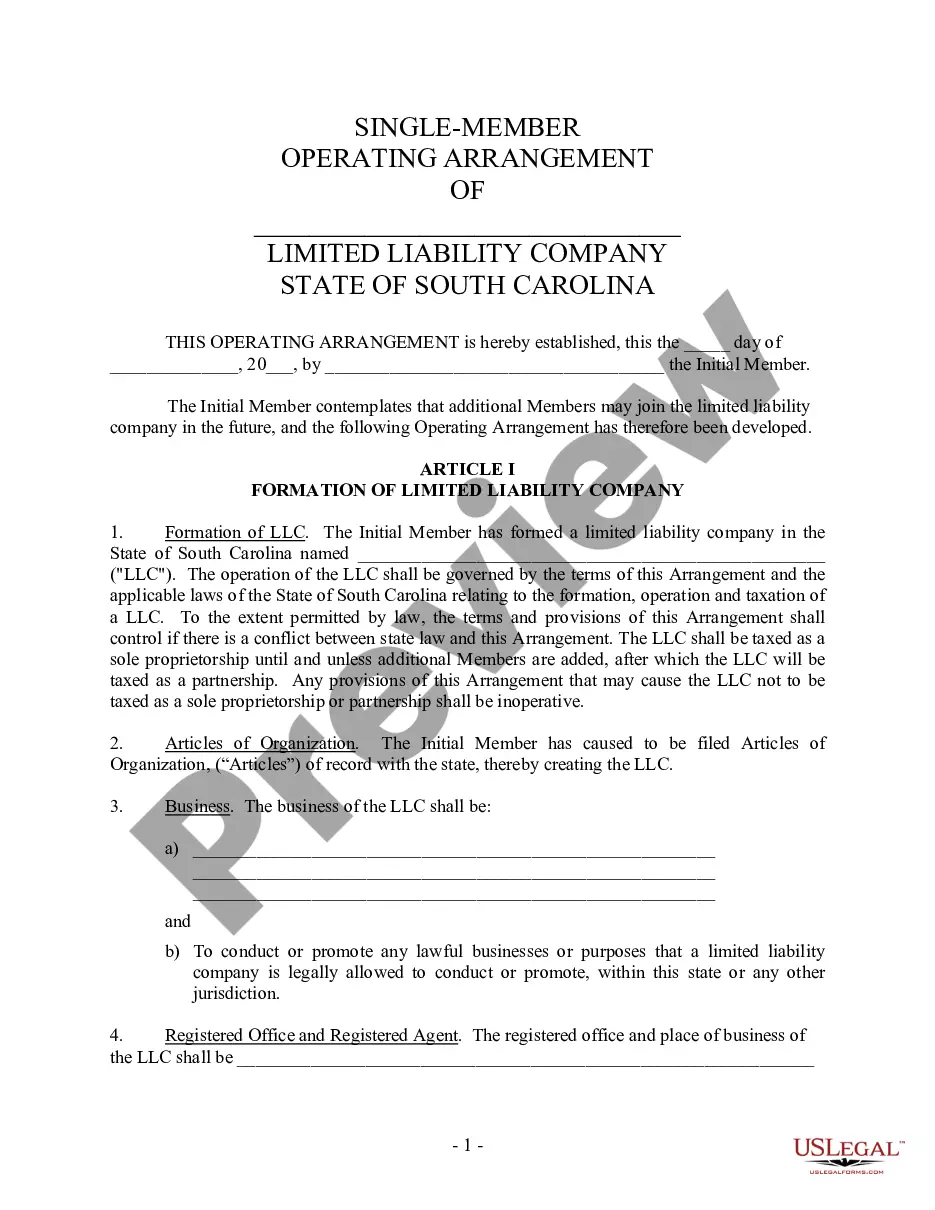

Mecklenburg County, North Carolina Notice of Change of Ownership or Control Non-Homestead Property is a crucial document that serves as a notification of any change in ownership or control over non-homestead properties within the county. Whether you are a property owner or a prospective buyer, it is vital to understand the purpose and different types of notices associated with this process. The Notice of Change of Ownership or Control Non-Homestead Property acts as an official declaration to disclose any alteration in ownership or transfer of controlling interest in commercial or non-residential properties located in Mecklenburg County. This notice is necessary for the local government to maintain accurate property records, ensure appropriate taxation, and provide efficient services to the community. There are several categories or types of notices that fall under the Mecklenburg County Notice of Change of Ownership or Control Non-Homestead Property. These categories depend on the specific circumstances of the change in ownership or control. Here are a few examples: 1. Notice of Sale: This type of notice is filed when a non-homestead property is sold to a new owner. It includes relevant details such as the new owner's name, contact information, purchase price, and effective date of transfer. Filing this notice allows for the proper update of ownership records within the county's property tax system. 2. Notice of Lease Assignment: If the control or ownership of a non-homestead property is transferred to a new tenant through the assignment of a lease, a Notice of Lease Assignment is required. This notice would contain information about the previous and new tenant, lease terms, and effective date of assignment. 3. Notice of Transfer of Controlling Interest: In cases where there is a change in controlling interest, but not in actual ownership of a non-homestead property, a Notice of Transfer of Controlling Interest is filed. This notice typically outlines the details of the parties involved, the percentage of controlling interest transferred, and the effective date of the transfer. 4. Notice of Merger or Acquisition: When a merger or acquisition affects the ownership or control of a non-homestead property, a Notice of Merger or Acquisition must be filed. This notice would provide information about the entities involved, details of the transaction, and the effective date of the merger or acquisition. It is crucial to ensure that the correct type of notice is filed promptly to facilitate a smooth transition and update the necessary property records accurately. Failure to file the appropriate notice may result in delays, penalties, or legal complications, so it is advisable to consult with legal professionals or county authorities for guidance in specific situations. Mecklenburg County, North Carolina takes these notices seriously to maintain accurate property records and preserve the integrity of its taxation system. By adhering to the guidelines and promptly filing the required notices, property owners and the local government can work together to ensure a transparent and efficient system of property ownership and control within the county.Mecklenburg County, North Carolina Notice of Change of Ownership or Control Non-Homestead Property is a crucial document that serves as a notification of any change in ownership or control over non-homestead properties within the county. Whether you are a property owner or a prospective buyer, it is vital to understand the purpose and different types of notices associated with this process. The Notice of Change of Ownership or Control Non-Homestead Property acts as an official declaration to disclose any alteration in ownership or transfer of controlling interest in commercial or non-residential properties located in Mecklenburg County. This notice is necessary for the local government to maintain accurate property records, ensure appropriate taxation, and provide efficient services to the community. There are several categories or types of notices that fall under the Mecklenburg County Notice of Change of Ownership or Control Non-Homestead Property. These categories depend on the specific circumstances of the change in ownership or control. Here are a few examples: 1. Notice of Sale: This type of notice is filed when a non-homestead property is sold to a new owner. It includes relevant details such as the new owner's name, contact information, purchase price, and effective date of transfer. Filing this notice allows for the proper update of ownership records within the county's property tax system. 2. Notice of Lease Assignment: If the control or ownership of a non-homestead property is transferred to a new tenant through the assignment of a lease, a Notice of Lease Assignment is required. This notice would contain information about the previous and new tenant, lease terms, and effective date of assignment. 3. Notice of Transfer of Controlling Interest: In cases where there is a change in controlling interest, but not in actual ownership of a non-homestead property, a Notice of Transfer of Controlling Interest is filed. This notice typically outlines the details of the parties involved, the percentage of controlling interest transferred, and the effective date of the transfer. 4. Notice of Merger or Acquisition: When a merger or acquisition affects the ownership or control of a non-homestead property, a Notice of Merger or Acquisition must be filed. This notice would provide information about the entities involved, details of the transaction, and the effective date of the merger or acquisition. It is crucial to ensure that the correct type of notice is filed promptly to facilitate a smooth transition and update the necessary property records accurately. Failure to file the appropriate notice may result in delays, penalties, or legal complications, so it is advisable to consult with legal professionals or county authorities for guidance in specific situations. Mecklenburg County, North Carolina takes these notices seriously to maintain accurate property records and preserve the integrity of its taxation system. By adhering to the guidelines and promptly filing the required notices, property owners and the local government can work together to ensure a transparent and efficient system of property ownership and control within the county.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.