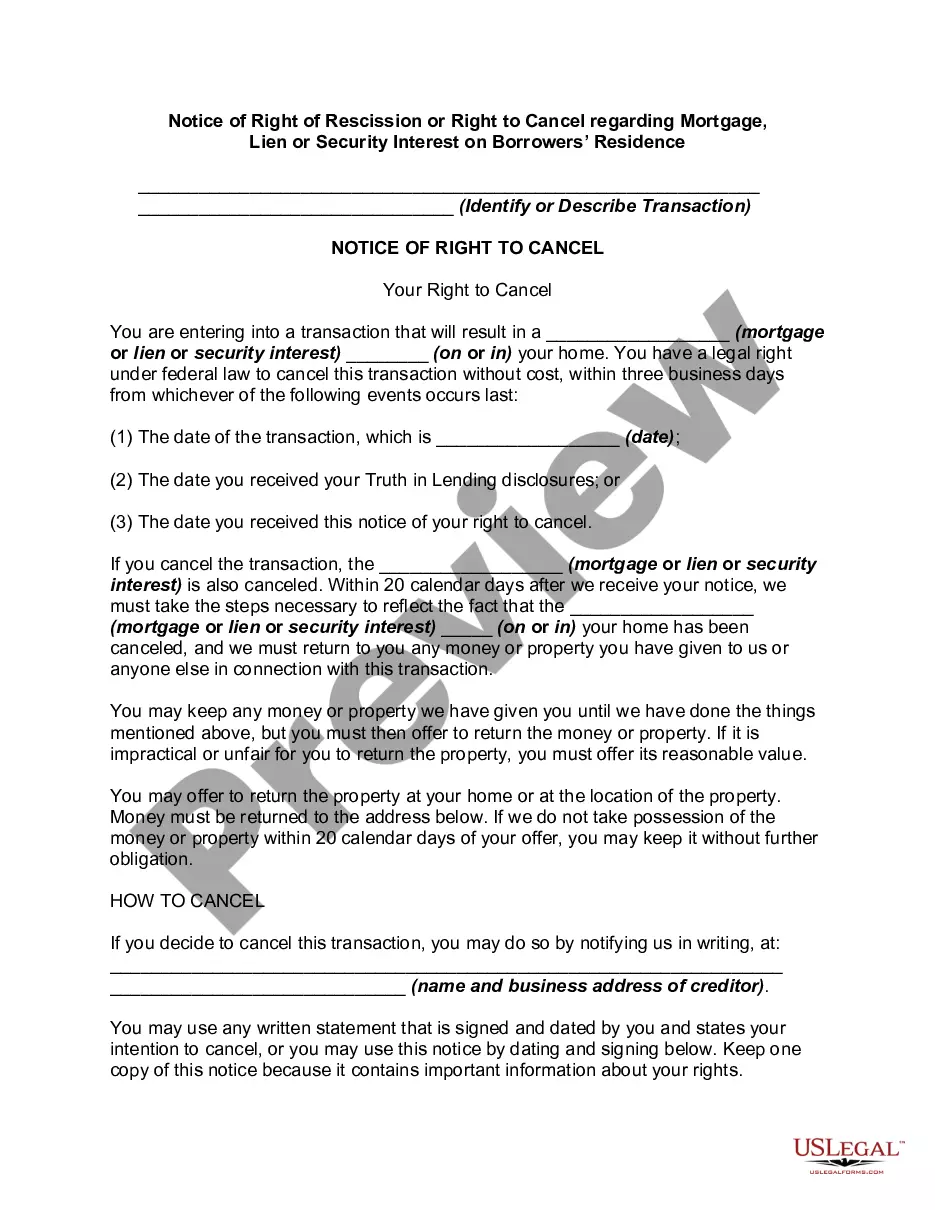

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

In Collin, Texas, the Notice of Right of Rescission (also referred to as the Right to Cancel) is a crucial legal document that is given to borrowers who are obtaining a mortgage, lien, or security interest on their residence. This notice grants borrowers the ability to cancel the transaction within a specific timeframe without any penalties or consequences. The purpose of this notice is to provide homeowners with a safeguard against impulsive decisions or potential abuses from lenders. It allows borrowers a period of time to carefully review all terms and conditions of the financial agreement after closing on the loan. By having this right of rescission, borrowers can ensure that they fully understand the obligations, risks, and costs associated with their mortgage or lien agreement. The Collin Texas Notice of Right of Rescission applies to several types of transactions involving residential properties, including: 1. Mortgage Loans: When borrowers acquire a loan from a financial institution to purchase, refinance, or obtain additional funds secured by their home, they receive a Notice of Right of Rescission. This notice must be provided by the lender within three business days after the loan closing. 2. Second Mortgages or Home Equity Loans: Similarly, when homeowners acquire a second mortgage or a home equity loan, they are entitled to the same right of rescission. The notice is given to borrowers within three business days after the closing of the loan. 3. Home Equity Lines of Credit (Helots): If borrowers decide to establish a HELOT, the Collin Texas Notice of Right of Rescission applies. Like other types of mortgages, borrowers receive the notice within three business days after closing the loan. 4. Reverse Mortgages: Homeowners who choose to obtain a reverse mortgage, an increasingly popular option for seniors, also benefit from the right of rescission. The notice is given at the closing of the loan, where borrowers have three business days to cancel the transaction. It is important to note that the three-day rescission period begins once the borrowers receive the notice, not when they sign the loan documents. During this period, borrowers have the right to change their minds and cancel the loan agreement by providing written notice to the lender. In conclusion, the Collin Texas Notice of Right of Rescission or Right to Cancel is an essential legal protection for borrowers obtaining mortgages, liens, or security interests on their residential properties. It grants homeowners the ability to review the terms and conditions of their loan agreement and safeguards them against rash decisions. The right of rescission applies to various types of transactions, including mortgage loans, second mortgages, home equity loans, Helots, and reverse mortgages.In Collin, Texas, the Notice of Right of Rescission (also referred to as the Right to Cancel) is a crucial legal document that is given to borrowers who are obtaining a mortgage, lien, or security interest on their residence. This notice grants borrowers the ability to cancel the transaction within a specific timeframe without any penalties or consequences. The purpose of this notice is to provide homeowners with a safeguard against impulsive decisions or potential abuses from lenders. It allows borrowers a period of time to carefully review all terms and conditions of the financial agreement after closing on the loan. By having this right of rescission, borrowers can ensure that they fully understand the obligations, risks, and costs associated with their mortgage or lien agreement. The Collin Texas Notice of Right of Rescission applies to several types of transactions involving residential properties, including: 1. Mortgage Loans: When borrowers acquire a loan from a financial institution to purchase, refinance, or obtain additional funds secured by their home, they receive a Notice of Right of Rescission. This notice must be provided by the lender within three business days after the loan closing. 2. Second Mortgages or Home Equity Loans: Similarly, when homeowners acquire a second mortgage or a home equity loan, they are entitled to the same right of rescission. The notice is given to borrowers within three business days after the closing of the loan. 3. Home Equity Lines of Credit (Helots): If borrowers decide to establish a HELOT, the Collin Texas Notice of Right of Rescission applies. Like other types of mortgages, borrowers receive the notice within three business days after closing the loan. 4. Reverse Mortgages: Homeowners who choose to obtain a reverse mortgage, an increasingly popular option for seniors, also benefit from the right of rescission. The notice is given at the closing of the loan, where borrowers have three business days to cancel the transaction. It is important to note that the three-day rescission period begins once the borrowers receive the notice, not when they sign the loan documents. During this period, borrowers have the right to change their minds and cancel the loan agreement by providing written notice to the lender. In conclusion, the Collin Texas Notice of Right of Rescission or Right to Cancel is an essential legal protection for borrowers obtaining mortgages, liens, or security interests on their residential properties. It grants homeowners the ability to review the terms and conditions of their loan agreement and safeguards them against rash decisions. The right of rescission applies to various types of transactions, including mortgage loans, second mortgages, home equity loans, Helots, and reverse mortgages.