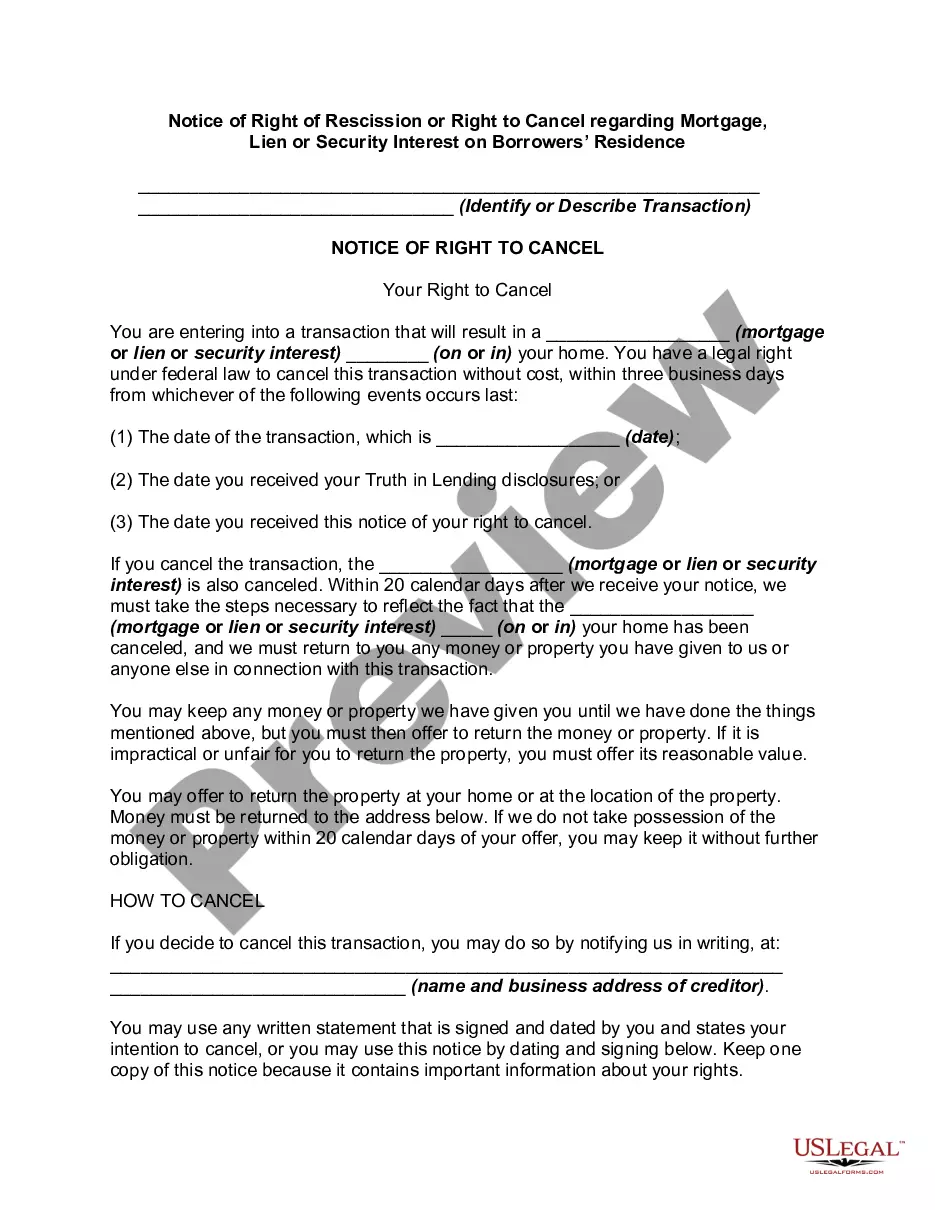

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Orange, California Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence is a legal document that provides homeowners in Orange, California with specific rights when entering into a mortgage, acquiring a lien, or granting a security interest on their residential property. It ensures that borrowers have the ability to rescind or cancel certain types of transactions within a specific timeframe, offering them protection and the opportunity to reconsider their decisions. The Notice of Right of Rescission or Right to Cancel is governed by federal law, specifically the Truth in Lending Act (TILL), and applies to various transactions, such as refinancing an existing mortgage, taking out a home equity loan, or securing a lien against one's property. The purpose of this notice is to inform borrowers of their legal rights, allowing them an opportunity to rethink their decision without incurring any penalty or cost. It offers homeowners a cooling-off period during which they can assess the terms and conditions of the transaction and evaluate its potential impact on their financial well-being. In Orange, California, there are typically two main types of Notice of Right of Rescission or Right to Cancel related to mortgages, liens, or security interests on borrowers' residences: 1. Three-Day Right of Rescission: This type of notice applies to specific transactions, including home equity loans or refinancing transactions with non-bank lenders. After signing the mortgage or loan documents, borrowers have three business days to completely cancel the transaction if they change their minds. The cancellation will require notifying the lender in writing. 2. Extended Right of Rescission: Certain refinancing transactions, such as those conducted with a bank or credit union, provide borrowers with an extended right of rescission. In these cases, borrowers have up to three years to exercise their right to cancel the transaction if the lender failed to provide them with all the necessary disclosures or violated others TILL requirements. It is essential for borrowers in Orange, California to be aware of their rights and carefully read through the Notice of Right of Rescission or Right to Cancel document, as it outlines the specific procedures and timelines for canceling a mortgage, lien, or security interest on their residential property. This notice empowers homeowners to make informed decisions and ensures their protection against any predatory or unfair practices in the lending market.Orange, California Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence is a legal document that provides homeowners in Orange, California with specific rights when entering into a mortgage, acquiring a lien, or granting a security interest on their residential property. It ensures that borrowers have the ability to rescind or cancel certain types of transactions within a specific timeframe, offering them protection and the opportunity to reconsider their decisions. The Notice of Right of Rescission or Right to Cancel is governed by federal law, specifically the Truth in Lending Act (TILL), and applies to various transactions, such as refinancing an existing mortgage, taking out a home equity loan, or securing a lien against one's property. The purpose of this notice is to inform borrowers of their legal rights, allowing them an opportunity to rethink their decision without incurring any penalty or cost. It offers homeowners a cooling-off period during which they can assess the terms and conditions of the transaction and evaluate its potential impact on their financial well-being. In Orange, California, there are typically two main types of Notice of Right of Rescission or Right to Cancel related to mortgages, liens, or security interests on borrowers' residences: 1. Three-Day Right of Rescission: This type of notice applies to specific transactions, including home equity loans or refinancing transactions with non-bank lenders. After signing the mortgage or loan documents, borrowers have three business days to completely cancel the transaction if they change their minds. The cancellation will require notifying the lender in writing. 2. Extended Right of Rescission: Certain refinancing transactions, such as those conducted with a bank or credit union, provide borrowers with an extended right of rescission. In these cases, borrowers have up to three years to exercise their right to cancel the transaction if the lender failed to provide them with all the necessary disclosures or violated others TILL requirements. It is essential for borrowers in Orange, California to be aware of their rights and carefully read through the Notice of Right of Rescission or Right to Cancel document, as it outlines the specific procedures and timelines for canceling a mortgage, lien, or security interest on their residential property. This notice empowers homeowners to make informed decisions and ensures their protection against any predatory or unfair practices in the lending market.