A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

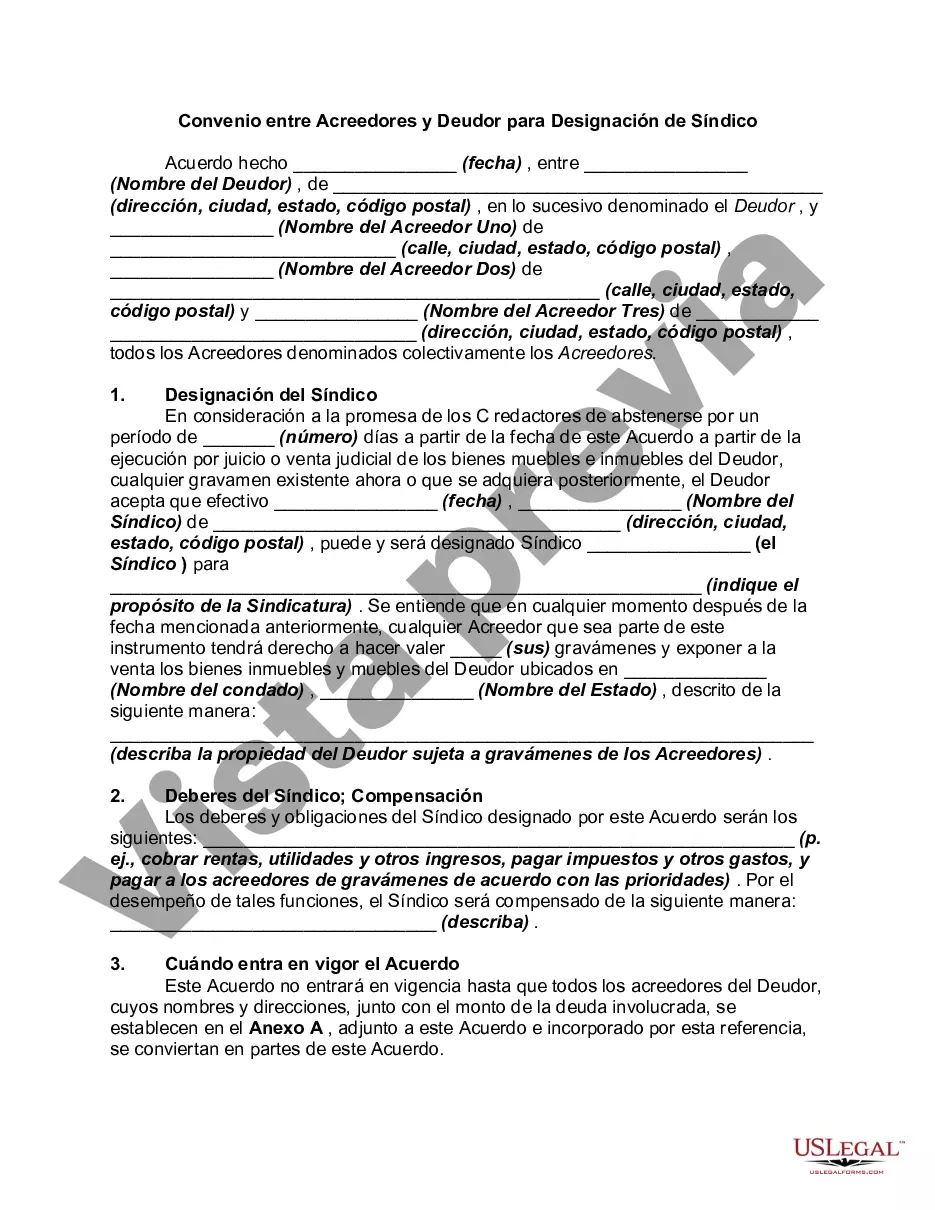

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Dallas Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by both parties involved in a debt dispute. This agreement is specifically designed to appoint a receiver, who is an impartial third party, to take control of the debtor's assets and finances. The document ensures a fair and efficient resolution to the debt issue while protecting the rights and interests of both the creditors and the debtor. In the Dallas Texas Agreement between Creditors and Debtor for Appointment of Receiver, important details such as the names and contact information of the involved parties, the outstanding debt amount, and the specific reasons for appointing a receiver are specified. The agreement also includes the scope of authority granted to the receiver, such as the power to access financial records, collect payments, and manage the debtor's assets. Additionally, the agreement includes provisions regarding the receiver's compensation, timeline for debt repayment, and any additional terms and conditions deemed necessary for the proper execution of the agreement. Both parties may seek legal counsel to ensure that their rights and obligations are adequately represented in the document. It is important to note that there are various types of Dallas Texas Agreements between Creditors and Debtors for Appointment of Receiver, which may include: 1. General Appointment Agreement: This type of agreement is used in cases where the debtor owes multiple creditors, and a receiver is appointed to manage and distribute assets among all the parties involved. 2. Specific Property Appointment Agreement: In cases where the debtor possesses specific assets or properties that need to be managed or sold to repay the debt, this type of agreement is utilized. 3. Business Operations Appointment Agreement: This agreement is relevant when the debtor owns and operates a business, and the receiver is appointed to oversee its operations, collect revenue, and manage finances until the debt is resolved. 4. Real Estate Appointment Agreement: If the debtor's primary assets include real estate properties, this type of agreement grants the receiver the authority to manage, rent, or sell the properties to satisfy the outstanding debt. These different types of Dallas Texas Agreements between Creditors and Debtors for Appointment of Receiver aim to provide specific guidelines based on the unique circumstances of the debt dispute. The agreements ensure fairness, transparency, and efficient resolution to benefit all parties involved in the process.The Dallas Texas Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by both parties involved in a debt dispute. This agreement is specifically designed to appoint a receiver, who is an impartial third party, to take control of the debtor's assets and finances. The document ensures a fair and efficient resolution to the debt issue while protecting the rights and interests of both the creditors and the debtor. In the Dallas Texas Agreement between Creditors and Debtor for Appointment of Receiver, important details such as the names and contact information of the involved parties, the outstanding debt amount, and the specific reasons for appointing a receiver are specified. The agreement also includes the scope of authority granted to the receiver, such as the power to access financial records, collect payments, and manage the debtor's assets. Additionally, the agreement includes provisions regarding the receiver's compensation, timeline for debt repayment, and any additional terms and conditions deemed necessary for the proper execution of the agreement. Both parties may seek legal counsel to ensure that their rights and obligations are adequately represented in the document. It is important to note that there are various types of Dallas Texas Agreements between Creditors and Debtors for Appointment of Receiver, which may include: 1. General Appointment Agreement: This type of agreement is used in cases where the debtor owes multiple creditors, and a receiver is appointed to manage and distribute assets among all the parties involved. 2. Specific Property Appointment Agreement: In cases where the debtor possesses specific assets or properties that need to be managed or sold to repay the debt, this type of agreement is utilized. 3. Business Operations Appointment Agreement: This agreement is relevant when the debtor owns and operates a business, and the receiver is appointed to oversee its operations, collect revenue, and manage finances until the debt is resolved. 4. Real Estate Appointment Agreement: If the debtor's primary assets include real estate properties, this type of agreement grants the receiver the authority to manage, rent, or sell the properties to satisfy the outstanding debt. These different types of Dallas Texas Agreements between Creditors and Debtors for Appointment of Receiver aim to provide specific guidelines based on the unique circumstances of the debt dispute. The agreements ensure fairness, transparency, and efficient resolution to benefit all parties involved in the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.