A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

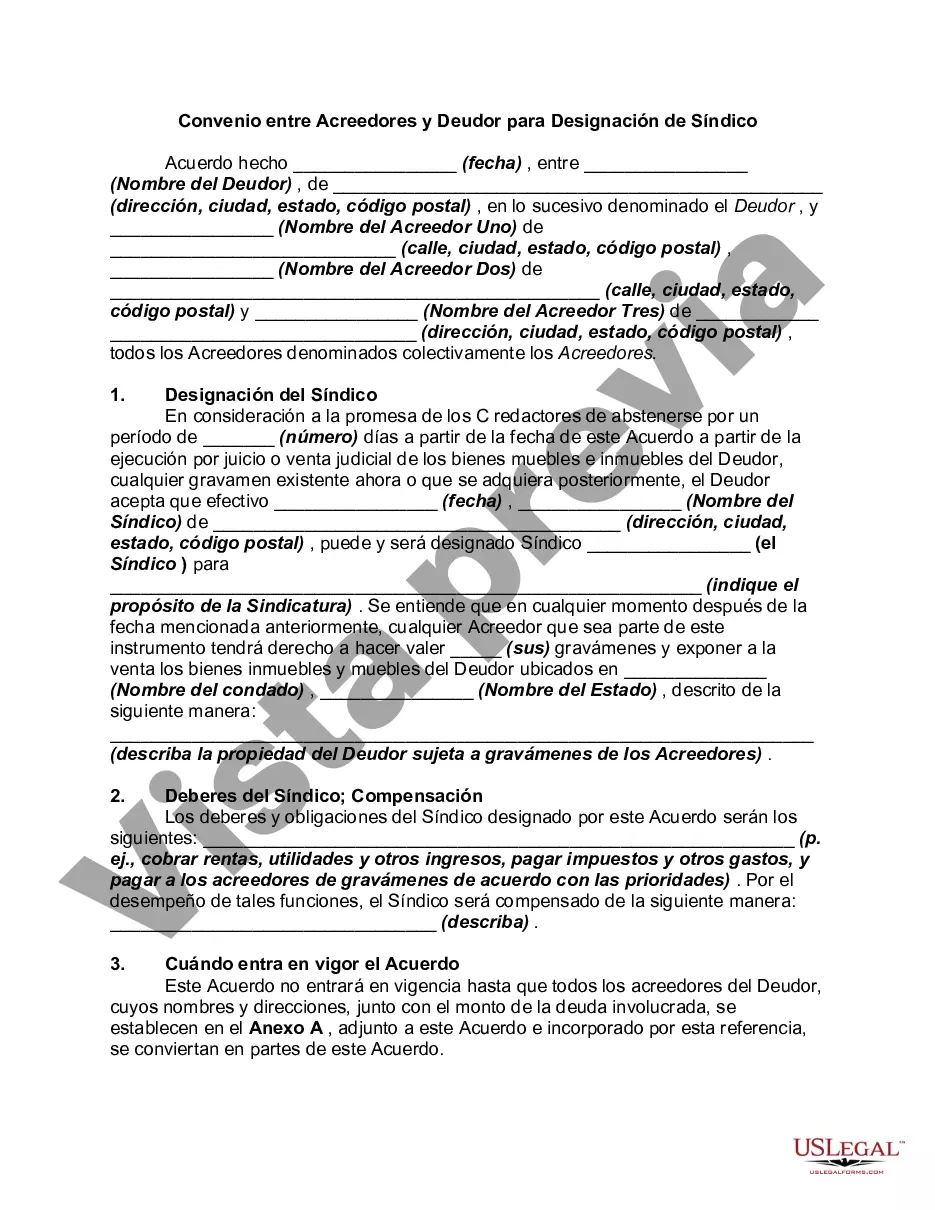

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oakland Michigan Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by creditors and debtors in Oakland County, Michigan. This agreement is used when creditors want to enforce their rights to collect unpaid debts by appointing a receiver to manage the debtor's assets and business operations. The purpose of the receivership is to protect the interests of the creditors and maximize the recovery of their debts. Through this agreement, the parties establish the powers, responsibilities, and limitations of the receiver, as well as the procedures for administering the receivership. Some relevant keywords to include in the content might include: 1. Receivership: This agreement establishes the appointment of a receiver who acts as a neutral third party, responsible for managing the debtor's affairs, assets, and operations during the enforcement process. 2. Debtor: The debtor is the individual or entity who owes debts to the creditors and is subject to this agreement. It could be a business or an individual who has failed to fulfill their financial obligations. 3. Creditors: Creditors are the individuals or organizations to whom debts are owed. They initiate the appointment of a receiver to enforce the collection of debts owed to them by the debtor. 4. Assets: This agreement specifies the types of assets that the receiver will have control over, such as bank accounts, real estate, inventory, and other valuable possessions owned by the debtor. 5. Business Operations: The agreement outlines whether the receiver will continue the debtor's business operations to generate income for the creditors or if they will be suspended during the receivership period. 6. Powers and Responsibilities: The document clearly defines the receiver's powers and responsibilities, including their authority to collect debts, manage assets, negotiate with third parties, and make financial decisions on behalf of the debtor. 7. Reports and Accounting: The agreement may include provisions for regular reporting and accounting by the receiver, ensuring transparency in the management of the debtor's assets and financial affairs. 8. Termination of Receivership: The document should establish the conditions for terminating the receivership, such as full repayment of the debts or reaching a settlement agreement between the parties involved. Different types of Oakland Michigan Agreement between Creditors and Debtors for the Appointment of Receivers may vary based on the specific circumstances and requirements of the parties involved. Some possible variations might include agreements for business debtors, personal debtors, or agreements tailored to specific industries or sectors. Overall, this type of agreement provides a legal framework for creditors to recover outstanding debts by appointing a receiver who will take control of the debtor's assets and manage their affairs in Oakland County, Michigan.Oakland Michigan Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions agreed upon by creditors and debtors in Oakland County, Michigan. This agreement is used when creditors want to enforce their rights to collect unpaid debts by appointing a receiver to manage the debtor's assets and business operations. The purpose of the receivership is to protect the interests of the creditors and maximize the recovery of their debts. Through this agreement, the parties establish the powers, responsibilities, and limitations of the receiver, as well as the procedures for administering the receivership. Some relevant keywords to include in the content might include: 1. Receivership: This agreement establishes the appointment of a receiver who acts as a neutral third party, responsible for managing the debtor's affairs, assets, and operations during the enforcement process. 2. Debtor: The debtor is the individual or entity who owes debts to the creditors and is subject to this agreement. It could be a business or an individual who has failed to fulfill their financial obligations. 3. Creditors: Creditors are the individuals or organizations to whom debts are owed. They initiate the appointment of a receiver to enforce the collection of debts owed to them by the debtor. 4. Assets: This agreement specifies the types of assets that the receiver will have control over, such as bank accounts, real estate, inventory, and other valuable possessions owned by the debtor. 5. Business Operations: The agreement outlines whether the receiver will continue the debtor's business operations to generate income for the creditors or if they will be suspended during the receivership period. 6. Powers and Responsibilities: The document clearly defines the receiver's powers and responsibilities, including their authority to collect debts, manage assets, negotiate with third parties, and make financial decisions on behalf of the debtor. 7. Reports and Accounting: The agreement may include provisions for regular reporting and accounting by the receiver, ensuring transparency in the management of the debtor's assets and financial affairs. 8. Termination of Receivership: The document should establish the conditions for terminating the receivership, such as full repayment of the debts or reaching a settlement agreement between the parties involved. Different types of Oakland Michigan Agreement between Creditors and Debtors for the Appointment of Receivers may vary based on the specific circumstances and requirements of the parties involved. Some possible variations might include agreements for business debtors, personal debtors, or agreements tailored to specific industries or sectors. Overall, this type of agreement provides a legal framework for creditors to recover outstanding debts by appointing a receiver who will take control of the debtor's assets and manage their affairs in Oakland County, Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.