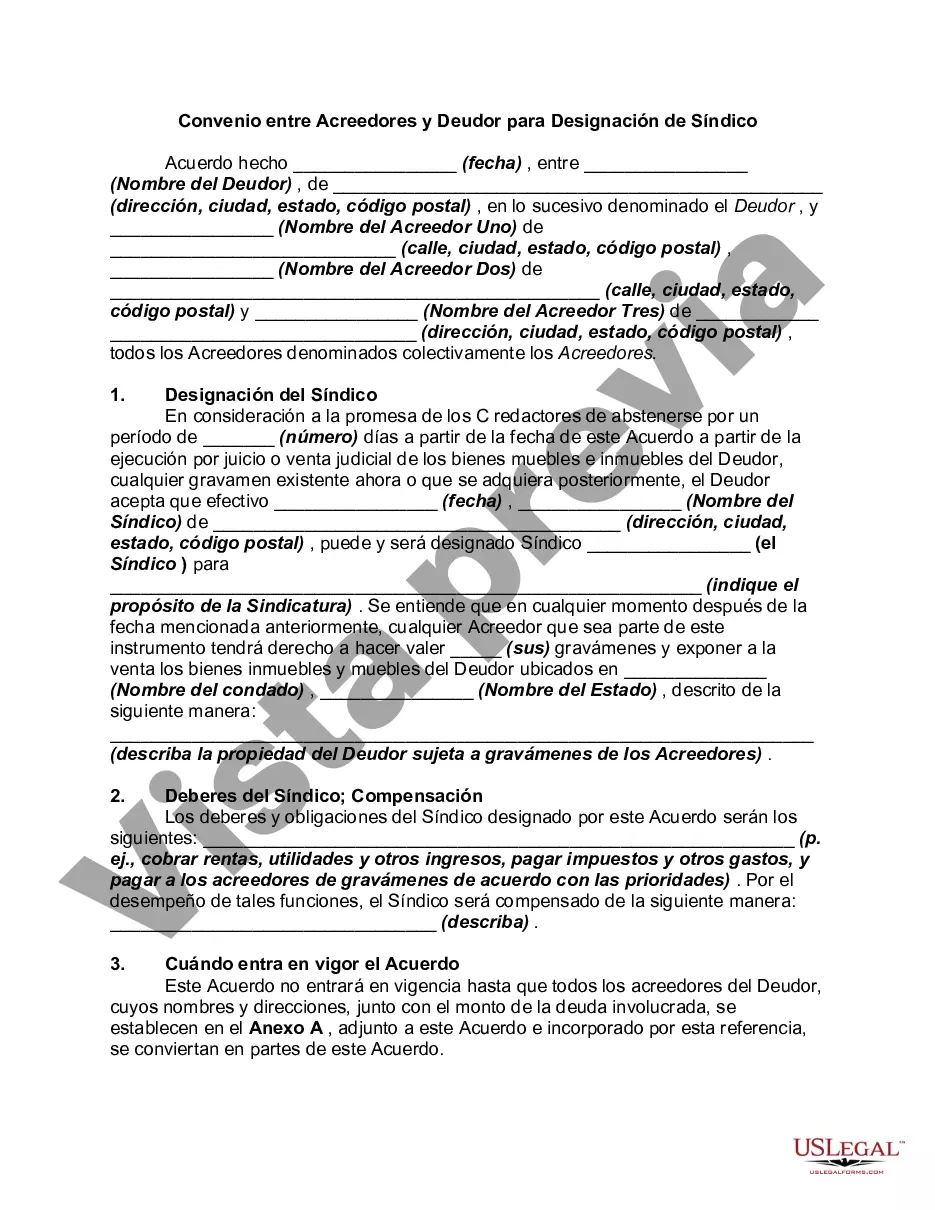

A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Diego, California is a vibrant city located on the Pacific coast in Southern California. Known for its stunning beaches, year-round mild climate, and diverse cultural scene, San Diego offers a wealth of opportunities for both residents and visitors. The Agreement between Creditors and Debtor for Appointment of Receiver is an important legal document that outlines the terms and conditions between creditors and debtors in San Diego, California. This agreement is particularly relevant in cases where a debtor is unable to meet their financial obligations and creditors seek the appointment of a receiver to collect and distribute assets. There are several types of San Diego California Agreement between Creditors and Debtor for Appointment of Receiver, depending on the specific circumstances of the debt. These include: 1. General Agreement: This type of agreement is applicable in most cases where creditors and debtors come together to appoint a receiver. It outlines the responsibilities of the receiver, the powers and limitations, payment terms, and the overall objective of the appointment. 2. Real Estate Agreement: In cases where the debt is associated with real estate properties, such as real estate loans or mortgages, a specific agreement is drafted. This document includes additional clauses related to the management and sale of the property, foreclosure procedures, and distribution of proceeds. 3. Business Receivership Agreement: If the debt is linked to a business entity, such as a corporation or partnership, a specialized agreement is created. This agreement may outline the scope of the business receiver's authority, inventory management, employee retention, and any necessary business operation decisions. 4. Personal Receivership Agreement: In certain cases involving individuals or personal finance matters, a tailored agreement is formulated to address unique circumstances. This type of agreement may include provisions related to personal assets, bank accounts, and future income sources. These various Agreement types are designed to cover a wide range of debtor-creditor relationships in San Diego, California. It is important for both parties to carefully review and negotiate the terms in order to ensure a fair and equitable resolution. Seeking legal advice from a qualified attorney is advisable to ensure compliance with relevant laws and to protect the rights and interests of all parties involved.San Diego, California is a vibrant city located on the Pacific coast in Southern California. Known for its stunning beaches, year-round mild climate, and diverse cultural scene, San Diego offers a wealth of opportunities for both residents and visitors. The Agreement between Creditors and Debtor for Appointment of Receiver is an important legal document that outlines the terms and conditions between creditors and debtors in San Diego, California. This agreement is particularly relevant in cases where a debtor is unable to meet their financial obligations and creditors seek the appointment of a receiver to collect and distribute assets. There are several types of San Diego California Agreement between Creditors and Debtor for Appointment of Receiver, depending on the specific circumstances of the debt. These include: 1. General Agreement: This type of agreement is applicable in most cases where creditors and debtors come together to appoint a receiver. It outlines the responsibilities of the receiver, the powers and limitations, payment terms, and the overall objective of the appointment. 2. Real Estate Agreement: In cases where the debt is associated with real estate properties, such as real estate loans or mortgages, a specific agreement is drafted. This document includes additional clauses related to the management and sale of the property, foreclosure procedures, and distribution of proceeds. 3. Business Receivership Agreement: If the debt is linked to a business entity, such as a corporation or partnership, a specialized agreement is created. This agreement may outline the scope of the business receiver's authority, inventory management, employee retention, and any necessary business operation decisions. 4. Personal Receivership Agreement: In certain cases involving individuals or personal finance matters, a tailored agreement is formulated to address unique circumstances. This type of agreement may include provisions related to personal assets, bank accounts, and future income sources. These various Agreement types are designed to cover a wide range of debtor-creditor relationships in San Diego, California. It is important for both parties to carefully review and negotiate the terms in order to ensure a fair and equitable resolution. Seeking legal advice from a qualified attorney is advisable to ensure compliance with relevant laws and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.