A Grantor Charitable Lead Annuity Trust (CLAT) is an irrevocable split-interest trust that provides for a specified amount to be paid to one or more charitable beneficiaries during the term of the trust. The principal remaining in the trust at the end of the term is paid over to, or held in a continuing trust for, a non-charitable beneficiary or beneficiaries identified in the trust. If the terms of a CLAT created during the donor's life satisfy the applicable statutory and regulatory requirements, a gift of the charitable lead annuity interest will qualify for the gift tax charitable deduction under § 2522(c)(2)(B) and/or the estate tax charitable deduction under § 2055(e)(2)(B). In certain cases, the gift of the annuity interest may also qualify for the income tax charitable deduction under § 170(a). The value of the remainder interest is a taxable gift by the donor at the time of the donor's contribution to the trust.

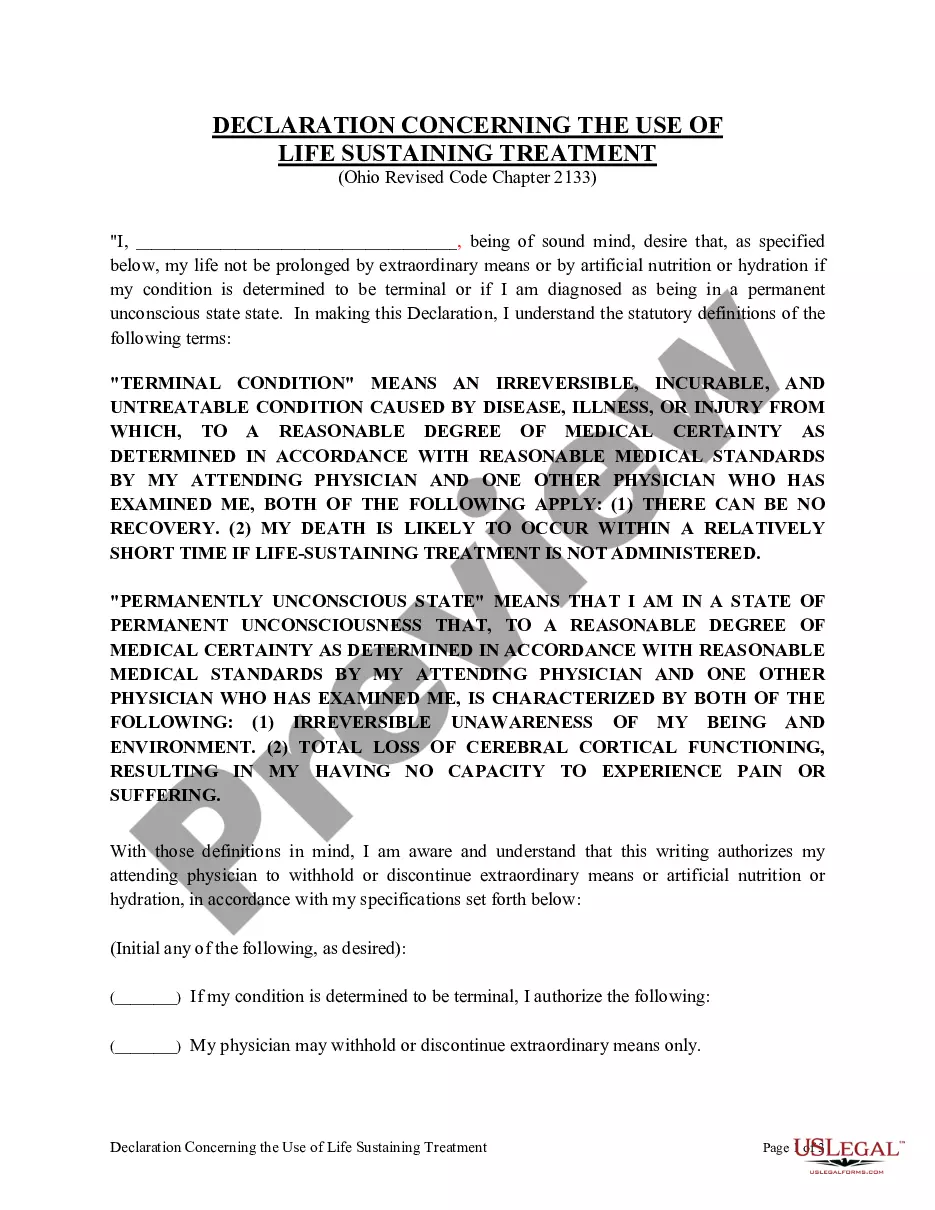

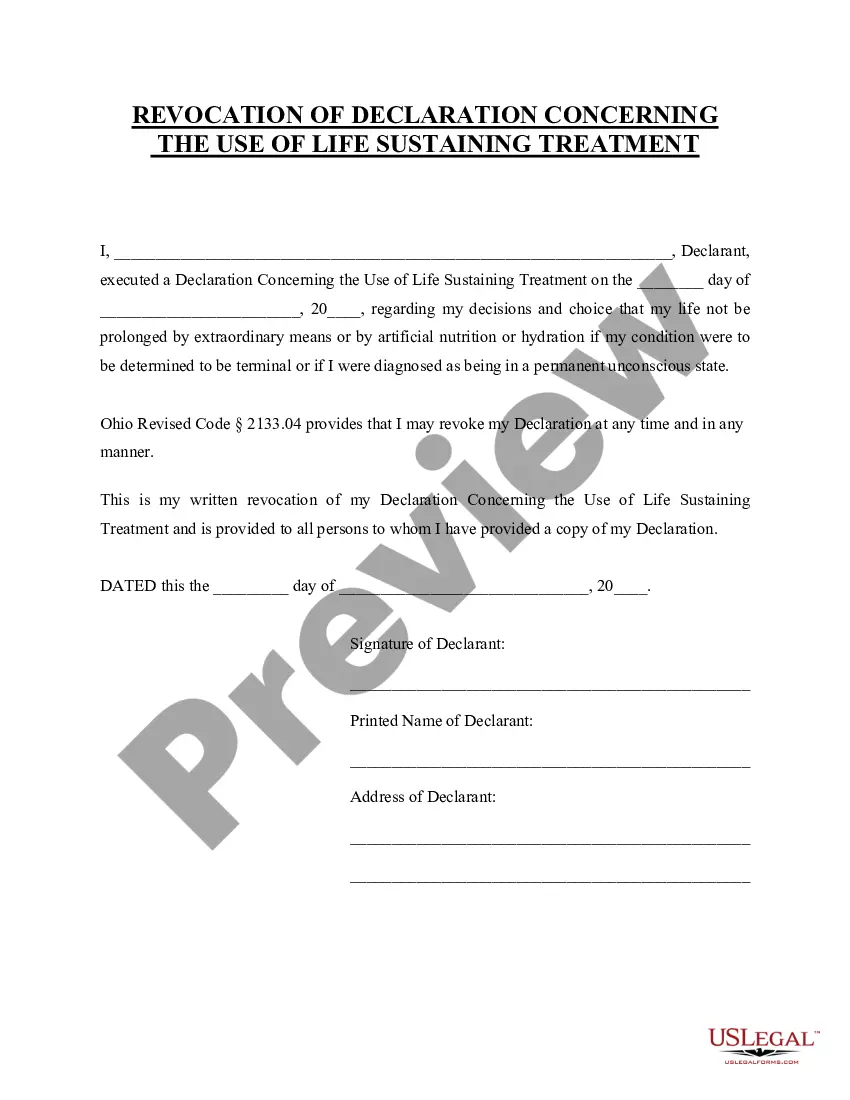

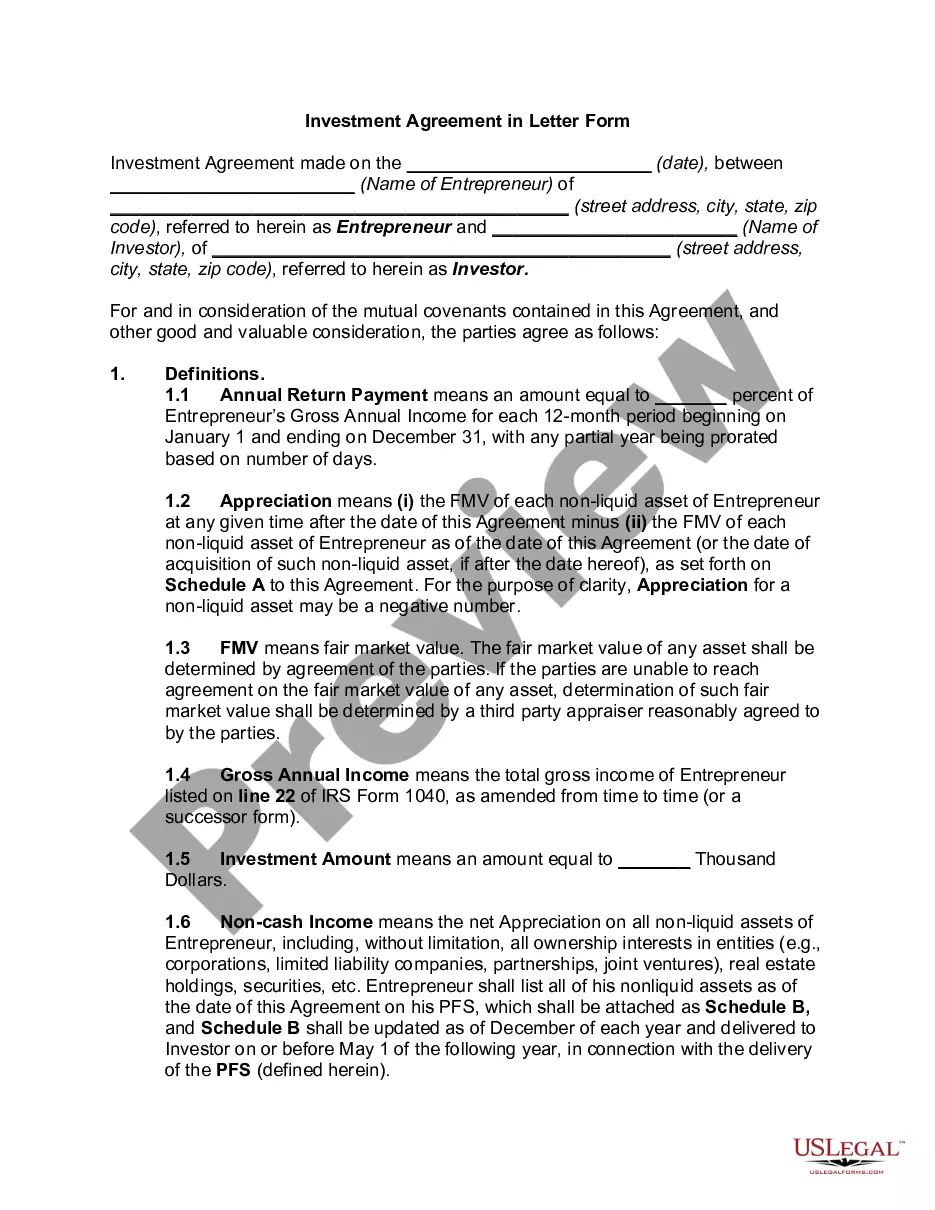

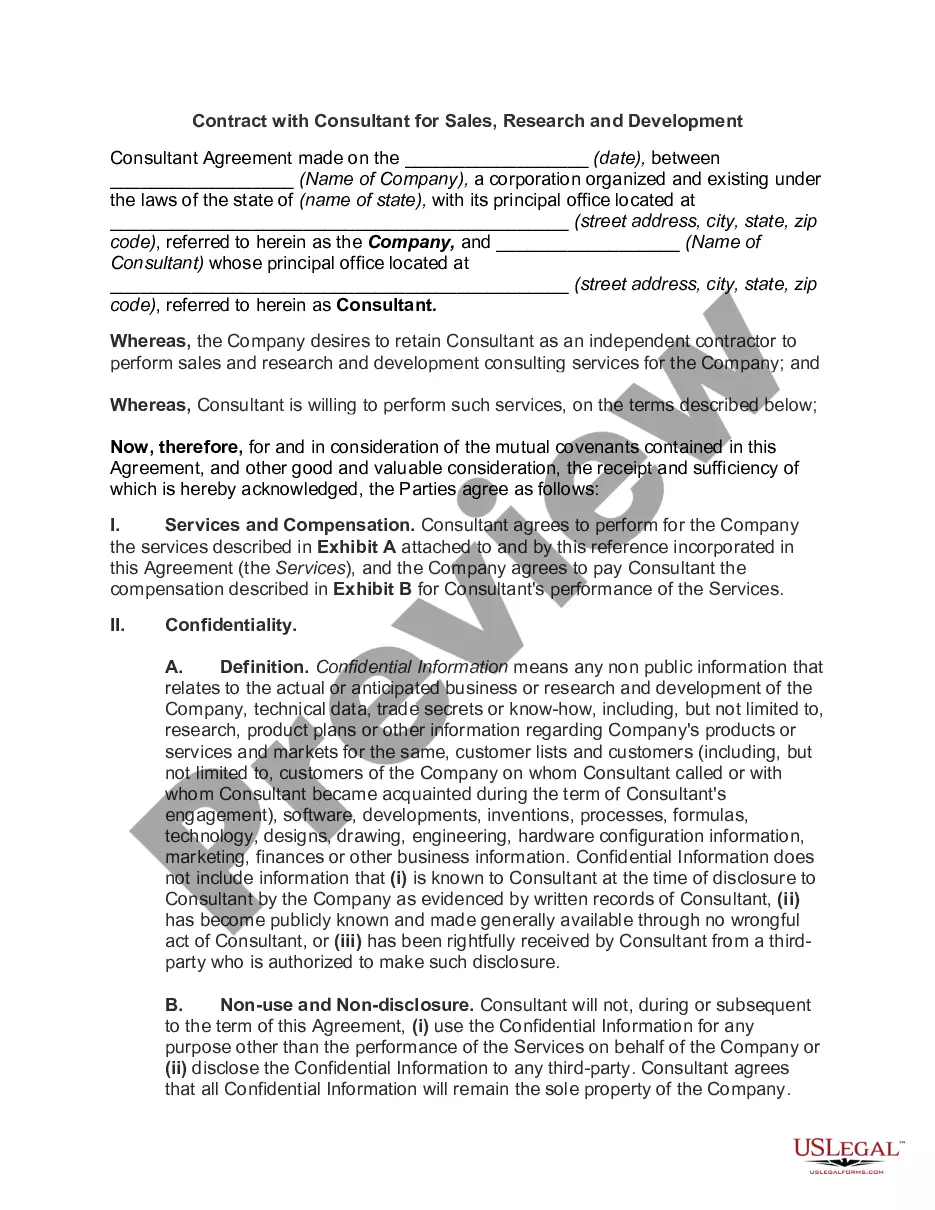

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.