It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

Allegheny Pennsylvania Business Purchase Proposal is a comprehensive document that outlines the terms and conditions for acquiring a business in Allegheny County, Pennsylvania. This proposal is designed to provide potential buyers with detailed information about the target company and present a compelling case for the purchase. Keywords: Allegheny Pennsylvania, business purchase, proposal, terms and conditions, acquiring, target company, potential buyers, detailed information, compelling case, purchase. There are two primary types of Allegheny Pennsylvania Business Purchase Proposals, namely: 1. Start-up Business Purchase Proposal: This type of proposal is applicable when acquiring a new business venture or a start-up company in Allegheny County, Pennsylvania. It includes detailed information about the business concept, growth potential, market analysis, financial projections, and the overall potential of the proposed start-up. The proposal focuses on showcasing the viability and profitability of the business to attract potential buyers. 2. Established Business Purchase Proposal: This type of proposal is designed for acquiring an established business in Allegheny County, Pennsylvania. It includes a comprehensive evaluation of the target company's financial statements, assets, liabilities, employees, contracts, customer base, market share, and overall business operations. The proposal highlights the potential synergies, growth opportunities, and risk analysis associated with the acquisition, providing an in-depth understanding of the value proposition to potential buyers. In both types of proposals, key components typically include: 1. Executive Summary: A concise overview of the proposal, highlighting the key points and benefits of the business purchase. 2. Company Information: Detailed information about the target business, including its history, ownership structure, products or services offered, competitive advantage, and market positioning. 3. Financial Analysis: A comprehensive analysis of the target company's financial performance, including revenue, profitability, cash flow, and assets. This section highlights the financial health and growth potential of the business. 4. Market Analysis: An assessment of the target market, industry trends, competition, and customer demographics. This analysis provides insight into the market potential and opportunities for growth. 5. Operational Overview: A detailed examination of the target company's operations, including production processes, supply chain, distribution channels, and quality control. This section helps potential buyers understand how the business functions and identifies areas for optimization. 6. Acquisition Strategy: An outline of the proposed acquisition strategy, including the terms and conditions of the purchase, purchase price or valuation, financing options, and potential synergies with the buyer's existing operations or expertise. 7. Risk Assessment: An evaluation of the risks associated with the acquisition, such as industry-specific risks, legal or regulatory challenges, or potential changes in market conditions. This section helps potential buyers make an informed decision by understanding the potential challenges and mitigating strategies. By presenting a well-drafted Allegheny Pennsylvania Business Purchase Proposal, potential buyers can assess the feasibility, value, and potential benefits of acquiring a business in Allegheny County, Pennsylvania, thereby facilitating informed decision-making.Allegheny Pennsylvania Business Purchase Proposal is a comprehensive document that outlines the terms and conditions for acquiring a business in Allegheny County, Pennsylvania. This proposal is designed to provide potential buyers with detailed information about the target company and present a compelling case for the purchase. Keywords: Allegheny Pennsylvania, business purchase, proposal, terms and conditions, acquiring, target company, potential buyers, detailed information, compelling case, purchase. There are two primary types of Allegheny Pennsylvania Business Purchase Proposals, namely: 1. Start-up Business Purchase Proposal: This type of proposal is applicable when acquiring a new business venture or a start-up company in Allegheny County, Pennsylvania. It includes detailed information about the business concept, growth potential, market analysis, financial projections, and the overall potential of the proposed start-up. The proposal focuses on showcasing the viability and profitability of the business to attract potential buyers. 2. Established Business Purchase Proposal: This type of proposal is designed for acquiring an established business in Allegheny County, Pennsylvania. It includes a comprehensive evaluation of the target company's financial statements, assets, liabilities, employees, contracts, customer base, market share, and overall business operations. The proposal highlights the potential synergies, growth opportunities, and risk analysis associated with the acquisition, providing an in-depth understanding of the value proposition to potential buyers. In both types of proposals, key components typically include: 1. Executive Summary: A concise overview of the proposal, highlighting the key points and benefits of the business purchase. 2. Company Information: Detailed information about the target business, including its history, ownership structure, products or services offered, competitive advantage, and market positioning. 3. Financial Analysis: A comprehensive analysis of the target company's financial performance, including revenue, profitability, cash flow, and assets. This section highlights the financial health and growth potential of the business. 4. Market Analysis: An assessment of the target market, industry trends, competition, and customer demographics. This analysis provides insight into the market potential and opportunities for growth. 5. Operational Overview: A detailed examination of the target company's operations, including production processes, supply chain, distribution channels, and quality control. This section helps potential buyers understand how the business functions and identifies areas for optimization. 6. Acquisition Strategy: An outline of the proposed acquisition strategy, including the terms and conditions of the purchase, purchase price or valuation, financing options, and potential synergies with the buyer's existing operations or expertise. 7. Risk Assessment: An evaluation of the risks associated with the acquisition, such as industry-specific risks, legal or regulatory challenges, or potential changes in market conditions. This section helps potential buyers make an informed decision by understanding the potential challenges and mitigating strategies. By presenting a well-drafted Allegheny Pennsylvania Business Purchase Proposal, potential buyers can assess the feasibility, value, and potential benefits of acquiring a business in Allegheny County, Pennsylvania, thereby facilitating informed decision-making.

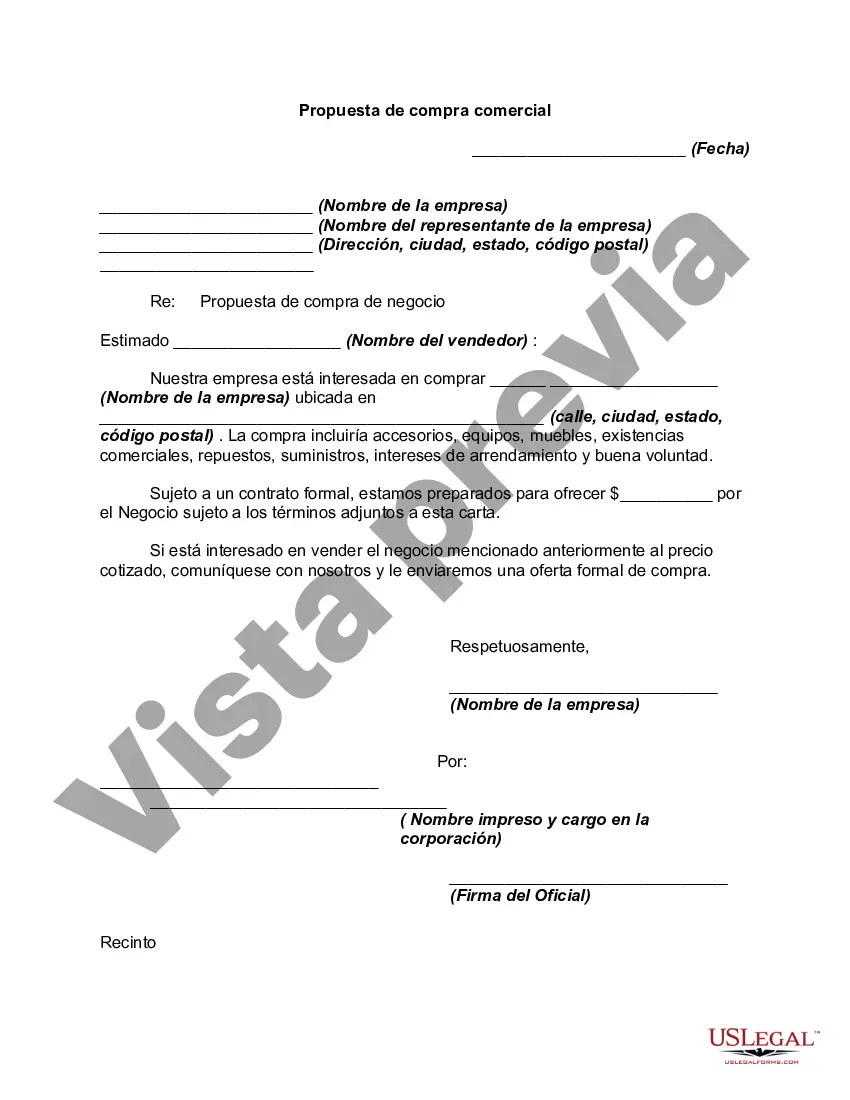

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.