It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

The Broward Florida Business Purchase Proposal is a comprehensive document that outlines the terms, conditions, and financial aspects of acquiring a business in Broward County, Florida. This proposal serves as a formal offer or request to purchase an existing business or to buy shares in a corporation. There are various types of Broward Florida Business Purchase Proposals, depending on the nature and structure of the proposed transaction. Some common types include: 1. Asset Purchase Proposal: This type of proposal involves buying the assets of a business, such as equipment, inventory, contracts, and goodwill, while excluding liabilities. The proposal typically specifies the list of assets to be acquired, their valuation, and any conditions or warranties associated with them. 2. Stock Purchase Proposal: In this case, the proposal focuses on acquiring the entire stock or shares of a corporation. The document covers the valuation of each share, the number of shares to be acquired, and any related terms, such as shareholder agreements or voting rights. 3. Merger or Acquisition Proposal: This type of proposal outlines the terms for merging two businesses or acquiring one business by another. It includes details about the new ownership structure, the exchange of shares or assets, and how the integration of operations and employees will be managed. 4. Partnership or Joint Venture Proposal: This proposal aims to establish a strategic partnership or joint venture between two or more businesses. It outlines the purpose, goals, and terms of the partnership, including the allocation of resources, profit sharing, management responsibilities, and exit strategies. The Broward Florida Business Purchase Proposal typically includes key sections such as: 1. Introduction: This section provides an overview of the proposed transaction, the parties involved, and their backgrounds. 2. Business Description: It includes a detailed description of the target business, its history, products/services offered, market position, and competitive advantages. 3. Purchase Price and Financial Terms: This section outlines the proposed purchase price, payment terms, financing arrangements, and any contingencies related to due diligence or financing approval. 4. Assets or Shares to be Acquired: In asset purchase proposals, this section specifies the list of assets to be acquired and their valuation. In stock purchase or merger proposals, it includes information about the ownership structure and the number of shares to be acquired. 5. Due Diligence: This section highlights the due diligence process to be undertaken to evaluate the target business, financial statements, legal documents, contracts, licenses, and other relevant aspects. 6. Transition and Integration: This section outlines the plans for transitioning the business to the new owner, including employee retention, customer relationships, supplier agreements, and post-acquisition integration strategies. 7. Legal and Regulatory Considerations: It covers any legal or regulatory requirements or approvals necessary for the proposed transaction, such as government permits, antitrust reviews, or industry-specific licenses. This Broward Florida Business Purchase Proposal demonstrates the seriousness and commitment of the prospective buyer or investor, outlining the terms and conditions for acquiring a business in Broward County effectively.The Broward Florida Business Purchase Proposal is a comprehensive document that outlines the terms, conditions, and financial aspects of acquiring a business in Broward County, Florida. This proposal serves as a formal offer or request to purchase an existing business or to buy shares in a corporation. There are various types of Broward Florida Business Purchase Proposals, depending on the nature and structure of the proposed transaction. Some common types include: 1. Asset Purchase Proposal: This type of proposal involves buying the assets of a business, such as equipment, inventory, contracts, and goodwill, while excluding liabilities. The proposal typically specifies the list of assets to be acquired, their valuation, and any conditions or warranties associated with them. 2. Stock Purchase Proposal: In this case, the proposal focuses on acquiring the entire stock or shares of a corporation. The document covers the valuation of each share, the number of shares to be acquired, and any related terms, such as shareholder agreements or voting rights. 3. Merger or Acquisition Proposal: This type of proposal outlines the terms for merging two businesses or acquiring one business by another. It includes details about the new ownership structure, the exchange of shares or assets, and how the integration of operations and employees will be managed. 4. Partnership or Joint Venture Proposal: This proposal aims to establish a strategic partnership or joint venture between two or more businesses. It outlines the purpose, goals, and terms of the partnership, including the allocation of resources, profit sharing, management responsibilities, and exit strategies. The Broward Florida Business Purchase Proposal typically includes key sections such as: 1. Introduction: This section provides an overview of the proposed transaction, the parties involved, and their backgrounds. 2. Business Description: It includes a detailed description of the target business, its history, products/services offered, market position, and competitive advantages. 3. Purchase Price and Financial Terms: This section outlines the proposed purchase price, payment terms, financing arrangements, and any contingencies related to due diligence or financing approval. 4. Assets or Shares to be Acquired: In asset purchase proposals, this section specifies the list of assets to be acquired and their valuation. In stock purchase or merger proposals, it includes information about the ownership structure and the number of shares to be acquired. 5. Due Diligence: This section highlights the due diligence process to be undertaken to evaluate the target business, financial statements, legal documents, contracts, licenses, and other relevant aspects. 6. Transition and Integration: This section outlines the plans for transitioning the business to the new owner, including employee retention, customer relationships, supplier agreements, and post-acquisition integration strategies. 7. Legal and Regulatory Considerations: It covers any legal or regulatory requirements or approvals necessary for the proposed transaction, such as government permits, antitrust reviews, or industry-specific licenses. This Broward Florida Business Purchase Proposal demonstrates the seriousness and commitment of the prospective buyer or investor, outlining the terms and conditions for acquiring a business in Broward County effectively.

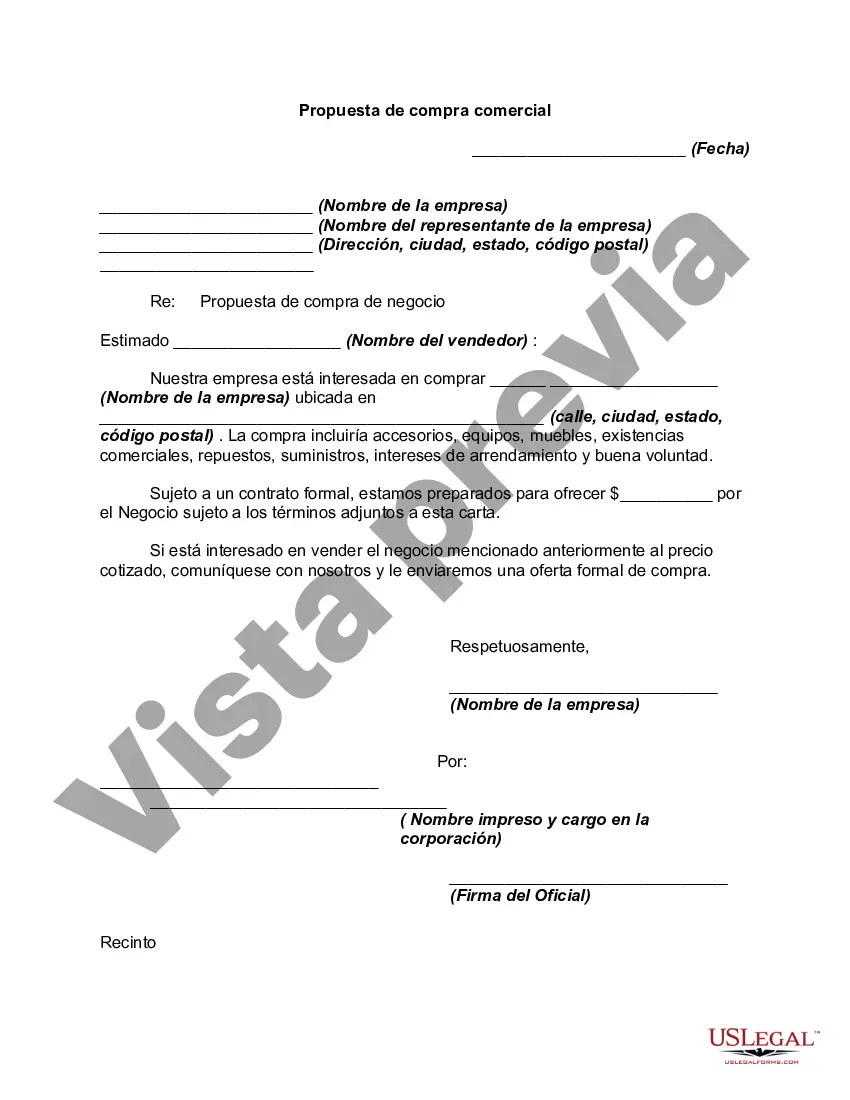

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.