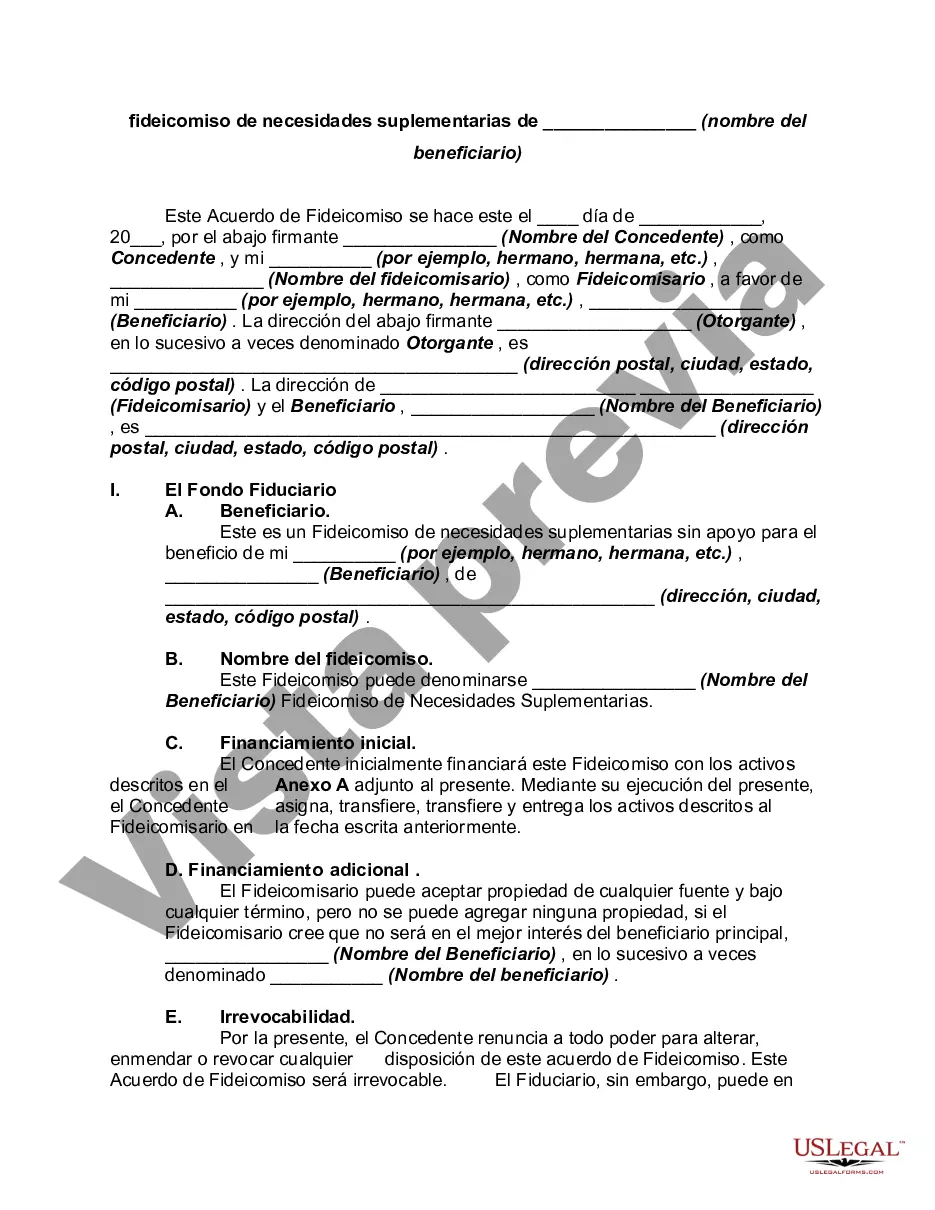

This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary is a type of trust that is specifically designed to provide ongoing financial support and resources for individuals with disabilities in Oakland County, Michigan. This trust is established by a third party, such as a family member, friend, or guardian, with the intention of supplementing the needs of the disabled beneficiary while preserving eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). The primary goal of an Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary is to enhance the quality of life for individuals with disabilities by providing funds for expenses that may not be covered by government benefits. This trust ensures that the disabled beneficiary can have necessary goods and services, including medical care, therapies, education, housing, transportation, recreational activities, and more. There are different types of Oakland Michigan Supplemental Needs Trusts for Third Party — Disabled Beneficiaries. They include: 1. Stand-Alone Supplemental Needs Trust: This type of trust is established independently of other legal documents, such as a will or a living trust. It is typically utilized when there is no existing estate plan in place or when the beneficiary is receiving a significant amount of assets that may jeopardize their eligibility for government benefits. 2. Testamentary Supplemental Needs Trust: This trust is created within a will and becomes effective upon the death of the individual establishing the trust, often referred to as the granter. It allows the granter to provide for the disabled beneficiary's needs after their passing while protecting their eligibility for government benefits. 3. Pooled Supplemental Needs Trust: A pooled trust is administered by a nonprofit organization and allows multiple beneficiaries to pool their resources together. This type of trust is suitable for individuals who do not have large assets or when the management of funds is burdensome for a family member or friend. Establishing an Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary requires careful consideration and consultation with an experienced attorney specializing in special needs planning. The trust document should be drafted to comply with federal and state laws to ensure maximum benefit to the disabled beneficiary while maintaining eligibility for crucial government programs. By creating this trust, families can provide for the long-term financial security and well-being of their loved ones with disabilities.Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary is a type of trust that is specifically designed to provide ongoing financial support and resources for individuals with disabilities in Oakland County, Michigan. This trust is established by a third party, such as a family member, friend, or guardian, with the intention of supplementing the needs of the disabled beneficiary while preserving eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). The primary goal of an Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary is to enhance the quality of life for individuals with disabilities by providing funds for expenses that may not be covered by government benefits. This trust ensures that the disabled beneficiary can have necessary goods and services, including medical care, therapies, education, housing, transportation, recreational activities, and more. There are different types of Oakland Michigan Supplemental Needs Trusts for Third Party — Disabled Beneficiaries. They include: 1. Stand-Alone Supplemental Needs Trust: This type of trust is established independently of other legal documents, such as a will or a living trust. It is typically utilized when there is no existing estate plan in place or when the beneficiary is receiving a significant amount of assets that may jeopardize their eligibility for government benefits. 2. Testamentary Supplemental Needs Trust: This trust is created within a will and becomes effective upon the death of the individual establishing the trust, often referred to as the granter. It allows the granter to provide for the disabled beneficiary's needs after their passing while protecting their eligibility for government benefits. 3. Pooled Supplemental Needs Trust: A pooled trust is administered by a nonprofit organization and allows multiple beneficiaries to pool their resources together. This type of trust is suitable for individuals who do not have large assets or when the management of funds is burdensome for a family member or friend. Establishing an Oakland Michigan Supplemental Needs Trust for Third Party — Disabled Beneficiary requires careful consideration and consultation with an experienced attorney specializing in special needs planning. The trust document should be drafted to comply with federal and state laws to ensure maximum benefit to the disabled beneficiary while maintaining eligibility for crucial government programs. By creating this trust, families can provide for the long-term financial security and well-being of their loved ones with disabilities.

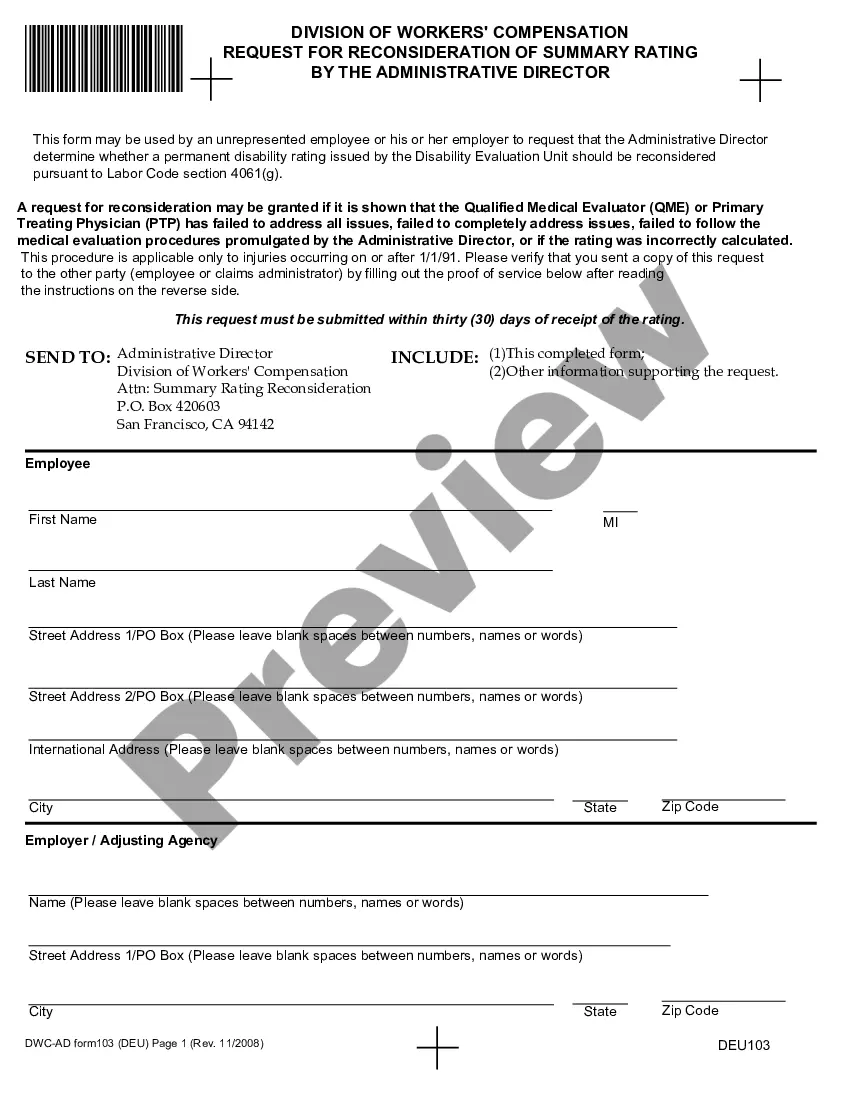

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.